Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Australia, Hong Kong, Singapore, South Korea and Taiwan each dropped more than 1%. Europe is currently mixed. Stockholm and Belgium are down the most; France and Amsterdam are up. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are up.

The bulls have not done a good job defending their turf this week. The onus was on them to dig in and prevent prices from dropping further, but they have failed. Every rally – big and small – has gotten sold. Day after day new lows are registered. If it wasn’t for tomorrow’s employment numbers, I’d say a big move is coming. Either the floor gets pulled out because the bulls throw in the towel, or we’d have a surprise snap back rally. But news trumps the charts, so things may be on hold until after tomorrow’s numbers.

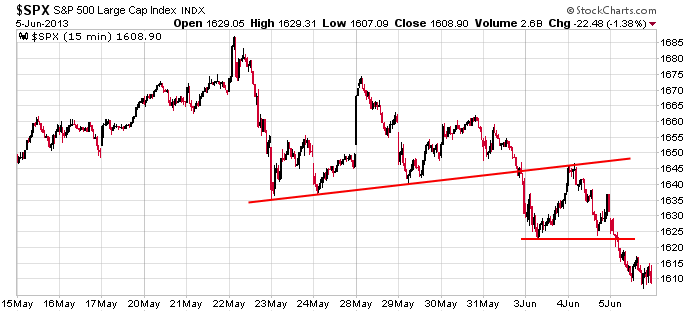

Here’s an updated of the 15-min SPX chart. Until proven otherwise, previous support levels are resistance.

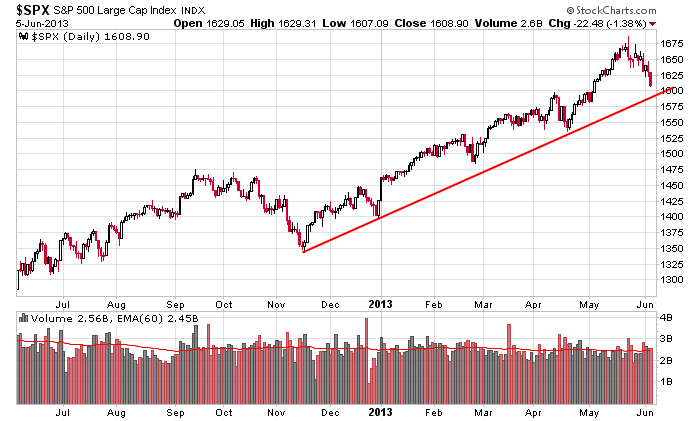

But don’t get too bearish. Here’s the daily. There is nothing wrong with the long term charts.

Tomorrow’s employment numbers are huge…not because the numbers are more important than previous months, because of the market’s reaction. Strong markets rally on good news and easily absorb or brush-off bad news. Weak markets do the opposite. The reaction to tomorrow’s numbers will be very telling.

Here are stock-specific stories from barchart.com…

CNET reports that the Touchscreen BlackBerry (BBRY +0.66%) A10 is set to launch in November.

Vera Bradley (VRA -0.22%) downgraded to “Neutral” from “Outperform” at RW Baird.

JM Smucker (SJM -0.26%) reported Q4 EPS of $1.29, better than consensus of $1.16.

Limited Brands (LTD -0.54%) reports May comparable store sales up 3%.

Ciena (CIEN -1.03%) reported Q2 adjusted EPS of 2 cents, better than consensus of a -1 cent loss.

Greif (GEF -1.84%) reported Q2 EPS of 70 cents, slightly better than consensus of 69 cents.

Endo Health (ENDP -1.37%) lowered guidance on fiscal 2013 adjusted EPS to $4.10-$4.40, below consensus of $4.27, and it also announced strategic alternatives to cut annual operating expenses by $325 million, which includes reducing its workforce by 15%.

J.C. Penney (JCP +1.11%) was initiated with a “Buy” with a price target of $23 and Dollar Tree (DLTR -0.89%) was also initiated with a “Buy” at Sterne Agee with a price target of $58.

Thermo Fisher (TMO -2.35%) announced a $2.2 billion common stock offering.

rue21 (RUE +0.21%) reported Q1 EPS of 44 cents, lower than consensus of 46 cents, and lowered guidance on fiscal 2013 EPS to $1.98-$2.03 from $2.00-$2.05, below consensus of $2.02.

Ascena Retail (ASNA -1.14%) reported Q3 adjusted EPS of 26 cents, lower than consensus of 30 cents, and cut guidance on fiscal 2013 EPS to $1.10-$1.15 from $1.20-$1.30..

VeriFone (PAY -4.94%) tumbled 18% in after-hours trading after it reported Q2 EPS ex-items of 42 cents, weaker than consensus of 47 cents.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 6)”

Leave a Reply

You must be logged in to post a comment.

Why anyone would put a buy on J.C. Penney is beyond me. Their stores are empty their customer base is frustrated. I am no stock picker but this one is going to tank.