Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Australia and New Zealand did well, but China dropped 2.6% and Hong Kong dropped 1.1%. Europe is currently up across the board. France is up 2.6%, and Austria, Germany, Stockholm, Switzerland and London are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

We entered this week with the market on thin ice and in need of a bounce. We got a small one yesterday – a small step – but it’s not enough. Volume declined and the small caps lagged. It was nice to see some big cap tech stocks do well (AAPL, MSFT for example and GOOG held its previous day’s gains), but I want to see more. I need more improvement from key stocks (CAT had a great day yesterday, so that’s good). Key groups need to lead, and many breadth indicators need to improve. Otherwise a bounce is likely to be short-lived.

Netflix (NFLX) did great with earnings…the stock is up 24% in premarket trading.

Also doing very well before the open are: VECO, CZR, ARMH, ILMN, SCMP, AMRN, CLDX, ACTG. The loser board is much shorter: IRWD is the only stock down more than 3%.

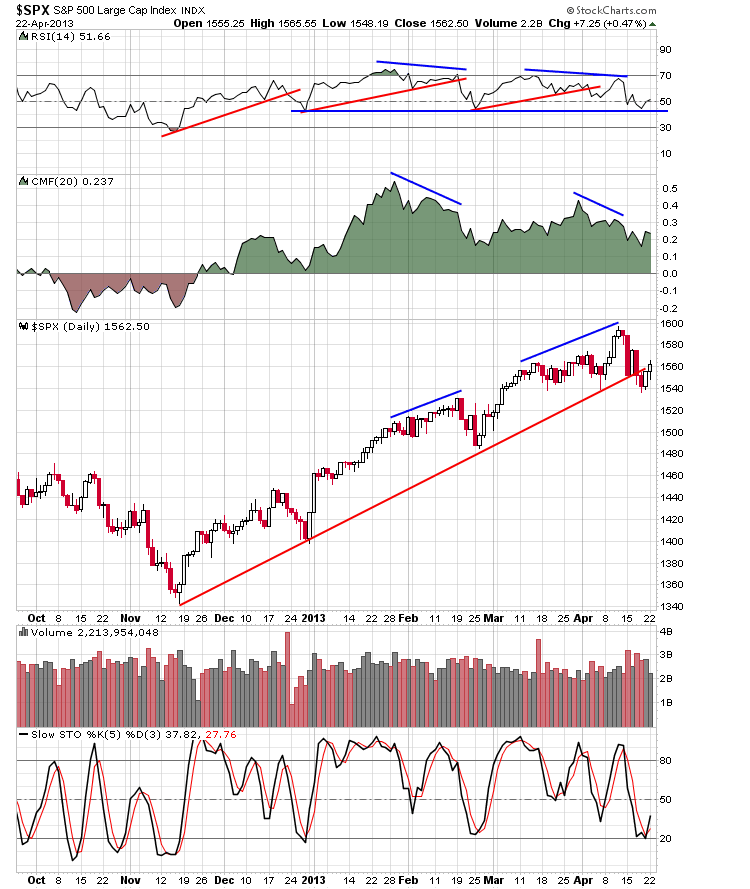

In the near term I’m continuing my thesis that a bounce is very doable (meaning there shouldn’t be too much technical resistance). In the chart below, the negative divergences between RSI and money flow have been satisfied, and with the RSI and Stoch turning up, we can get several more up days.

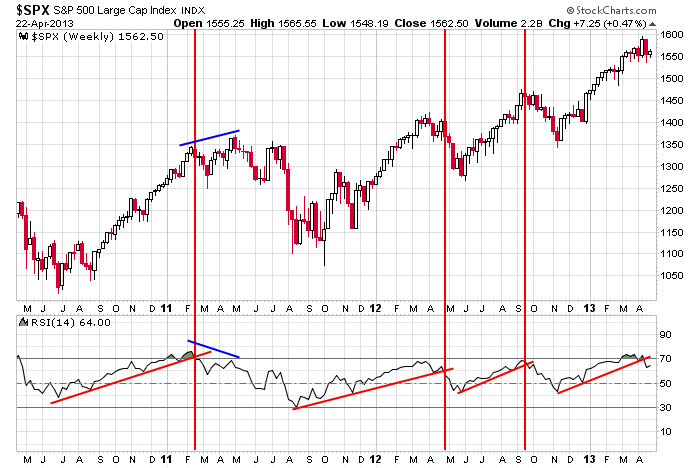

But backing up gives me pause. The weekly looks more like a top than a simple consolidation pattern.

Ultimately the charts will tell guide us. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 23)”

Leave a Reply

You must be logged in to post a comment.

Earnings always cheer the investor, who is shortsighted. The money flows into the market and it will float up until the lemmings cease to believe their leaders are rational.

t/a ish im watching spx 1573 ish

The NASDAQ was up almost 1% yesterday. IWM was up only .3%.

Right now be long and be wrong.

furline teddy bear and lady grizelly bear have just told me that we need to faten up the bulls

before we sell them

ndx 100 just closed gap at 2838 and just below r2 piviot

Another flash crash. Is the market nervous?