Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China and India dropped, Hong Kong rallied. Europe is currently mostly down. Amsterdam is down 2.1%, and Austria, Spain and Germany are down more than 1%. Stockholm is up 1.3%. Futures here in the States point towards a down open for the cash market.

The dollar is down slightly. Oil and copper are down. Gold and silver are down.

The market has had a very good week. Five days of gains accompanied with improvement from some key stocks, improvement from key groups and a reversal of a few indicators have changed things. No longer is the market on thin ice and at risk of breaking down and officially beginning a correction. It’s not out of the woods, but it definitely have some wiggle room.

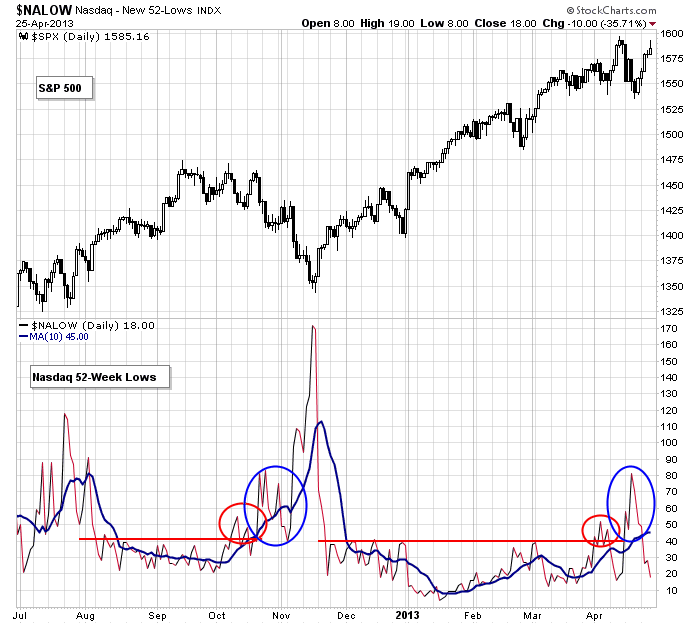

Here’s an example of an indicator which is no longer supporting a correction. Nasdaq New Lows had broken out, paused and then surged. The first move up isn’t a big deal because there are always a handful of stocks at the bottom of the exchange that don’t deserve to be publicly traded companies. But the second surge told us this pullback may be different. This isn’t the case any more. With new lows plunging, we’re not getting a signal that there’s beneath-the-surface deterioration. It’s one piece of the puzzle. Things can change as they have this week, but for now things are looking much better.

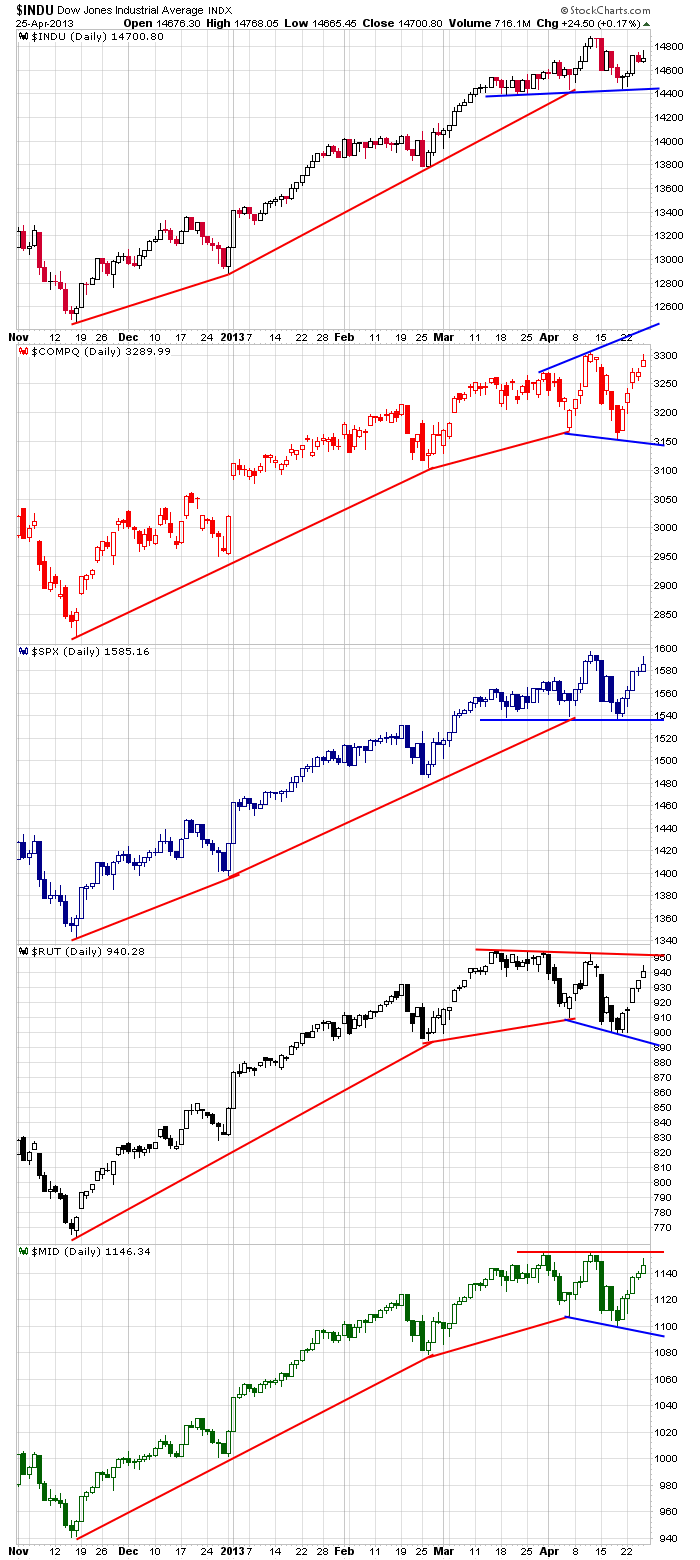

Here’s a quick shot of the indexes. Overall they are mostly in a 2-month consolidation range.

AMZN missed on revenue but beat on earnings. The stock is down 3% before the open.

SBUX met earnings expectations but guided lower going forward. The stock is down 2% in premarket trading.

up premarket — SYNA, LOGM, AVNR, CSTR, SPWR, GT, FB, NFLX

down premarket — COBR, SIMO, BIDU, HMSY, AMZN, AMAT, ARNA, WIN, ANGI, SBUX

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 26)”

Leave a Reply

You must be logged in to post a comment.

Going down day. Yen is climbing.

good point Whidbey

equities/gold is just part of the currency war

but today felt more like a weekly opts ex day