Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 3.5%; China, Hong Kong, India and Japan dropped more than 1%. Europe is down across-the-board. Greece is down 4.5%, and France, Germany, Amsterdam, Norway, Switzerland, London, Spain, Italy and the Czech Republic are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

Big news come from Japan. Its benchmark overnight rate and monetary base target were left unchanged, and the maximum length of its fixed-rate loan facility to banks was left at 1 year (expectations were for the BOJ to extend the maturity of the loans to 2 years or longer). The yen has jumped, and markets around the world are taking big hits.

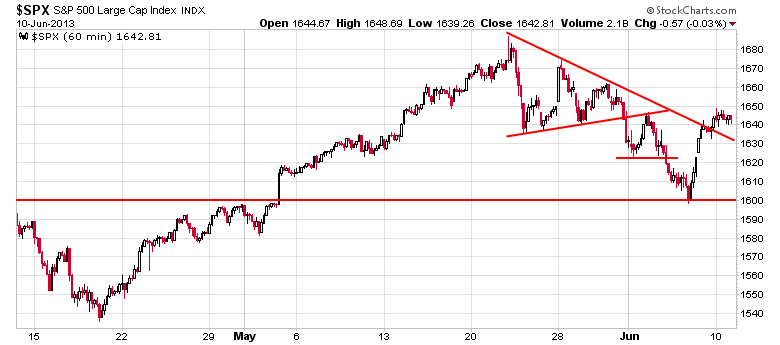

Here’s the 60-min SPX chart. Yesterday the index closed right in the middle of its May high and June low. Today’s open will be somewhere in the high 1620’s. The bulls have a little wiggle room, and unfortunately for them, instead of getting to methodically defend their turf intraday, they’ll have to do it right at the open.

The gap down seems excessive. Do we really care about Japan that much? I guess we’ll find out today. It would seem our recovery is more important than Japan, which has been in a recession for two decades.

Trading wise things remain the same…tougher than usual. A dominant near-term trend does not exist, so we gotta swing four singles, not home runs.

Here are stock-specific stories from barchart.com…

CEMEX (CX +0.18%) was downgraded to “Sector Perform” from “Outperform” at Scotia Capital.

Reuters reported that the U.S. Navy plans to sign a five-year contract valued at near $6.5 billion to buy 99 new V-22 Osprey tilt-rotor aircraft built by Boeing (BA -0.24%) and and Bell Helicopter, a unit of Textron (TXT -0.04%) .

Dole (DOLE +3.34%) up 16% in pre-market trading to $11.85 after CEO offers buyout at $12 per share.

Disney (DIS -1.57%) was upgraded to “Outperform” from “Neutral” at Macquarie who also rasied their price target on the stock to $75 from $70.

GSI Technology (GSITD) reported that the International Trade Commission has confirmed the initial determination of Chief Administrative Law Judge Charles E. Bullock in the patent litigation between GSI and Cypress Semiconductor (CYD +0.51%) , finding that GSI’s memory devices do not infringe the patents of Cypress.

Diamond Foods (DMND +8.00%) rose 5% in after-hours trading after it reported Q3 EPS of 5 cents, better than consensus of a -17 cent loss.

Pep Boys (PBY +0.16%) reported Q1 EPS of 7 cents, weaker than consensus of 9 cents.

CardioNet (BEAT -0.93%) surged 36% in after-hours trading after it announced that it has entered into a three-year National Provider Agreement with UnitedHealthcare Insurance ({=UNH , covering all of CardioNet’s monitoring modalities.

Symmetry Medical (SMA -0.76%) cut guidance on its fiscal 2013 EPS to 40 cents-50 cents, below consensus of 63 cents. and lowered guidance on its 2013 revenue view to $400 million-$415 million from $420 million-$440 million, lower than consensus of $426.46 million.

lululemon (LULU +1.04%) plunged 12% in after-hours trading after CEO Day said he will step down when a successor is named.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 11)”

Leave a Reply

You must be logged in to post a comment.

Jason – maybe we care about Japan because of the worldwide derivatives time bomb.

I do not believe it is Japan as much as our bond market reaction that ES is reacting to. At some point that more appealing 10 year yield is going to become a no-brainer for money flows from equities to bonds/notes with a higher yield and perceived lower downside risk than equities at all time highs.

Do the bulls step in on this gap down as they have in the last 6 months or do we go to free fall?

Don’t look to me for answers.

dow ZERO

well we had a false break low

now for a failed top

and 1929 1987 will be minor lows

The bulls did not bounce back today. Short on bounces.