Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Australia, Hong Kong, India and Indonesia did poorly; Malaysia did well. Europe is currently trading mixed and with a bearish slant. Austria, Norway and the Czech Republic are doing well; Greece is down 4%. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

It’s Tuesday. The market has gained ground 18 consecutive Tuesday’s – that’s the longest Tuesday winning streak in history and the second longest such streak overall (in 1968 the Dow rallied 24 straight Wednesdays).

I’ve known about the Tuesday streak for several weeks but didn’t want to mention it and jinx it. Now it’s mainstream knowledge. There aren’t many traders out there that are closely tuned in that aren’t aware of it. 🙁

Here’s another interesting stat. The last time the Dow dropped three straight days was the end of December 2012. The number of days that have passed since then and today is the most since 1900. Yesterday was a down day. If the Tuesday streak is broken today, we’ll get to see if the Dow can keep this other stat alive tomorrow.

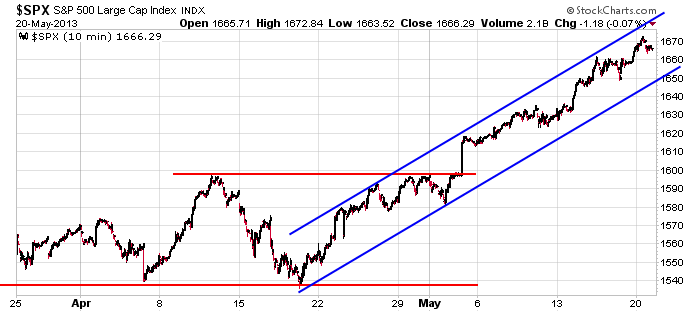

Whether these two stats remain in place is fun to follow, but let’s not lose sight of what the market has been doing. Here’s the 10-min SPX chart.

Stock news from barchart.com…

Home Depot (HD -0.13%) is up over 4% in pre-market trading after it reported Q1 EPS of 83 cents, better than expectations of 76 cents.

UBS raised their price target on Microsoft (MSFT unch) to $40 from $33.

AutoZone (AZO unch) reported Q3 EPS of $7.27, stronger than expectations of $7.21.

Best Buy (BBY -0.33%) reported Q1 EPS of 32 cents, better than expectations of 24 cents.

Medtronic (MDT unch) reported Q4 EPS of $1.10, better than expectations of $1.03.

Carnival (CCL +0.91%) plunged 12% in pre-market trading after it lowered guidance on fiscal 2013 to $1.45-$1.65 from $1.80-$2.10, well below consensus of $1.97.

Great Lakes Dredge (GLDD unch) was awarded a $122.2 million U.S. Army contract for dredging services along the Miami Harbor.

Senator Levin stated in a press conference that Apple (AAPL +2.23%) has used Ireland as a tax-haven for the past five years by creating “No-shore” tax entities.

Lockheed Martin (LMT unch) awarded $111.51M U.S. Navy contract for the development, integration and production of AN/SQQ-89A15 Surface Ship Undersea Warfare Systems.

Northrop Grumman (NOC unch) was awarded $113.72 million U.S. Navy contract for the Full Rate Production of five E-2D Advanced Hawkeye Lot 2 aircraft.

Standard & Poor’s Ratings Services lowered its corporate credit and senior unsecured debt ratings on (DELL) to ‘BBB’ from ‘A- and said its outlook on Dell remains watch negative.

Hasbro (HAS -0.44%) was initiated with an “Overweight” at Piper Jaffray with a price target of $55.

Mattel (MAT -1.33%) was initiated with an “Overweight” at Piper Jaffray with a price target of $53.

hhgregg (HGG +1.23%) fell over 7% in after-hours trading after it reported Q4 EPS of 31 cents, better than consensus of 30 cents, although it reported Q4 revenue of $597.6 million, below consensus of $622.57 million, as Q4 same-store-sales fell -9.8%.

Urban Outfitters (URBN -0.11%) dropped over 2% in after-hours trading after it reported Q1 EPS of 32 cents, better than consensus of 29 cents, although it said Q1 revenue was $648 million, weaker than consensus of $655 million.

Two Fed officials give speeches today.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 21)”

Leave a Reply

You must be logged in to post a comment.

Fed speak today has center stage and the prospects are for more doubletalk which means no decision has been made and the taper down of buying is just a trial balloon more than likely. But it is raising hell with bonds. Transitory bet you.

The attempted rally in Precious metals yesterday is going to retest the lows and at that point may be a buy, with 5% stops. Or better yet a call or two. The miners are the best prospect, and platinum preferred in my book. S Africa is having problems keeping its Plat mines open and it is an industrial metal.

The doldrums of summer are likely to arrive this weekend. More cash and less effort to catch a ride going your way.

Historically Tuesday is the worst day of the week assuming you are a bull. There was a time a few years back the I calculated that the NASDAQ had lost it’s entire value on Tuesday.

Perhaps human nature has changed with this streak or the law of averages has taken over. What ever the case the market has been acting strangely.

Paul

its fed tuesday to spend money

but the bigboy instos can override that if they are commited to sell here

and they may well do starting now till close

the purpose of the bigboys is to catch everyone of gaurd