Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan and Taiwan rallied more than 1%; Australia, India, Indonesia and South Korea also did well. Europe is currently mostly up. France, Germany, Switzerland and the Czech Republic are doing well. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil is flat, copper is down. Gold is up, silver down.

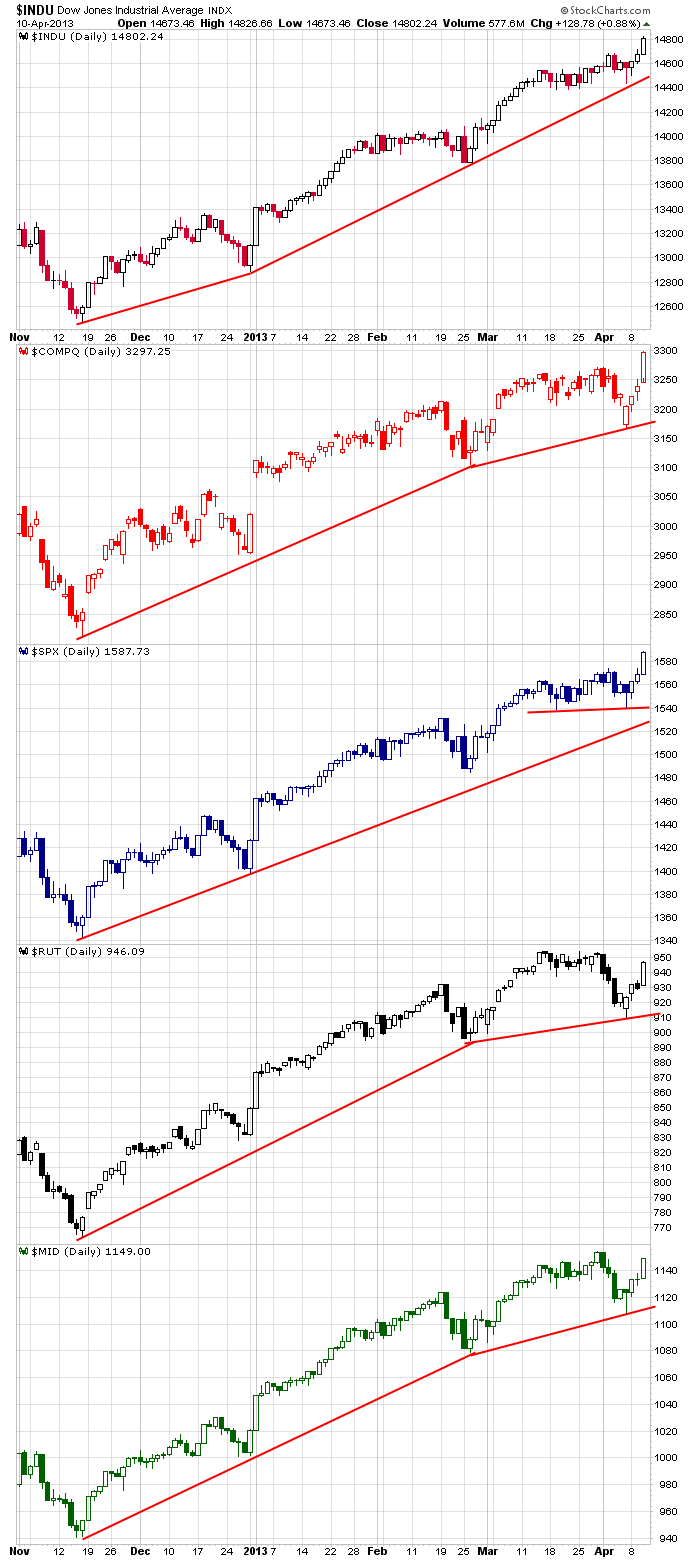

Yesterday the market rallied huge. The Dow, S&P 500, Nasdaq and Nas 100 are at new highs. The Russell 2000 small caps and S&P 400 mid caps are lagging some. Here are the daily charts.

If the bears weren’t pissed off and frustrated Monday and Tuesday, they’ve certainly smashed a few keyboards after yesterday. I don’t get it. Why guess what’s going to happen in the future? Why not just see what’s happening and go with the flow?

Within an uptrend, I’m either long or on the sidelines. Within a downtrend, I’m either short or on the sidelines. I don’t trade opposite the prevailing trend. When the market makes a major turn, I miss the beginning, but oh well. I’d rather miss the beginning once than incorrectly guess when the turn will come numerous times.

But what the heck. I like the bears. They add fuel to the fire. The provide the proverbial wall of worry for the market to climb. They are badly needed to round out the playing field, so perhaps I should stop making fun of them. 🙂

At this point we can throw the technicals out the window. I don’t know when this mini run will reverse. Don’t get greedy. Take some profits and manage trades wisely. There’s lots of emotion out there. The bulls are euphoric, the bears are ready to jump out a window. Cooler heads will prevail…actually the bulls have been prevailing for a long time. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 11)”

Leave a Reply

You must be logged in to post a comment.

“At this point we can throw the technicals out the window. I don’t know when this mini run will reverse.”

Yes but it will reverse. I won’t trade this insane market.

Jason hope weather is good where you are. Here in the great state of Michigan 350 miles north west of your home town we went snowshoeing yesterday. I am thinking it is time to move to the tropics some place warm.

Yesterday The Fed slipped its notes to a few of its friends a little earlier than the general public: and a few lobby firms. Said it was an error. Today the president meets with the Huber bankers, and the Congress attempts to decide on a budget. The scene is connived to keep investors distrusting and spreading hate and discontent, other than that it is spring in Wall Street and all is not well. The earnings are looking ragged and they will fall over the next couple of years taking the P/E down and the market into correction. Right now the market is a buy when in doubt, the Fed is spending. I look for some small cap action this summer to play catch up. But we are entering the statistically low earnings season in May to Oct when cash or bonds may be the best play. Maybe a good entry to some dividend stocks after July.