Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Japan dropped almost 4%; Australia, Hong Kong, Singapore and South Korea dropped more than 1%. Europe is currently down across the board. Belgium, France, Germany, Amsterdam, Stockholm and London are down 0.9% or more. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are down.

We entered this week with the onus on the bulls. They’re the ones who had to dig in and protect their turf. That’s what they did on Monday by buying early weakness, but the recovery was completely given back yesterday before buyers stepped in late in the day. It seems each bounce is travelling less distance and lasting a shorter period of time.

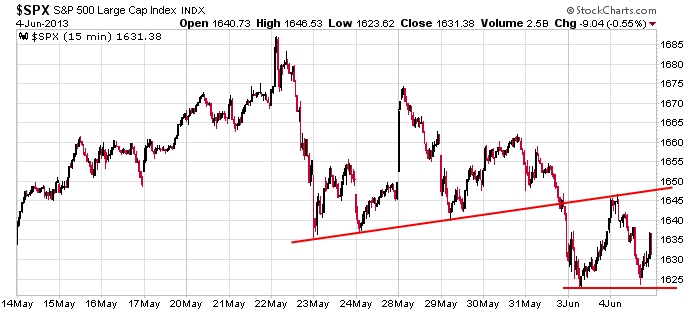

Here’s the 15-min SPX chart. Price got squeezed into the apex of a triangle and then got pushed out the bottom. A bounce back to the previous support trendline got rejected, and a test of the low followed. Today’s open will be near the low. The near term trend is down. The onus remains on the bulls.

Don’t be a hero out there. And remember, the biggest moves up occur in downtrends.

Here are some stock-specific stories from barchart.com…

JPMorgan believes PC demand remains weak, creating risk to the guidance and consensus estimates for Intel (INTC +0.48%) and AMD (AMD +1.26%) .

Bed Bath & Beyond (BBBY -2.02%) was upgraded to “Buy” from “Neutral” at Nomura who rasied their target price on the stock to $82 from $72.

Main Street (MAIN -3.24%) was initiated with a “Buy” at Wunderlich with a target price of $35.

Axiall (AXLL -1.40%) was initiated with a “Buy” at BofA/Merrill with a target price of $56.

Callaway Golf (ELY +2.31%) was downgraded to “Neutral” from “Outperform” at Wedbush.

UnitedHealth (UNH -0.70%) raises its dividend from 21.25 cents per share to 28 cents per share.

Bloomberg reported that Apple (AAPL -0.31%) lost a patent case against Samsung, and according to an ITC ruling, will face a limited import ban on select products.

In a CNBC interview, analyst Meredith Whitney mentions Discover (DFS -0.02%) as an equity pick in financial services.

Bob Evans (BOBE +0.13%) reported Q4 EPS of 71 cents, better than consensus of 64 cents.

The WSJ reported that The Federal Housing Administration could face a loss as large as $115 billion over 30 years according to the results of a previously undisclosed stress test conducted last year.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 5)”

Leave a Reply

You must be logged in to post a comment.

ADP disappoints. Lower lows and lower highs do a trend make. How far down is possible. Try the 200 day EMA. Is that a prediction? Yes.

Neals imprisonment of my dead cats–gruesome and awesome to a life of debortuary and the good life in his modleing agency has caused them to refuse to bounce

i have sent the cats a note reminding them of their duty and with the breaking of spx 1620 a turn around 1600 is possible it should be a piviot false break low

but i dont hold any hope for the market till 666

capitulation–any attempt to buy was immediatly sold

or we will have a fatal crash