Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. China rallied 1.4%; Indonesia, Malaysia and Singapore dropped 1% or more, and India and Japan also posted noticeable losses. Europe is currently mostly up. Amsterdam is down 1%; Austria, Belgium and Greece are posting decent gains. About 20 minutes before the employment numbers were to be released, futures here in the States pointed towards a slight down open for the cash market, but this will change.

The dollar is down. Oil and copper are up. Gold and silver are up.

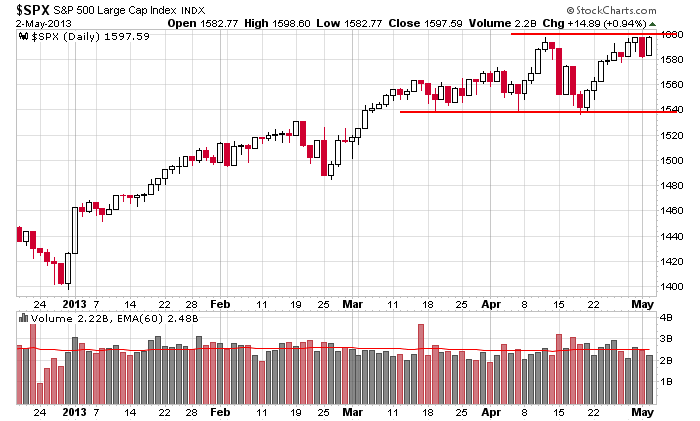

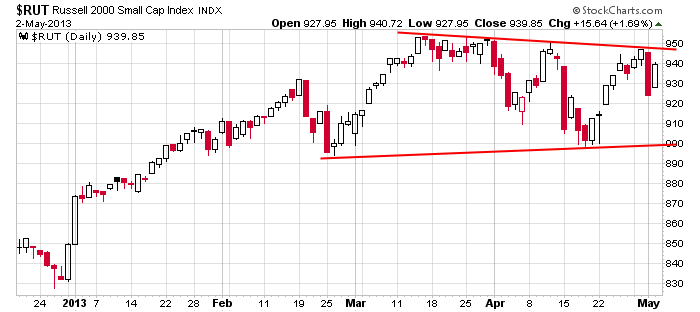

This has been a big week. Many earnings reports, more than 30 economic reports including the latest employment figures, and and FOMC meeting, and as of now all the indexes are posting gains for the week. All the indexes are in large consolidation patterns, but they’re not all acting the same. Here’s the S&P and Russell. The #1 thing I’ll be looking for going forward is for the movement of the small caps to match the movement of the large caps. If the S&P breaks out, the Russell MUST NOT be far behind. Otherwise the S&P will not go very far. Simple as that.

Here are the employment numbers…

unemployment rate: 7.5% (was 7.6% last month)

nonfarm payrolls: +165K

private payrolls:

average workweek: down 0.2 hours to 34.4

hourly wages: up 4 cents to $23.87

February and March were revsied up a combined 124K.

On the news S&P futures jumped about 10 points. The long term trend remains up. The intermediate term trend is neutral. Let’s see if the indexes can breakout today. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 3)”

Leave a Reply

You must be logged in to post a comment.

The NFP is the usual public relations. Last month revised up, and the labor participation rate is down, so if the numerator rises the unemployment ratio falls. New orders were up. Lots of LALA. Now futures are up a hundred points and all is well. Not quite, but are you willing to go against on the BLS guesses? Yes, Jobs are what matter, when ~200K is needed to maintain the labor participation, the only answer is cut the labor participation rate which makes unemployment fall. If you what 4% unemployment just push more people out of the participation pool.

Yes May can be up, but without volume we are just waiting for the fall back to where the buyers are. Watch carefully the volume today it tells it all.

Russell MUST NOT be far behind. (and it has been lagging.)

Amen Jason.

Today’s gap up is worth shorting into. Livermore said look at the market see if it feels right and if the calculations support your intuition jump.

so the end of the bulls will be a false break high–amen

unconfirmed