Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. India and Singapore rallied more than 1%; Indonesia dropped 1.3%, and Australia, Japan and New Zealand also posted moderate losses. Europe is currently mostly down. Austria, Amsterdam, Norway and Stockholm are posting the biggest losses. Futures here in the States suggest a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is up.

The market fell hard yesterday. By itself this is no big deal and not a surprise. The S&P had rallied 7 of 8 days and was sitting right at resistance. It’s hard building gains on top of gains, so pulling back or at least pausing was desirable movement compared to trying to breakout. But while the S&P dropped less than 1%, the Russell small caps dropped 2.5% – not good. The small caps tend to lead the market in both directions. If traders and investors have an appetite for smaller, more speculative growth stocks, it’s a very good sign. If they don’t, it’s a bad sign. The small caps performed well Jan-Mar and then under-performed in April when the market struggled. They then led again during the most recent winning streak. This is one of my favorite indicators. When money rotates out of small caps and into safer larger caps, a major warning is flashed. Perhaps yesterday was just a 1-day aberration. We’ll see. The market will not breakout and rally hard without participation from the small caps.

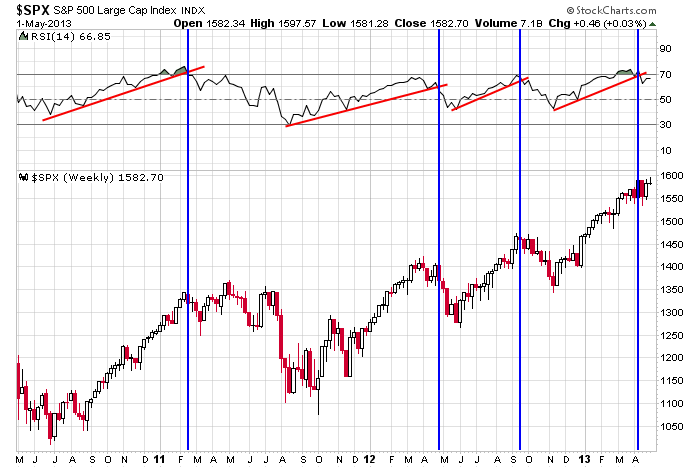

The long term trend is solidly up, but two things make me pause in the near term. 1) The indexes are range bound, and until we get a forceful breakout, we have to keep trades shorter term and be skeptical of rally attempts. 2) Charts like the following suggest a top may be forming. I want to see the RSI trendline break negated.

Don’t push it. This has been my MO for a couple months. Trade, but since the intermediate term trend is neutral, you can’t depend on market strength to “raise all ships.” More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 2)”

Leave a Reply

You must be logged in to post a comment.

Futures are up. In the past few months I would short these. Today is not a predicable day.

Nothing the market does today will surprise me. I may try a collar on options expiring Friday hoping for a big move. Na… Time to walk away.