Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed and with a bearish bias. Japan rallied 1.7%, Australia 1%. Hong Kong dropped 1.1% while China and Indonesia dropped 0.7%. Europe is currently trading mixed and with a slightly bearish bias. France, Norway and Spain are down 0.7% or more. Futures here in the States point towards a slight down open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up.

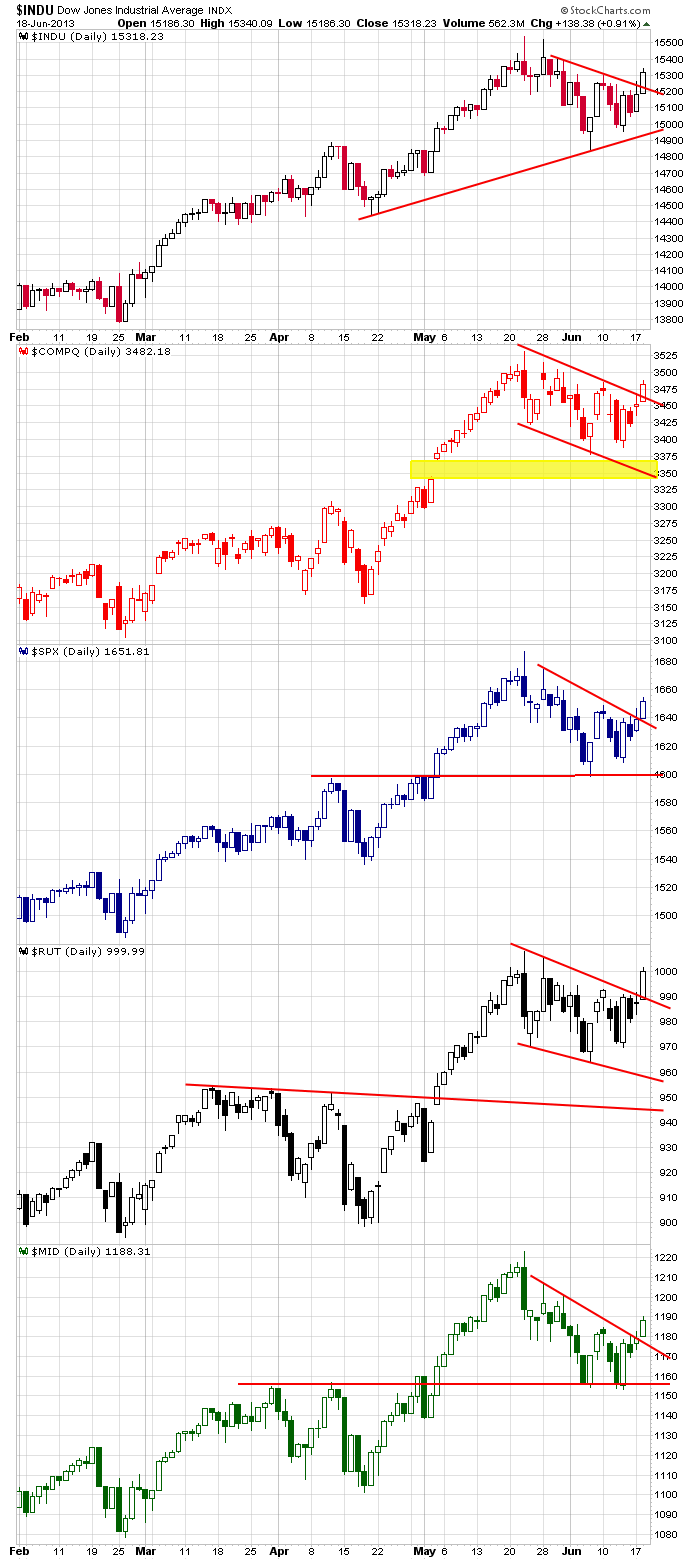

Yesterday all the indexes moved above resistance levels. Some took out the previous high from within their consolidation patterns. The price action was very good, but volume was light. Here are the daily charts. It’s a step, but there’s still lots of resistance overhead. At the very least, the bulls have once again defended their turf and given themselves some breathing room.

Today is Fed day. Most Fed days the last few years have been boring and irrelevant because rates would stay the same, and the Fed would copy & paste their statement from the previous meeting. It was a pretty easy job. But rumors are swirling the Fed is looking to taper their bond purchases which would of course would enable bonds to drop and interest rates to rise. I don’t know why they would do this since they’ve stated several times in the past they want the unemployment rate down to 6.5%, but nevertheless this is the rumor. As always, the news is less important than the reaction to the news. The market has had time to start factoring in higher rates, so at least some of the news is priced in.

Anything goes in the near term. Having a lot of exposure is akin to gambling. You really don’t know how Wall St. will react when an anticipated move becomes a reality.

In the longer term, the bulls deserve the benefit of the doubt. The long term trends remain solidly up, and anticipating or guessing a top has lost the bears a lot of money over the years.

Here are stock-specific stories from barchart.com…

Reuters reported, citing unnamed sources, that the BOJ isn’t planning to launch any new stimulus measures in the near-term, even though Japanese stocks have sold off sharply and the country’s bond yields have risen significantly.

United Natural Foods (UNFIA) was upgraded to “Overweight” from “Neutral” at Piper Jaffray who also raised its price target to $64 from $57.

Sonic (SONCA) was upgraded to “Equal Weight” from “Underweight” at Morgan Stanley.

Sprint (SA -4.70%) was downgraded to “Neutral” from “Outperform” at Macquarie.

Coca-Cola (KOA) was initiated with an “Outperform” at Credit Suisse with a price target of $48.

CEMEX (CXA -0.34%) was upgraded to “Overweight” from “Equal Weight” at Barclays.

FedEx ({=FDX reported Q4 EPS of $2.13, stronger than consensus of $1.95.

DreamWorks (DWA +2.40%) rose 1% in after-hors trading after it said said it expects to generate about $100 million of television revenue in 2013, and expects to grow its television revenue number to $200 million annually by 2015.

La-Z-Boy (LZB +6.40%) reported Q4 EPS of 30 cents, better than consensus of 28 cents.

Bloomberg reported that Microsoft (MSFT -0.06%) will use Qualcomm (QCOM +0.50%) chips in its updated Surface RT tablet and Nvidia’s (NVDA -0.62%) Tegra chip will continue to be used for some versions of the Surface tablet.

Adobe (ADBE -0.07%) rallied 5% in after-hours trading after it reported Q2 EPS of 36 cents, better than consensus of 34 cents.

Carl Icahn reported a 8.68% stake in Dell (DELL +0.52%) .

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 19)”

Leave a Reply

You must be logged in to post a comment.

This week the market has been downright strange. I expect a big move up or down.

day traders using CFD’S are gamblers and under british law are non taxable

—unless u are a professional gambler

puting the little squiggle trend lines on the above charts a different way ,

i can make a case for a top being in and a wave 2 corrective being under way

for every technical analyst has a different way of seeing the charts

therefore t/a is a gamblers tool

i need something more certain ,where the masses will follow me after i put on a bet on ,

thus throwing my bet into profit

as this is a synthiic fantasy manipulated market, i use my quad witches fantasy wand to tell me the direction