Good morning. Happy Tuesday.

The Asian/Pacific markets closed with an upward lean. India dropped while Australia, China and Hong Kong rallied. Europe is currently up across-the-board. Greece is up 5.3% followed by Austria (up 1.4%), Belgium (0.6%) and London (0.5%). Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

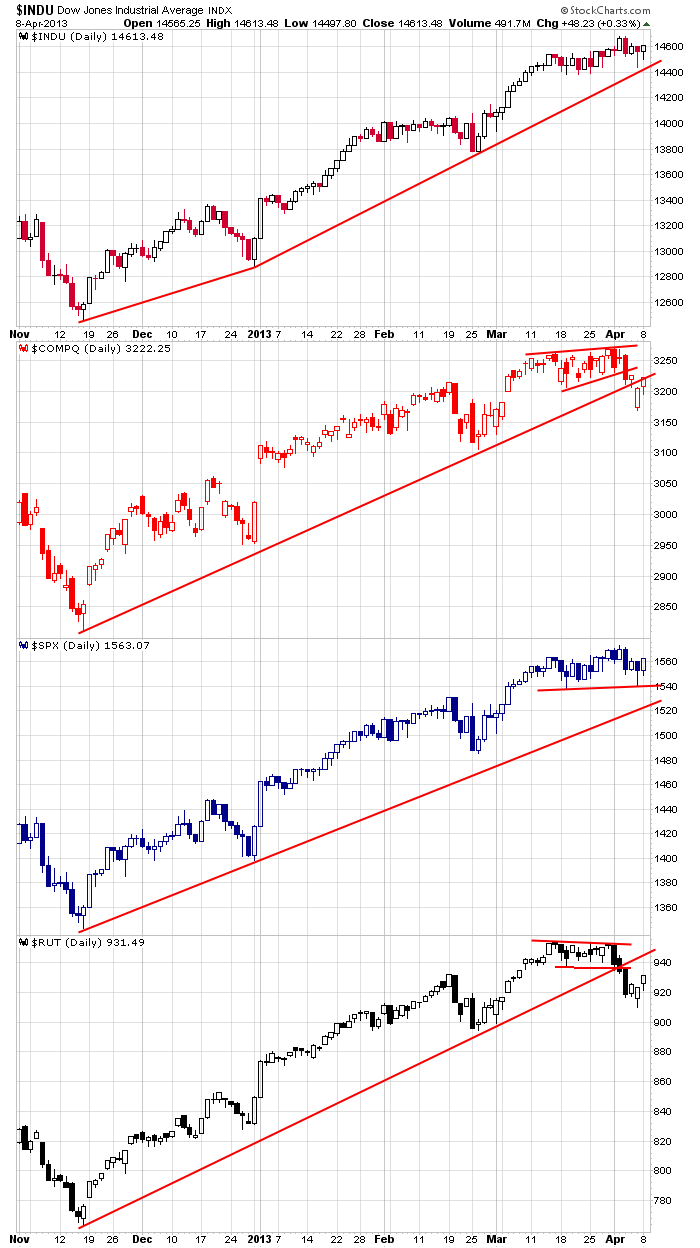

Yesterday most of the indexes traded quietly the first half of the day and then rallied in afternoon action and closed the Friday morning gap downs. Here’s an update of the daily charts. From a technical standpoint, I don’t like how the Nas and Russell fell out of small consolidation patterns and then penetrated longer term trendlines while the Dow and S&P held up. Breaking down and correcting is fine – perfectly normal activity for a strong and healthy market. But I don’t like the divergence. Money should be flowing into the small caps and tech stocks, not out of them.

Also, there are several breadth indicators which have cycled down. Again, this is perfectly fine as long as they now bottom and move up. Failure to do this would have me question the market’s upside potential. In the short term anything goes, but over the intermediate term, those indicators matter. A declining AD line can exist in the near term, but it cannot continue if the market is to leg up and make a new high.

Complacency is growing again. Nobody cares about Cyprus. Nobody cares about Portugal. North Korea is going to start a stupid war they have no chance of winning. The market doesn’t care about that either. Markets climb walls of worry…where’s the wall. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 9)”

Leave a Reply

You must be logged in to post a comment.

Earnings bring speculation and hope for a major (in numbers) but selective rally for two weeks. Missing are the large cap consumer retailers and technology the consumer is squeezed. The Yen has unhinged currency speculation as the EMU reexamines its options and techniques for easing. China and Australia have cut deals in their own currency, thus cutting out their need for holding Treasuries; may lead to jump or minor collapse if China starts selling it hoard of bonds. The little relief rally in the Euro is very short lived it is headed for dollar parity in 2014. EUO becomes a play. Divergences are in my view a symptom of traders awareness of serious excesses in mid and small caps. Sell in May maybe too easy. The summer may see IWM (R2K) rally hard to new highs just before a collapse in August/Sept. Volatility may make this summer a traders dream.