Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Malaysia rallied 3.4%; China, Hong Kong, Indonesia and New Zealand rallied more than 1%. Europe is currently mixed. Austria, Belgium, London and Greece are posting solid gains. Futures here in the States are flat.

The dollar is up slightly. Oil is up, copper down. Gold is up slightly, silver flat.

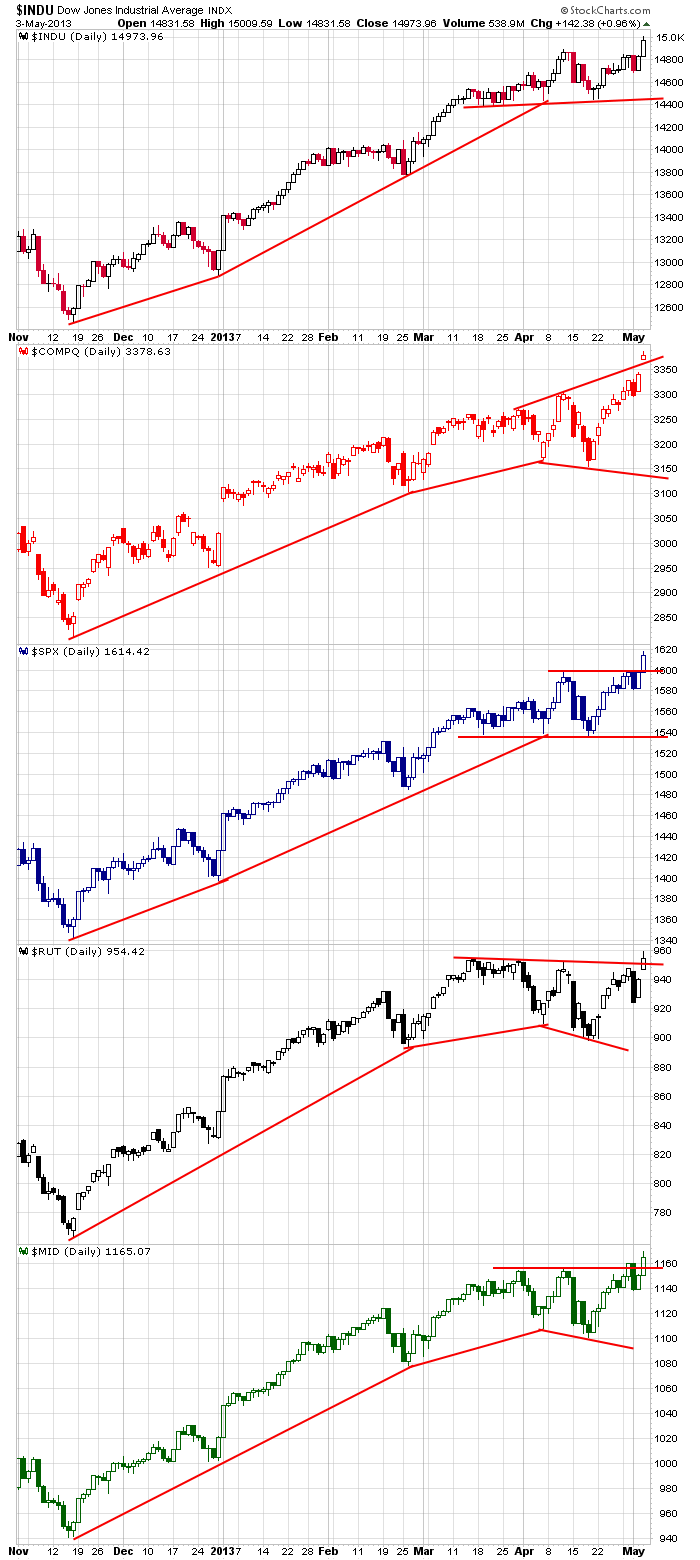

We begin this new week with most of the indexes at or near all-time highs. You can analyze the market from any angle you want, and eventually you just have to call a bull market a bull market. The long term trend has been up for a long time. There have been pauses along the way and a couple corrections that were deep enough to justify shorts, but overall the trend has been up and it’s been wise to stick with the long side. Again, sometimes you gotta call a spade a spade and go with the flow and not try an out-think the movement.

Here are the daily charts. Given Friday’s across-the-board breakouts, the market’s movement the next couple days is important for the next couple weeks. Within a range, the market can go up and down and bounce around, and nothing really gets my attention as long as the range holds. But as soon as the market tries to resolve in one direction, it’s important to get some follow through and separation. Otherwise the odds of a false breakout increase significantly. So ups and downs right now above the range are not the same as ups and downs within the range.

Unlike last week where there were hundreds of earnings reports and 30+ economic releases including an FOMC meeting, earnings season is winding down, and there are very few economic reports out this week. News trumps the charts, but there won’t be much news this week. With news being light, the market will have to move on its own. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 6)”

Leave a Reply

You must be logged in to post a comment.

When you say,

“More after the open”, Do you have regular posting

address and times ?? Thanks, SD

SD…yes, I post comments throughout the day in the member’s section of the site. Also, we have a message board where many of our members hang out and talk about trades and the market.

Jason

This market is like no other. The put call ratio remains near one where I normally would look for a bottom. When the bulls are running out of control the PC ratio is less than .5 and bears best get out of the way. When the ratio hangs .8 to .6 I look for a top.

I look for a flat to down week but then I am not a famous trader.

above charts–jaws of death

gloom doom ,broadening ,gloom doom

a day trader is not a bull or bear has no bias and follows the trend–intraday

our advantage over the long term buy hold /prey types is we play with 100 to one leverage

how many long or medium term long ownlys are in front of the sideways markets

i bet most are chickens and took profits at 12000 or 13000 or was it 15000

neal when are you going to teach daytrading

oops geting ready for intraday trend change–?

Neal,

daytrading is easy /fun/exciting./exhilerating/profitable

but i dont have the temperment/mind set to be a gurrou/teacher

and much prefer to play the fool

the market is controled by the marsians

sometimes the ladies from venus and supervised by the galactic confederation