Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. Japan rallied 2%, Australia, China, Hong Kong, Singapore and Taiwan rallied more than 1%. Europe is currently mostly up. Belgium is up 1.4%, France, Germany, Amsterdam, Switzerland and the Czech Republic are doing well too. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Yesterday, the market followed through on Monday’s gains. Volume was heavy, but this may be due to the mini midday crash.

When the week began, a bounce made sense. But the first move is the easy move. Now we need support from a number of sources for me to believe the rally can continue. Key stocks needed to firm and move up, key groups needed to perform better and some breadth indicators needed to improve. So far, so good. I don’t expect everything to happen at once.

Our canary in the coal mine (CAT) has done great the last couple days. Banks, semis and several other groups have played a leadership role. And a few indicators have started acting better. All in all it’s been a good first step. If the improvement continues, it’s possible a bottom is in place. Be patient. We’ve gotten lots of ups and downs lately, so there’s no clear signal.

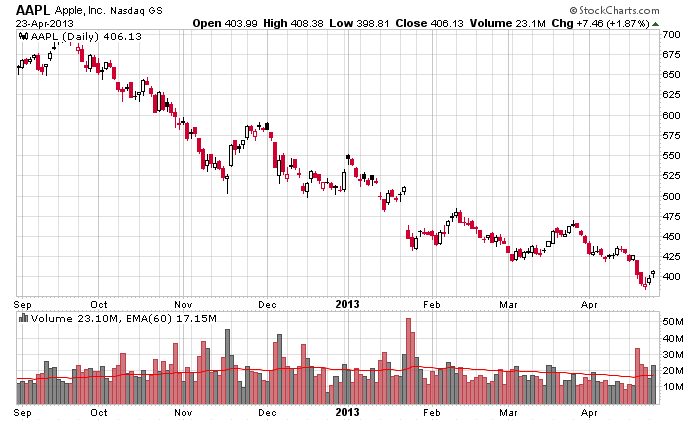

Apple (AAPL) did well with earnings but Q2 guidance was less than expected. The stock popped 5% in after-hours trading but is now down about 12 bucks (3%).The company said they’ll be returning $100B to shareholders by the end of 2015 in the form of a stock buy-back and increased dividend. Here’s the chart. It looks dreadful…it looks like a gold stock.

The jury is out. Was last week’s weakness a pullback within an uptrend or the beginning of a correction. We don’t know the answer yet. When the week began all signs pointed towards a bigger correction, but things have improved some. I still lean towards a correction but am open to a bottom being in place. Don’t guess…the charts will guide us. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 24)”

Leave a Reply

You must be logged in to post a comment.

Jason

I am with you. With yesterdays mini crash investors seem jumpy. The market has strength but I don’t think we have seen the bottom.

Paul

Todays numbers on investment and production (down sharply) were blamed on Boeing, but it is not so easy. The economy is slowing and unemployment has fall only because of drop outs from the labor force lower the total seeking work. The current labor participation rate is 67% of those in working age groups; lowest in a decade or two. While it is not clear what is taking place yet, one possibility is that the bull is long in the tooth. Go away its May or use stops liberally.

why to we use the term –investors–they are a dying bread

the big problem is not so much the economy which is st fed,

but it is that way because of insto derivitives on margin

there is some 360 trillion usds equivilent of derivitives

its a derivitives ponsi on margin some at 100 to one margin

i trade at 100 to one margin day trader rates

if this derivitives market crashes like a lehmans event the whole world will be in the bigest depression ever and margin calls everwhere

but back to trading,like Jason said we dont know the trend yet

if a lower high prob down

i like perry como,mario lanza,franky,deano,bing

are they at vegas

WE DO HAVE SOMEWHAT A EDGE

know whom u are trading against—robo cop

know their modus opperendi that they can see all orders/stops limit stops in the market

that they want to run ur stops –so have the mind set to have a mental stop not market stop

and determination to execte the mental stop

that their masters the marsian vegas instos create the propoganda needed to run ur stops –yesterdays mini crash

use live only indicators designed to detect robo cop

ie my tick ind tells me robo cop is in a chern mood today so far staying close to the neutral line but it also tells me when its in a buy or sell mood

old inds are ok for trend followers happy with middle trend profits,but that is not this market

will marolyn munrow be there