Yesterday, for the 19th straight Tuesday, the Dow posted a gain. This is the longest Tuesday winning streak in history and the second longest of its kind (in 1968, Wednesday’s had a winning streak totaling 24).

This stat and others offer more evidence this rally is unlike many others we’ve seen.

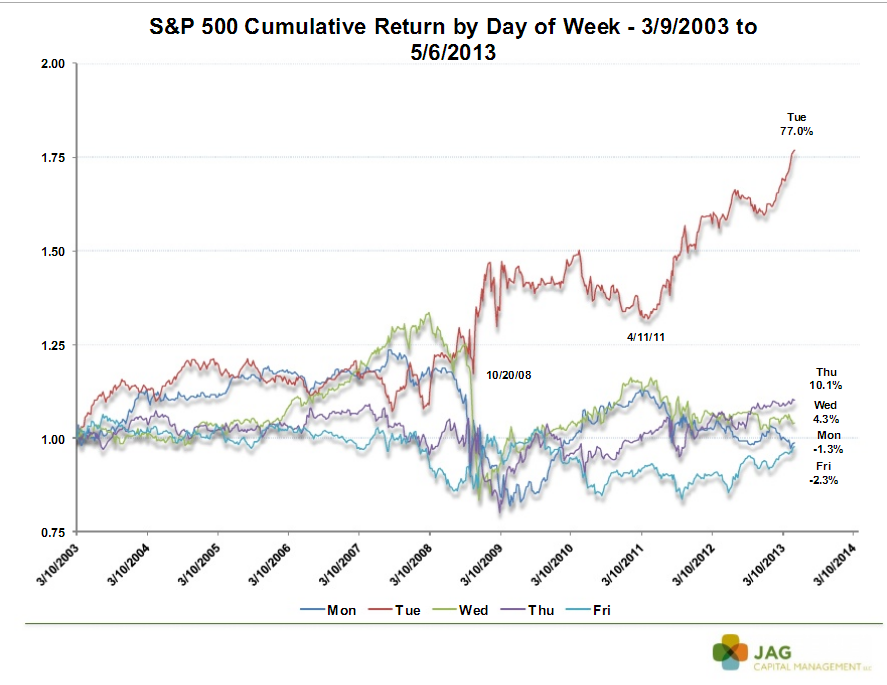

But the Tuesday streak thing isn’t a recent phenomenon. Here’s a chart showing the S&P’s performance the last ten years broken out by day of the week. Tuesday has been the strongest day by far. Other notables include:

- Tuesday is the strongest day. I guess the term “turnaround Tuesday” is well deserved.

- Monday and Friday are the weakest. This is odd. Friday is traders’ last chance to tinker with their portfolios before the weekend, and Monday is their first chance, given all the news and events over the weekend, to do the same. According to the Traders’ Almanac, a down Friday/Monday combination is a bearish omen, but this doesn’t seem to be true. There have no doubt been many down Friday/Monday combos which then reversed on Tuesday.

- Monday and Friday weren’t just the weakest, they both posted net losses. This stands out because over the last ten years, the market has been in rally mode for eight. Think about that. The market has rallied 80% of the last 10 years, yet these two days posted losses.

- There are many times Tuesday diverged from the other four days. For example, starting in March 2008, Tuesday rallied and the other four days dropped. And then the opposite occurred in March 2010 when Tuesday declined and the other days rallied.

Does anyone want to throw out a theory on why Tuesdays are so strong. It’s not just a little stronger, it’s significantly stronger. Almost 80% of the market’s gains took place 20% of the days. That means you could have made a lot of money trading futures by buying Monday’s close and selling Tuesday’s close. Or buying Monday’s close and selling Thursday’s close.

There’s a small part of me that doesn’t believe these stats. It wouldn’t be hard to download ten years of data into a spread sheet and attempt to verify the numbers. Does anyone want to volunteer to do this?

Jason

As an engineer I do not always understand why I just accept the fact if an action takes place another action usually follows.

I do understand when the boss brings doughnuts people stop working.

Paul

Fund Managers more active buying on Tuesdays? Just a wild guess

Then again, maybe it has to with the moon cycles and astrological events happen every Tuesday! LOLOL!

Jac

Neal join LB….then you’ll be able to hang out on the message board where numerous successful traders post throughout the day.

The answer is common sense… the Fed meets on Tuesdays, once a month. the economy and market have been Fed driven the past 10 yrs, more than other decades by far. duh!!!