Good morning. Happy Thursday.

The Asian/Pacific markets closed down across-the-board. Japan dropped more than 6%; China, Hong Kong and Taiwan dropped more than 2%; Indonesia, Malaysia and South Korea dropped more than 1%. Europe is currently down across-the-board. Belgium, Germany, Stockholm, Switzerland and the Czech Republic are down more than 1%. Futures here in the States point towards a gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold is down, silver up.

The World Bank cut is global GDP forecast for 2013 from 2.4% to 2.2%.

The market feels like it’s on thin ice. Japan is down more than 20% off its recent high. Brazil is close to a 4-year low. China is at its lowest level since last fall.

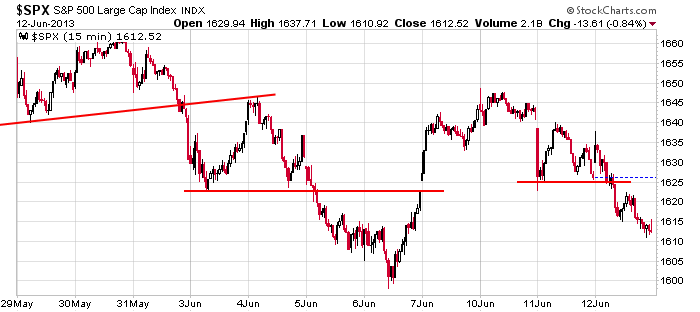

Here’s an update of the 15-min SPX chart. Yesterday it lost the 1623-1625 zone I mentioned and suffered a stiff decline. The next support level is 1600; it’s a big one.

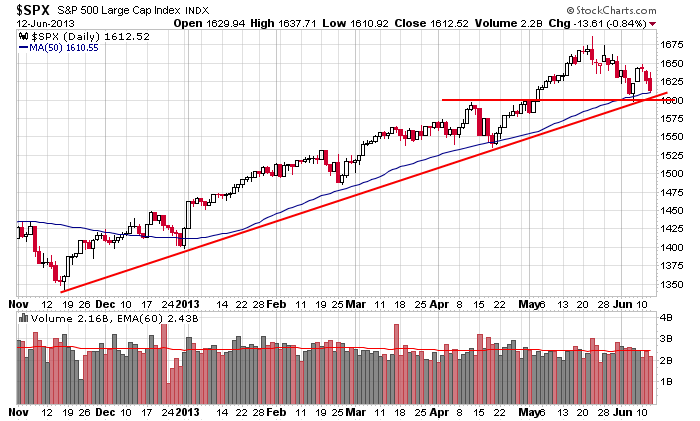

1600 was the April high and last week’s low…it’s also trendline support going back to the November low…and it’s pretty close to the 50-day MA. Here the daily chart.

I’m trying to give the bulls the benefit of the doubt. I’m giving them every opportunity to prove the market is still strong and worthy of being bought, but the bulls aren’t doing their job very well. Rallies aren’t lasting long or going far. Needless to say, the bulls are back on the clock. They no longer have much wiggle room. The must dig in and defend their turf.

Here are stock-specific stories from barchart.com…

Safeway (SWY -0.86%) was downgraded to “Neutral” from “Buy” at Citigroup.

The NY Post reported that California congresswoman Linda Sanchez has asked the Federal Trade Commission to investigate Herbalife (HLF +4.36%) over allegations the company is a pyramid scheme.

Waste Management (WM -0.30%) was downgraded to “Neutral” from “Buy” at Goldman.

Ross Stores (ROST -0.49%) was upgraded to “Buy” from “Neutral” at Sterne Agee with a price target of $75.

International Paper (IP -2.82%) was upgraded to “Conviction Buy” from “Neutral” at Goldman.

Reuters reported that Apple (AAPL -1.24%) is considering launching iPhones with bigger screens, as well as cheaper models in a range of colors, over the next year.

Gilead (GILD -2.42%) was upgraded to “Buy” from “Hold” at Argus with a price target of $62 and Celgene (CELG -0.54%) was upgraded to “Buy” from “Hold” at Argus with a price target of $140.

Gannett (GCI -1.59%) will acquire Belo (BLC -3.51%) for $13.75 per share, or approximately $1.5 billion.

Also, IBM is laying off thousands of workers worldwide.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 13)”

Leave a Reply

You must be logged in to post a comment.

“The market feels like it’s on thin ice”

Agree and many indicators support this.

Yesterdays action tells me the market is weak.

a rant-

i suspect y/day and today in asia may have been a thin ice bottom and we should now be in the hands of the corupt quad witch opts ex gamblers

some large usa ect hedge funds to fed and other central bank gambling funny money and tryed the carry trade with short yen long equities and are in big trouble as evidenced the japan equities n225 gorgously down some 25% in a few weeks

a market based on fed gambling money doesnt last long and proves the fed and central banks dont control the markets ,but the markets control the fed

a short term ride on the long side may be a change and set up for a gigantic crash to ZERO

OOPS–we may not even be able to get up of the floor for next weeks quad opts ex

Aussie JS…are you Mentally ok ?,,,, ’cause you do not sound it !!

Jay,

mentally im very retarded,opinionated,excentric love to rant and have only a IQ well above a genious————-obviously my mental condition was caused by to many implantations and visits to mars

spiritually im always right,with a fun loving nature and miraculouse spiritual powers and insights

did you buy the xjo or spi aussie indexes and japan at their lows y/day or overnite