Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a bullish slant. Japan and South Korea did the best. Hong Kong pulled up the rear. Europe currently leans to the downside. Austria and Greece are down more than 1%; there are no notable winners. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil is down, copper up. Gold and silver are up.

Bernanke speaks today starting at 10:00 EST to the Joint Economic Committee of Congress. He’ll of course be questioned about QE unlimited and if Congress has any balls, he’ll be questioned about the effects QE is having on the stock market, namely if another bubble is forming.

Minutes of the last FOMC meeting will be released at 2:00 EST. Traders will be looking for any discussion regarding tapering off bond purchases sooner rather than later.

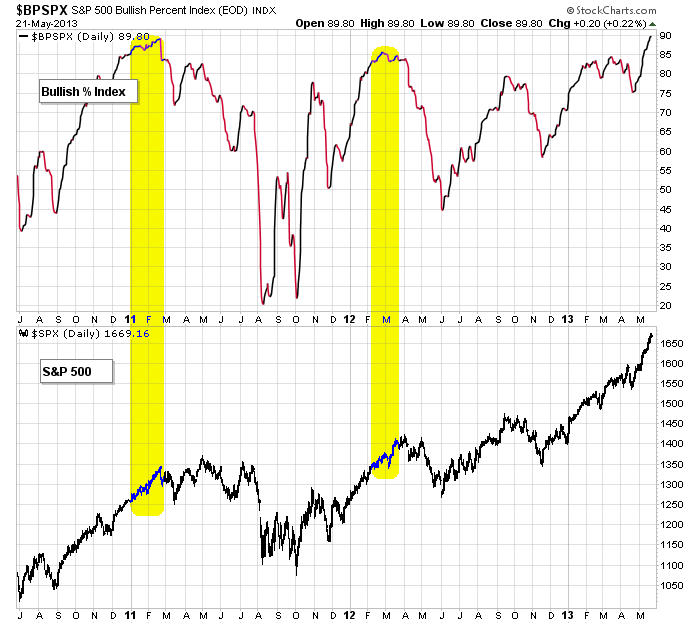

I’ve said several times the last few weeks to lay down your analysis tools because the market has a mind of its own right now. It’s going to do what it wants to do. But laying down my tools doesn’t mean I’m ignoring them. I’m still checking a few out to see how the current rally compares to past rallies. According to the following SPX Bullish % chart, the extent of the current rally has produced more buy signals on the point-n-figure charts than another other rally the last three years. A full 90%!. When the market first rallies, only the best companies move up. Then good and average companies join. Eventually the bottom of the barrel stocks participate. That’s what’s happening now. Everything, even the garbage stocks, are being bid up.

We gotta stay long, but we also have to be careful about initiating new positions with the market being as stretched as it is.

Here are some stock specific headlines from barchart.com…

Target (TGT +0.86%) reported Q1 adjusted EPS with items of 77 cents, weaker than consensus of 87 cents, and lowered guidance on fiscal 2013 EPS to $4.70-$4.90 from $4.85-$5.05.

Lowe’s (LOW +0.17%) reported Q1 EPS of 49 cents, weaker than expectations of 51 cents.

Staples (SPLS +0.55%) reported Q1 EPS of 26 cents, lower than consensus of 27 cents.

Chesapeake (CHK +0.24%) was upgraded to “Positive” from “Neutral” at Susquehanna who also raised its price target on the stock to $26 from $23.

Xcel Energy (XEL +0.07%) boosted its dividend from 27 cents to 28 cents per share.

Moody’s Investors Service placed Carnival’s (CCL -4.28%) A3 senior unsecured debt rating under review for possible downgrade.

Dycom (DY +0.34%) surged nearly 13% in after-hours trading after it reported Q3 EPS of 21 cents, stronger than consensus of 17 cents, and raised guidance on Q4 EPS to 40 cents-47 cents, better than consensus of 38 cents.

Sak (SKS +11.32%) jumped 18% in after-hours trading after the NY Post reported that Saks has hired Goldman Sachs to explore strategic alternatives, including a possible sale.

NetApp (NTAP -1.51%) rose nearly 3% in after-hours trading after it reported Q4 EPS of 69 cents, better than consensus of 68 cents, and said it has undertaken a realignment of resources and restructuring.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 22)”

Leave a Reply

You must be logged in to post a comment.

garbage stocks? you mean TSLA isn’t an $11 billion dollar company? do you mean that maybe, just maybe, Yahoo should not have paid $1.1B to a high school drop out who runs the Twitter-esque rip off full of porn? oh no, this market is totally legit. get in 1000:1 leverage. widows and orphans on full margin…

Mark, thumbs up !

I’m not talking about TSLA, I’m talking about solar stocks which were left for dead a couple months ago. They’re rallying huge.

Mark is upset. He is being too literal. So porn is a business we got to make allowances?

Fed speak today is a no show. The volume is very low on advances, but when it happens and things start down it will be fast for the first move, then we see what they really think. “They” is of course the algorithms that live on buy side computers very near the exchange computers. We know that the buy-side computers are slaves to arcane rules

and passions that can lead to things being connected that we would never of guessed, so trade what you see. Don’t follow the quants into selling because they are set to attempt rallies every time volume slows. It is a probabilistic world, a kind of new religion.

Yes, Mark and ES, it’s fraudulent, but fighting the manipulators and money counterfeiters has been murderous to account balances.

Neal your comments are so inappropriate for this site.

We are traders. It’s what we do for a living. It’s how we make money to pay the bills.

I can turn a $100K account into $300K in one year. You can’t do that collecting dividends.

Your style is for investors who already have a healthy nest egg, but making 10%/year (the historical average) doesn’t get you very far unless you have a lot of money.

well said Jason

in this market traders make more than investors

the old days of buy /hold /prey are not relevent to todays market

but if you want to be a bit more fun loving/risk taking on margin/thrill seaker

then daytraders can make or loose that ammount in a day

its all in a days work at the casino

but probably not relevent to this site

Target TGT

One of the stocks that tends to move before the market.

with not a bear to be found anywhere in the galaxy

is it time to think about selling now

i see on my tick ind that the instos with their parobolic computers

as starting to sell the strengh in the last hour