Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mostly down. Indonesia dropped almost 3%; China, Hong Kong and South Korea dropped more than 1%. Europe is currently down. Austria is up 1%; Belgium is down 1.6% while Norway, Stockholm, Greece and the Czech Republic are down noticeably. Prior to the release of the jobs numbers, futures here in the States suggested a flat open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

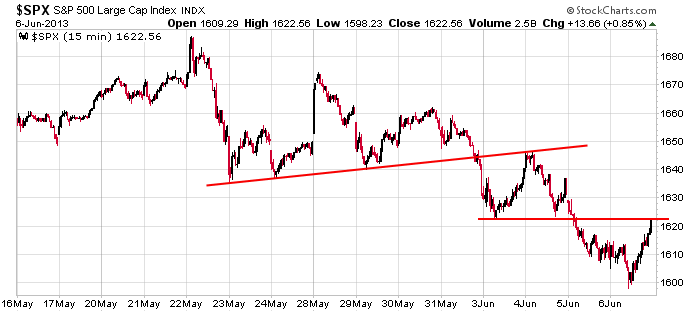

The market staged an impressive comeback yesterday. It dropped to a new 1-month low and then rallied all the way back to its previous support level. The S&P moved about 25 points off its low. Here’s the 15-min SPX chart. The near term trend remains down. Yesterday’s bounce doesn’t look much different than any other bounce that have played out the last couple weeks. The onus is still on the bulls to reverse this move.

Here are the employment numbers…

unemployment rate: 7.6% (was 7.5% last month)

nonfarm payrolls: +175K

private payrolls:

average workweek: 34.5 (unchanged)

hourly wages: up 1 cent to $23.89

March raised from 138K to 142K

April was lowered from 165K to 149K

As I mentioned yesterday, the reaction to the numbers is more important and telling than the numbers themselves. We’ll see what happens. The initial knee-jerk reaction was up.

Here are stock-specific stories from barchart.com…

Oppenheimer keeps an “Outperform” rating on Microsoft (MSFT +0.52%) and raises its price target on the stock to $39 from $34.

Iron Mountain (IRM +0.91%) was downgraded to “Hold” from “Buy” at Stifel.

JPMorgan (JPM +0.89%) was downgraded to “Neutral” from “Outperform” at Macquarie.

Abercrombie & Fitch (ANF +0.59%) was upgraded to “Buy” from “Neutral” at BofA/Merrill.

Dun & Bradstreet (DNB +1.48%) was upgraded to “Neutral” from “Underweight” at JPMorgan.

Standard & Poor’s Ratings Services said it revised the outlook on its long-term ratings on Brazil to negative from stable.

The U.S. Department of Justice has settled two lawsuits against PG&E (PCG +2.27%) and its contractors who will pay $50.5 million for wildfires that scorched 18,000 acres of national forest.

Take-Two (TTWO +0.63%) initiated with a Buy at Stifel with a price target of $21.

Thor Industries (THO +0.32%) reported Q3 EPS of 97 cents, stronger than consensus of 88 cents.

Quiksilver (ZQK +4.50%) reported an unexpected Q2 EPS loss of -12 cents, much weaker than consensus of a 4 cent gain.

Myriad Genetics (MYGN +1.94%) initiated with a “Buy” at Cantor with a price target of $40.

Cooper Companies (COO +1.92%) reported Q2 EPS ex-items of $1.50, stronger than consensus of $1.38, and raised guidance on fiscal 2013 EPS to $6.15-$6.25 from $5.95-$6.10, stronger than consensus of $6.05.

Vail Resorts (MTN -1.29%) reported Q3 EPS of $2.66, weaker than consensus of $2.74.

Gap (GPS +1.81%) climbed over 3% in after-hours traading after it reported May sales of $1.22 billion and that May Same-Store-Sales rose 7%, much better than consensus of a +3.7% increase.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 7)”

Leave a Reply

You must be logged in to post a comment.

Good article, Jason. Always thought Buffet’s maxim was trite and meaningless. Your article nicely says that he’s full of crap. The only way he could trade and not have losses is to know the outcome ahead of time; and there is one way to do that – insider info. Makes you wonder. At least it makes me wonder.

NFP was in line. The belief now is that QE is good to go for the rest of the year. So its Friday and it will be up in a relief rally. Dow futures are up 70 etc. The bears have got a while to move it down toward the 200 day ema. Me? I have a short spread, and am long for Friday: back to day trades. No tread, just confusion and exploitation. Hold cash is my strategy.

At sea,the Oceans are dirty with trash, plastic bottles, food scrapes and radiation. This is going to be a major problem, probably is already. Fishermen we spoke at sea 200 miles off the Columbia say their catch is radiation “hot” due to the Japanese nuke melt down last year. They say take Iodine to avoid radiation illness. What a mess. 40 years of sailing an now it could be lethal eat the fish we catch. Bad day in hell.

Total PC ratios are very high. I see that at the bottom not the top. When the market is not right walk away. I see a big move just don’t know up or down.

Hearing the big short will start in about a month. July 19th give or take. Up until then. We shall see.

bears like to short fat bulls

so after hiting resistance piviots i have changed sides to short the world

but insto hedgies control the market and they may want to stop run some higher short stops

oslama talking so hot air hindenberg now