Good morning. Happy Friday.

The Asian/Pacific markets closed up across-the-board. Indonesia rallied better than 3%; Australia, India, Malaysia, Japan and Singapore move up 1% or more. Europe is currently mostly up. Austria, Belgium and Greece are leading the way. Futures here in the States point towards a slightly down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

Yesterday the market experienced its best up day in several months. It was weak out of the gate but then grinded higher all day. The AD line closed at a high level, the TICK average stayed above 0 all day, and the small and mid caps led the way. It was a good old fashion up day.

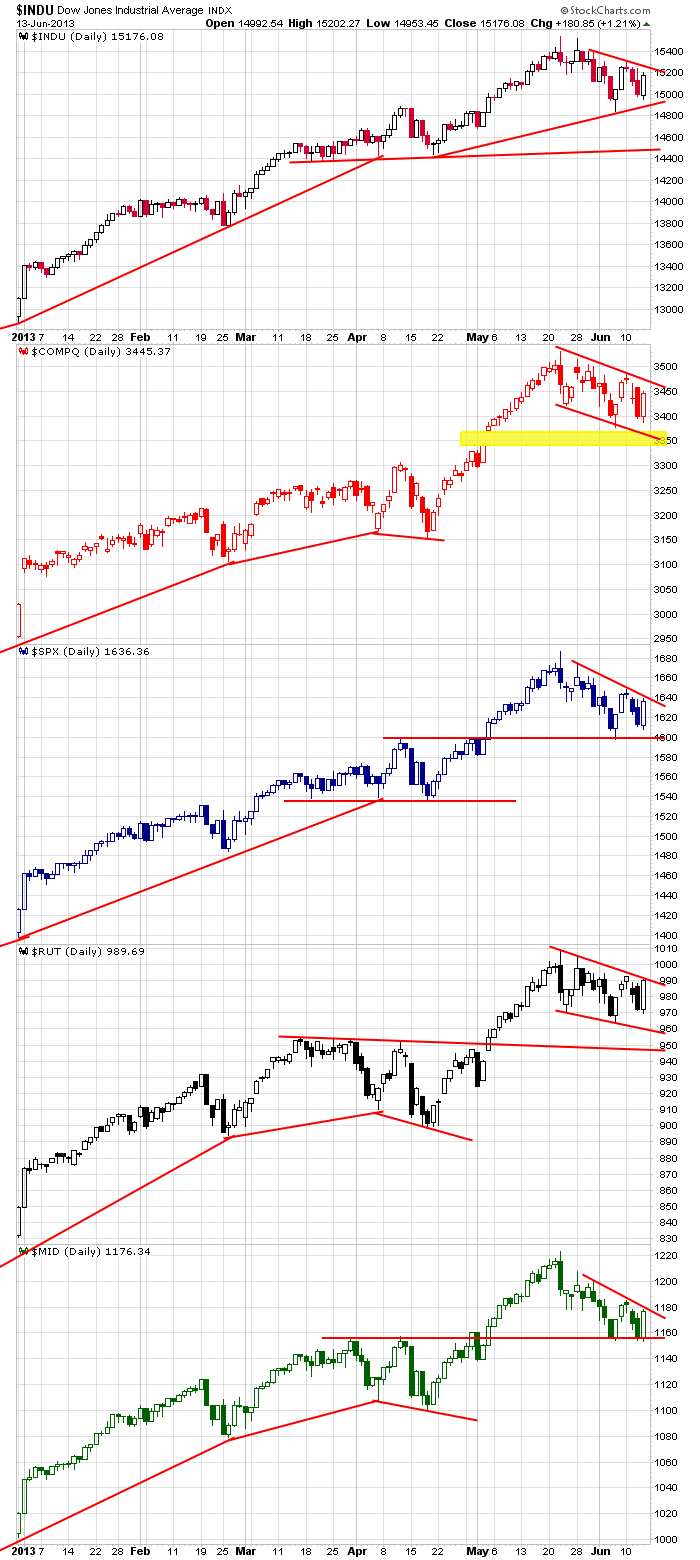

The last couple weeks have been a little frustrating because the market has gapped a lot, there have been many intraday reversals, volatility has increased and of course prices have moved down against their overall trend. But the overall trend has remained solidly in tact. Here are the daily charts. In all cases the indexes are trading in bullish continuation patterns within up trends. Rectangles, wedges, triangles – doesn’t matter. The bulls continue to deserve the benefit of the doubt because the overall trend is strong and has lasted a long time. And of course the bears have been wrong so many times.

Yesterday bought the bulls some breathing room, but with lower highs in place, they don’t have much wiggle room. It wouldn’t take much for the above charts to fall through support.

I’d suggest continuing to play it safe until the market decides what it wants to do next.

For what it’s worth, we have an FOMC meeting next Thursday.

Here are stock-specific stories from barchart.com…

Myriad Genetics (MYGN -5.63%) was downgraded to “Neutral” from “Buy” at BofA/Merrill following the Supreme Court’s ruling on gene patents.

SunTrust (STI +1.98%) was downgraded to “Neutral” from “Buy” at UBS.

DuPont (DD -0.65%) was downgraded to “Neutral” from “Buy” at BofA/Merrill.

Praxair (PX +1.49%) was initiated with a “Strong Buy” at Raymond James with a proce target of $135.

Wells Fargo (WFC +1.66%) was downgraded to “Neutral” from “Buy” at Sterne Agee.

American Express (AXP +0.66%) was downgraded to “Equal Weight” from “Overweight” at Barclays.

AB InBev (BUD +0.64%) coverage reinstated with an “Overweight” at JPMorgan.

CSC (CSC +1.04%) was upgraded to “Buy” from “Hold” at BNP Paribas.

Piper Jaffray kept its “Overweight” rating on Coinstar (CSTR +1.74%) and rasied its price target on the stock raised to $75 from $65.

Tetra Tech (TTEK -0.89%) was awarded a $100 million U.S. Navy contract for environmental remediation services at various Department of Defense installations.

Sikorsky Aircraft, a division of United Technologies (UTX +1.74%) , was awarded a $244.86 million multi-year government contract for the procurement of UH-60M Black Hawk helicopters.

Smith & Wesson (SWHC +2.31%) rose over 5% in after-hours trading after it raised its view on Q4 EPS to 44 cents with revenue of $179 million, higher than consensus of 40 cents with revenue of $170.72 million. The company then announced a $100 million share repurchase authorization.

Casey’s General Stores (CASY +2.84%) reported Q4 EPS of 60 cents, lower than consensus of 62 cents.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 14)”

Leave a Reply

You must be logged in to post a comment.

The word ” ground ” should be used instead of ” grinded ” Jason.

I have been trading into gaps but not yesterday. I was sure the bulls had given up. I must admit I was wrong. It is nice to be wrong and not have traded.

a daytrader should have no bias what so ever and simply trade the intraday swings,which have been good and volitie latly

however the prospect of a weak move up into opts ex in usa is exhilerating as it could led to a almighty crash afterwards—-the usa markets have not yet crashed like some others

some markets are already in a noticable downtrend–japan n225 aussie xjo and spi,london ftse

and could be ready for a wave 2 corrective up

no doubt the currecies/bonds/unwinding of the japan carry trade ect are having a influence as well

back to my intraday ,where im sometimes a bull or bear depending on the reality of the moment

next week FOMC

the fed lies that its funny money is to help unemployment/inflation

the funny money is only there to cover the govt deficit

with the seequester their is less deficit so less QE3 is needed

the big banks know it so have been cutting back on their gambling money

what ever happened to slippery tiny tim of treasury