Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

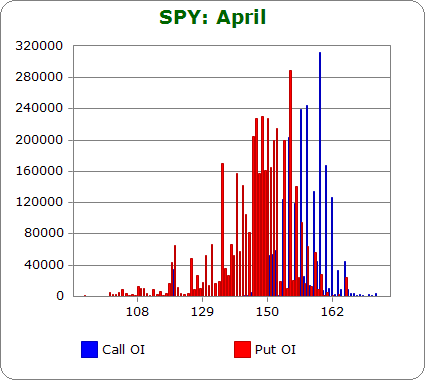

SPY (closed 157.32)

Puts out-number calls 2.1-to-1.0 – slightly more bearish than last month.

Call OI is highest between 154 and 162.

Put OI is highest at 135 and between 140 and 157.

There’s clear overlap between 154 and 157, so a close within the range would cause a lot of pain. But since put OI is heavier than call OI, I’m willing to let some call buyers make money at the expense of causing even more put buyers to lose. So a close near the top of the range would cause max pain. Today’s close was at 157.32 – the top of the range. Perfect. No movement is needed the rest of the week.

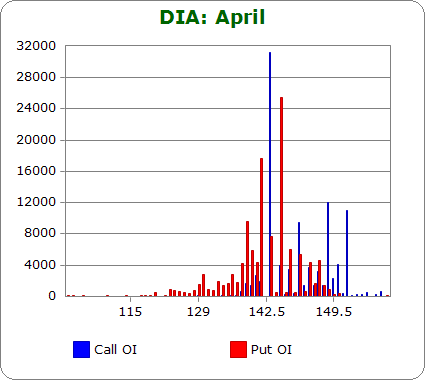

DIA (closed 147.29)

Puts out-number calls 1.3-to-1.0 – slightly more bearish than last month.

The big call spike is at 143, and then there are moderate spikes at 146, 149 and 151.

The big put spikes are at 142 and 144, and there’s one moderate spike at 139.

To cause max pain, we need those spikes to close worthless or as close to worthless as possible. Closing at 143 would accomplish this. The big call spike and the three smaller ones would expire worthless, and the biggest put spike would have some value, but when factoring in the cost to enter a position, it’s unlikely buyers of the 144 puts will be profitable. DIA closed at 147.29 today – well above our desired level. A big move down is needed for max pain. The caveat of course is that volume is so tiny compared to SPY and IWM, DIA numbers don’t really matter.

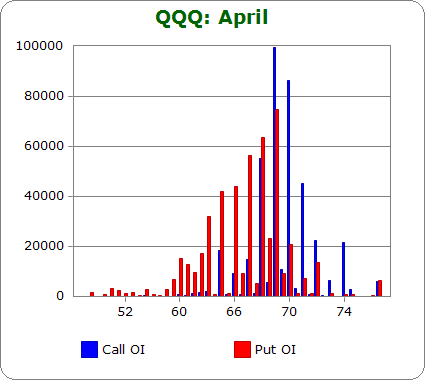

QQQ (closed 69.51)

Calls out-number puts 1.2-to-1.0 – about the same as last month.

Call OI is highest between 68 and 71

Put OI ramps up from 64 to 69, with 69 being the biggest spike.

This analysis is easy. The biggest call and put spikes fall at 69, and there’s very little overlap. Hence a close at 69 would cause the most pain. QQQ closed at 69.51, slightly above our ideal level.. No movement or a slight move down the rest of the week is needed.

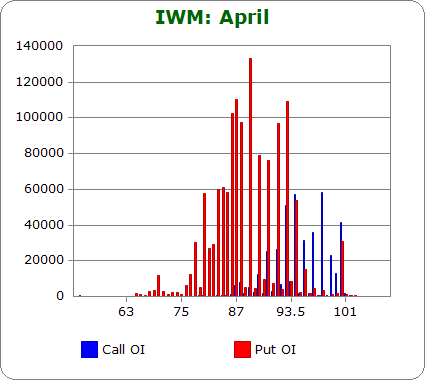

IWM (closed 91.67)

Puts out-number calls 3.3-to-1.0 – slightly more bearish than last month.

Call OI is highest at 93, 94 and 97.

Put OI is highest between 86 and 93.

High OI calls and puts meet at 93, and since there are two distinct zones and very little overlap, a close there would cause max pain. IWM closed at 91.67, slightly below our ideal level. If the stock doesn’t move the rest of the week, a lot of pain will be felt buy option buyers, but if IWM can move up slightly max pain will be achieved.

Overall Conclusion: Miraculously, yesterday’s massive sell-off and today’s bounce have put the market pretty much exactly where it needs to be to achieve max pain. No movement the rest of the week would be fine. A small move up might produce slightly more pain.

0 thoughts on “Using Put/Call Open Interest To Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Thanks useful.

Thanks. Didn’t know about this. Very helpful information indeed.

Thank you, your comments – always enjoy to read.