Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Hong Kong, India, Japan and South Korea all did well. Europe is currently up across-the-board. Austria is up 2%, Belgium, France, Germany, Amsterdam, Greece and the Czech Republic are up more than 1%. Futures here in the States point towards a gap up open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

Yesterday the Dow and S&P 500 hit new highs before easing into the close. The Nasdaq, Russell small caps and S&P mid caps didn’t come close.

FOMC minutes get released today. They’ll give us a glimpse of behind-the-scenes discussions that took place at the last Fed meeting and might hint at how much support Bernenke has in keeping rates low until the unemployment rate drops to 6.5%.

The bears are no doubt very frustrated and confused right now. Last Friday they were super excited about the big gap down. The Nas and Russell had already penetrated their long term uptrend lines, and the Dow and S&P were very close. They’ve been calling a top for…ummm, well forever, they’re always calling tops, and they’re almost always wrong…but hope doesn’t die easy. And here we are three trading days later, the S&P and Dow are back at their highs. When the bears stop trying to pick tops, the market will top. Sorry, that’s how Wall St. works.

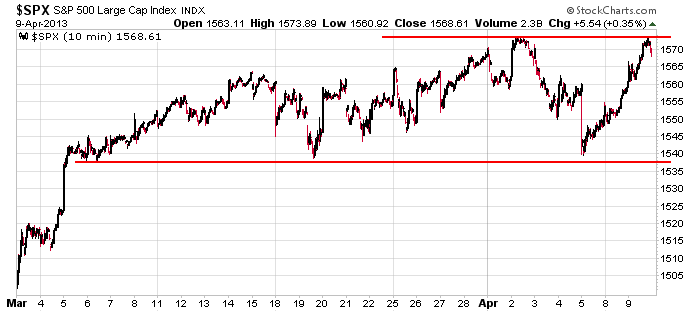

Having said this, it’s a concern the small and mid caps are lagging, and despite the S&P flirting with a new high, it’s still mostly range bound over the last month. Here’s an intraday chart. Rallies have gotten sold, dips bought. Within a range it’s just a big transfer of wealth from amateurs to pros. Wash, rinse, repeat. There are lots of price swings within a range, lots of emotional swings too. And then a month later you realize price is unchanged, and everything that happened was irrelevant. The market trends and it chops, and unfortunately for us traders, it chops more than it trends. To survive, you can’t force your trending set-ups on a range bound market and vice versa. You must be a little flexible. Off my soap box. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 10)”

Leave a Reply

You must be logged in to post a comment.

from my soap box

this nice 3 day bounce was caused by my dead cats –gruesome and awesome ,

scared that i may sell them back to neal for his modleing agency

but i hope this volitility continues till next weeks monthly opts ex

esp ndx 100