Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

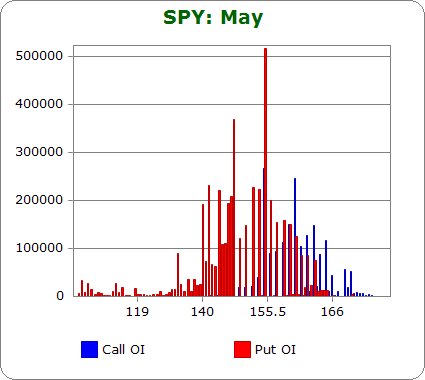

SPY (closed 163.54)

Puts out-number calls 2.2-to-1.0 – about the same as last month.

Call OI is highest at 150 and between 155 and 165.

Put OI is highest 140, 142 and between 145 and 160.

The bulk of the overlap occurs between 155 and 160, but since puts dominate, we’ll want a close in the upper part of the zone to cause the most pain. Today’s close was at 163.54, well above the range. As of now, some call buyers will make some money, and the put buyers will lose nearly everything. In the area above 160, calls out-number puts, so a move down is needed to cause max pain. This would allow some put buyers to make money, but even more call buyers will lose.

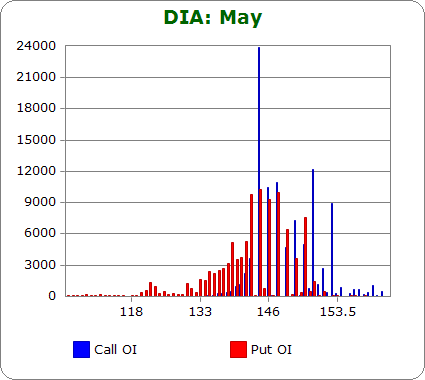

DIA (closed 150.86)

Puts out-number calls 1.2-to-1.0 – about the same as last month.

The big call spike is at 145. OI is also strong (relatively speaking) at 146, 147, 151 and 153.

Put OI is highest between 144 and 147.

There’s some overlap between 145 and 147. A close in the middle of the zone would cause the most pain but still allow some put buyers at higher strikes to make money. That’s just the way it goes. A move up would enable call buyers to profit. Today’s close was at 150.86, well above the range. A healthy move down is needed for max pain.

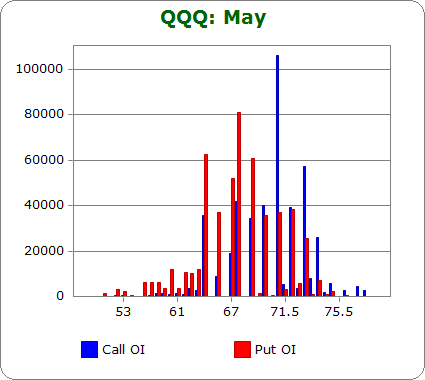

QQQ (closed 73.14)

Calls out-number puts 1.0-to-1.0 – less bearish than last month.

Call OI is highest at 65 and between 68 and 74 with the big spike falling at 71.

Put OI is highest between 65 and 72.

There’s a lot of overlap here over a wide range. Put and call OI is pretty heavy between the mid 60’s and low 70’s, and since calls and puts have been bought equally, a close in the middle is the best chance to achieve max pain. Today’s close was at 73.14, above the zone. A big move down is needed to achieve max pain.

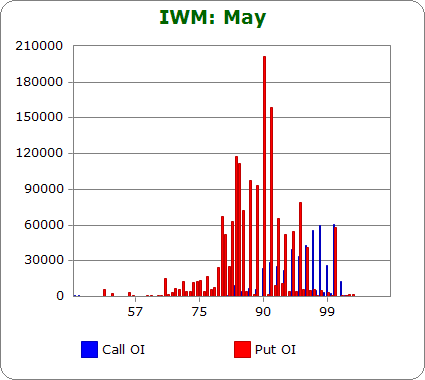

IWM (closed 96.76)

Puts out-number calls 3.2-to-1.0 – about the same as last month.

Call OI is highest at 97, 98 and 100 and ramps down below 97.

Put OI is highest between 84 and 95.

There isn’t much overlap here – at least among the higher strikes. A visual inspection tells me a close near 95 would cause the most pain. Most of the put OI falls below that level, and the biggest call strikes are above. IWM closed at 96.76 – not bad but still a little high. We need a move down to achieve max pain.

Overall Conclusion: It’s not a surprise that anyone who bet on a move up is in the money right now, and the bears once again are feeling a lot of pain. A lot of pain will be felt at the current level, but to achieve max pain, in all cases, a move down between now and Friday is needed.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I am very interested if max pain generally pans out every month. Thx

The Tepper Day came and went, but it proves the case that news pushes this market. Some heavy numbers tomorrow and the end of the week. OpEx may have its way, but news may shock all. Nice exercise Jason. But probably pearls before swine.