Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with an upward bias. Australia, Hong Kong, India and South Korea rallied nicely; China dropped. Europe is currently mostly up. Austria and Greece are up more than 2%; Stockholm is up 1.7%; Germany, Norway and the Czech Republic are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is down slightly, copper is up. Gold and silver are up.

Going back to last Friday the market is on a nice run, and I’ve seen across-the-board improvement. The small caps have been leading. Some key stocks have improved. Some key groups improved. Some breadth indicators have perked up.

When the week began, the market was on thin ice and had very little wiggle room. I still considered the move off the highs to be a pullback within an uptrend and not yet the beginning of a correction. And with this week’s bounce, this is still the case. The bulls had their backs up against the wall, and they responded.

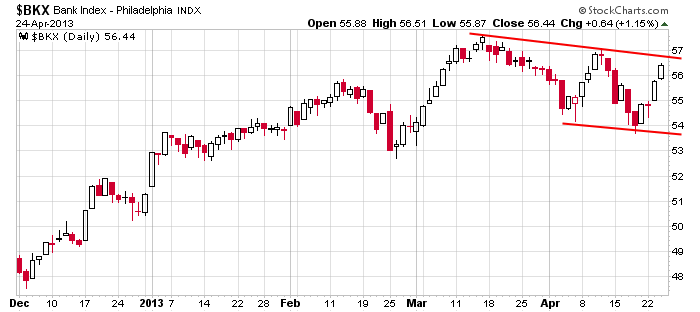

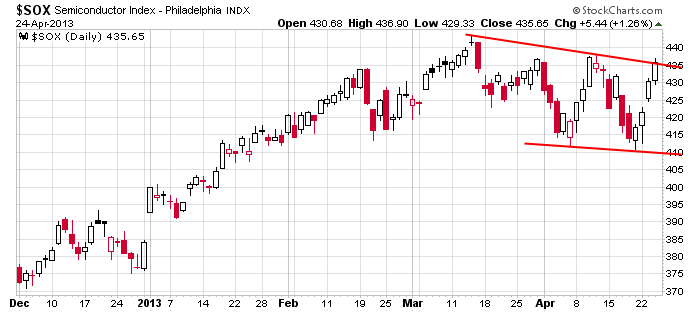

Here’s $BKX and $SOX, banks and semis, both much improved.

The bulls can breathe a little easier now, but their job isn’t done.

In premarket trading, INFN, AKAM, YNDX, CAKE, VOD, BIIB, FFIV, WDC and RRD are up the most while INTU, ZNGA, MLNX, CTXS, AVEO, QCOM, EQIX and JBLU are down the most.

The market’s next trending move is still not known. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 25)”

Leave a Reply

You must be logged in to post a comment.

Merely earnings distorting the market, which are statistically only low average for most industries. Buying into the earnings winners is typically window dressing for fund managers. Most private managers are suspicious of turn around stories, and watching for signs of weakness in a name, but they may buy a name to dress up their list. I Watch volume, particularly volume off the highs or a local high. GE, IBM, PG and AMGN,CELG,PEP are all bellwethers indicating something is happening to leadership: a caution. If the index volumes rise to Seasonal averages, own a little, But it is late in April leading into a season when historically losses out weigh winnings. Just probabilities.

First time claims today down and 4 wk is 358,000, but the BLS says their numbers are foggy so don’t take them too seriously (meaning they fudged them).

Good point Jason the small caps are doing well.