Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India rallied 2.1%, Indonesia 1%. Australia, Hong Kong, Japa and New Zealand dropped. Europe is currently down across the board. Greece is down 2%, Belgium and Stockholm 1%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is down. Oil is down slightly, copper up. Gold and silver are both up.

Heading into this week I was skeptical of last week’s breakout. The price action was very good, but the lack of confirmation from several breadth indicators, several key groups and many stocks made me pause. Plus the S&P had rallied 50 points in five days.

Then the market got killed yesterday. It was easily the biggest down day in a long time led by commodities which got crushed. Gold suffered its biggest 2-day drop in 30 years, but I don’t care much about gold. It’s a speculative asset class which is not indicative of anything. I do care about oil, steel, copper, aluminum and other metals that suggest deflation is a real threat. Gold is a very small group; the combined market cap of the entire group is very small. Oil on the other hand is obviously a different story. The group is massive, very important, very indicative of what’s going on in the world and very influential with regards to the movement of the indexes. If oil continues down, it will be hard for the indexes to right themselves.

In the very near term anything goes.

Over the long term I still like the market; I still think 2013 will be a good year for stocks.

But in the intermediate term, there’s definitely been some deterioration, and the odds of a spring/summer pullback is growing.

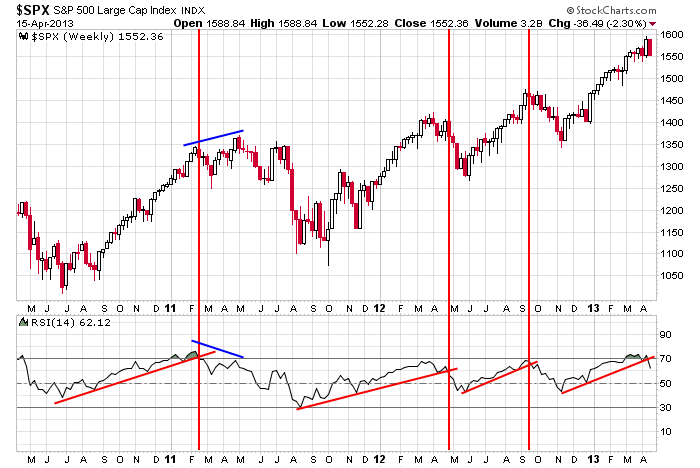

Charts like the following weekly S&P chart are getting my attention. Each time the RSI has broken support, a correction has followed. The caveat is that this is a weekly chart, so the RSI won’t close until Friday. If the market bounces the next four days, the RSI could close back above 70.

Be very careful here. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 16)”

Leave a Reply

You must be logged in to post a comment.

No quarrel with your statement re oil vs gold. Nor with your

point that the basic metals etc THEMSELVES are more important indicators

of the economy than gold. But the market cap of gold is huge by comparison

and this affects investor mood/confidence. The GLD ETF, after yesterday, is worth

$53.3 billion, and just 2 gold stocks, ABX and NEM, are 37B together. US Steel

is $2.4 billion, Alcoa is 8.6, and Freeport copper and gold (only partly copper)

is $27.8B. True, the above are all heavily USA copanies, not world. The big

successful world player is BHP, with a market cap of $107B, but it of course

is also part gold & silver in nature. It will be interesting to see the effect

of ETFs on the metals as well as the stocks. You get in effect double wealth loss

when ETF shares are redeemed, as the underlying stocks or metal are sold too.

Like mutual funds’ effects, only muh faster, as ETF buyers have not been schooled

to buy and hope forever.

Don in Denver

Hi Don,

I still consider the market cap of gold to be very small. The combined market cap of every publicly traded gold stock is about $140B. This is bigger than copper, aluminum etc, but compared to any other group (oil, tech, banks) it’s pretty small.

And I don’t think the ETF counts. Wall St. can’t just invent a product and brag about the market cap. That’s how the financial crisis happened…derivative products were created and packaged and sold…throw in a lot of leverage, and it was a house of cards.

We’ll see what happens. It still bothers me CAT has been so weak.

Nice gap up. I say it don’t hold and we have a reversal. It is going to be a quick trade.

long gold short japan yen financed in japan yen ,is the carry trade

that is unwinding

gold did not fall ,but gold in usd did

gold in yen just peaked

its all a currency war that usa just warned japan on y/day and g20 end of week