Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. China and Hong Kong dropped more than 1%. Indonesia rallied almost 2%. Europe is currently split. Italy and Norway are posting solid gains; Belgium is down 1.5%. Futures here in the US point towards a moderate gap up open for the cash market.

The dollar is up. Oil and gas are up. Gold is up; silver is down.

Today will be the third day out of the last four the market is gapping significantly at the open. First there was a gap up last Friday. Then a big gap down yesterday, and now today a big gap up.

The market can’t make up its mind. Volatility has increased significantly, gaps are bigger, intraday swings are bigger, nervousness is heightened. It’s a far cry from the slow and gentle action we’ve had most of the last six months.

This is not a time to take big chances. For a couple weeks I’ve been advising to swing for singles, not homeruns. Be content with little 5% gains, and don’t give profits back. The market changes its stripes from time to time, and only those willing and able to make minor adjustments survive. My #1 adjustment is my holding time. Instead of entering with the thought I may be able to ride a move for several weeks, I enter knowing I may only be in for a couple days.

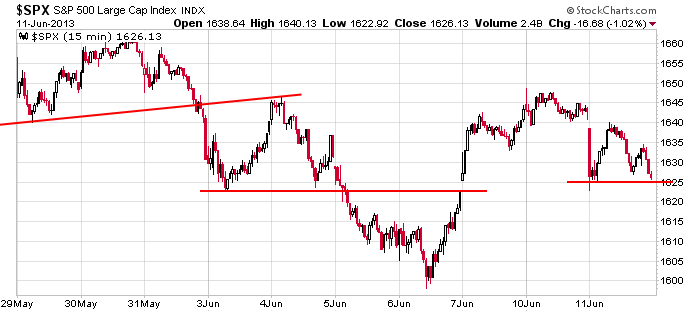

Here’s the 15-min S&P chart. There’s a air pocket in the 1623-1625 area that could lead to a quick drop to 1615. But the bulls have some room to work with because today’s open will be in the mid 1630’s.

Here are stock-specific stories from barcharts.com…

Praxair (PX -0.66%) was upgraded to “Overweight” from “Neutral” at JPMorgan who raised their price target on the stock to $133 from $118.

Manitowoc (MTW -3.36%) was initiated with a “Buy” at Stifel with a price target of $25 and Terex (TEX -3.90%) was also initiated with a “Buy” at Stifel with a target of $44.

Prudential (PRU -1.98%) was downgraded to “Outperform” from “Top Pick” at RBC Capital.

Bunge (BG +0.23%) was upgraded to “Overweight” from “Neutral” at Piper Jaffray.

American Water (AWK +0.10%) was upgraded to “Overweight” from “Neutral” at HSBC.

Health Management (HMA -1.42%) was upgraded to “Fair Value” from “Sell” at CRT Capital.

Hewlett-Packard (HPQ -1.02%) launched an IT system for businesses in cooperation with Google (GOOG -1.17%) .

First Solar (FSLR -7.29%) dropped over 7% in after-hours trading after it filed to sell 8.5 million shares of common stock.

Yum! Brands (YUM -0.98%) fell nearly 2% in after-hours trading after it said its China Same-Store-Sales were down 19% in May.

Dean Foods (DF -1.55%) was downgraded to “Market Perform” from “Outperform” at Bernstein.

Ulta Salon (ULTA -2.84%) jumped nearly 10% in after-hours trading after it reported Q1 EPS of 65 cents, better than consensus of 62 cents.

Rambus (RMBS -2.19%) rallied over 9% in after-hours trading after it announced that it settled patent litigation and signed a 5-year patent license agreement with SK Hynix. The agreement will pay Rambus $12 million per quarter for the next 5 years for the use of Rambus memory-related patented innovations in SK Hynix semiconductor products.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 12)”

Leave a Reply

You must be logged in to post a comment.

a good trade should last 2 hours or less

volitility is great

no time to get bored

Aussie is correct!

I am collaring weekly options.

my stratagy is for index futures only,daddy

we just had a pop below y/days low ,which can be a false break,with excessive extream negative tick ind ,so im out,even though most likly more down,to next piviot

im got bored

this may also turn into a creapy crawlly sideways now for a while,with europe closed now

i never trade creapy crawlies,except for after hours for strategic positioning

sometimes i feel im a computer

often i behave like a robot

my name is ,”oil can harry,,’

should get volitile for close may even take a short term long

with the amount of sell on the down tick and negative tick extrems today may have been a capitulation day of sorts,but this market is very nervious

had a 2 hour sleep and back for close