Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. India and Japan closed up better than 2%; Hong Kong and Taiwan also did well. Australia dropped 0.6%. Europe is currently mostly up. Greece is up 2.4%; Switzerland and the Czech Republic are also doing nicely. Futures here in the States point towards a slightly down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

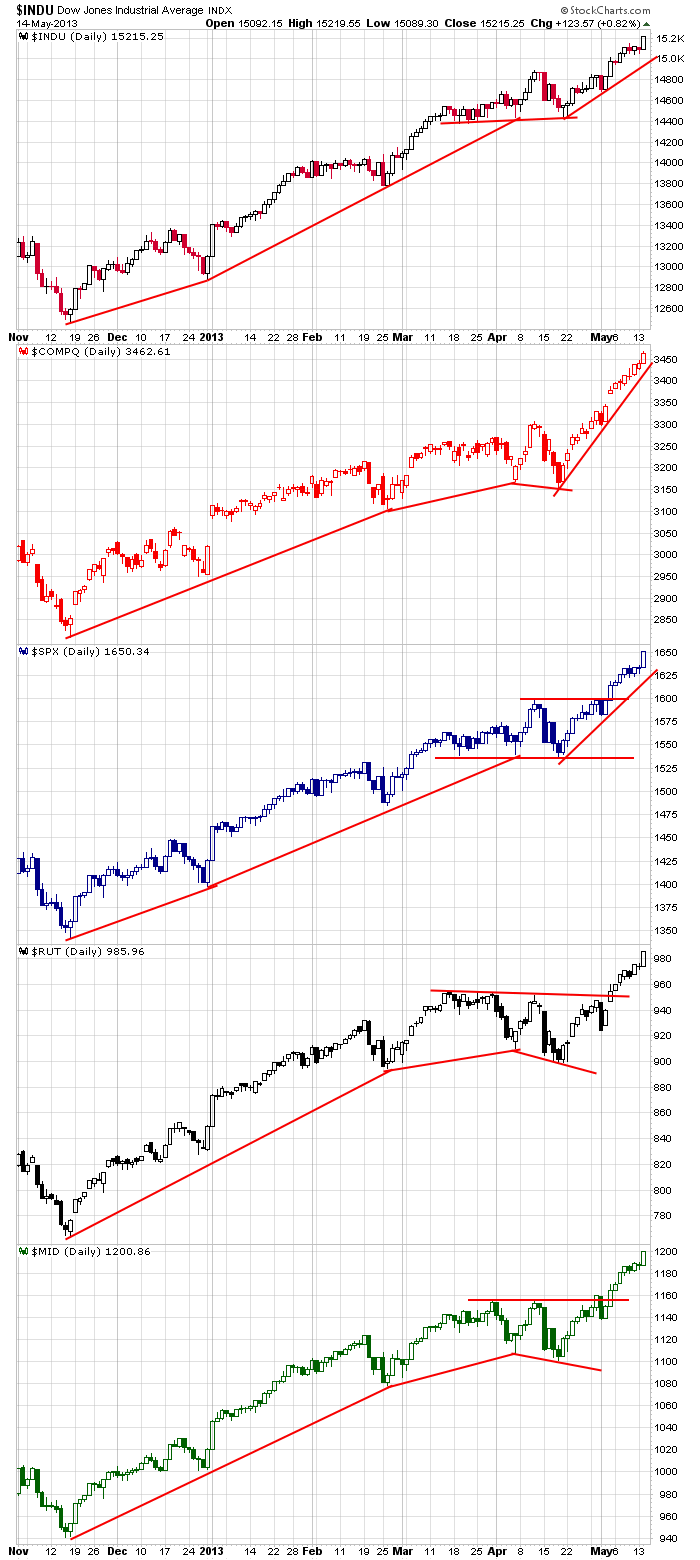

The market continues to be on a tear. The indexes keep going and going and going. It’s the Energizer Bunny market. Here are the daily charts.

There are many ways the market is acting like it rarely acts. The most consecutive up months…the number of consecutive up months to start the year…the length of time between 5% corrections – all of these number put the current state of the market is a category it rarely enters. It won’t last forever, but I’m not about to guess when it’ll end.

Stock news from barcharts.com…

Noble Energy (NBL +1.69%) was upgraded to “Buy” from “Hold” at Stifel with a price target of $140.

Morgan Stanley raised its price target on Google (GOOG +1.09%) to $996 from $932 and keeps an “Overweight” rating on the stock.

Discover (DFS +3.03%) reported April net charge-offs of 1.94% vs. 2.13% last month and an April delinquency rate of 1.65% vs. 1.73% in March.

Deere & Co. (DE +1.29%) tumbled 11% in pre-market trading after it reported Q2 EPS of $2.76, better than consensus of $2.72, but said global financial pressures, weather add caution to its outlook.

Northrop Grumman (NOC +1.81%) increased its dividend to 61 cents a share from 55 cents.

Polaris Industries (PII +1.42%) has been awarded a $382.5 million government contract for fire and emergency vehicles.

Safeway (SWY +3.25%) announced that it will increase to its regular quarterly cash dividend from 17.5 cents per share to 20 cents per share.

Pandora (P +6.82%) fell 4% in pre-market trading after the WSJ reported that Google (GOOG +1.09%) will launch a a paid, Spotify-like music streaming service.

Agilent (A +2.16%) lowered guidance on fiscal 2013 to $2.70-$2.85, below consensus of $2.88, and said it will initiate a restructuring program that is expected to cut approximately 450 regular employees, or approximately 2% of its global workforce.

Apollo Investment (AINV +0.91%) fell over 3% in after-hours trading after it filed to sell 18 million shares of common stock.

The market has a mind of its own right now. Don’t fight it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 15)”

Leave a Reply

You must be logged in to post a comment.

the greatest show on earth is about to start