Good morning. Happy Thursday.

The Asian/Pacific markets got hit hard. Indonesia is down 3.7%; Australia, China, Hong Kong, India, Singapore and South Korea are down 2% or more; Japan, New Zealand and Taiwan are down more than 1%. Europe is currently down across the board. Greece is down 3.6%; France, Germany, Stockholm, London, Spain and the Czech Republic are down more than 2%; Austria, Belgium, Amsterdam, Norway and Switzerland are down more than 1%. Futures here in the States point towards a large gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are getting crushed.

Yesterday the Fed didn’t say much during their scheduled statement, but then Bernanke said the following during the press conference:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year.

and

And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid year.

None of this should be a surprise. Not only have there been rumor swirling the Fed was going to taper, most people have accepted it was a foregone conclusion. The market sold off anyways and today futures are getting hit hard. Buy the rumor, sell the news.

There’s no question the market has benefited from the Fed flooding the market with money. The purpose was to keep the economy going, but now that many economic numbers have gotten better, it’s time for the Fed to ease off and let the market be on its own. It’s about time. I’m more than done getting 0 interest on my money sitting in the bank.

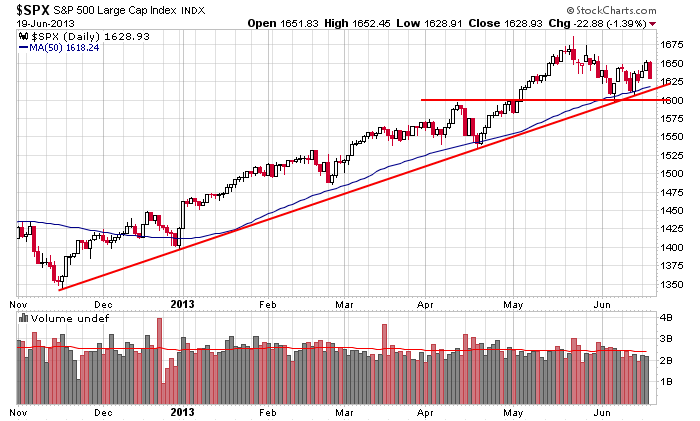

Here’s the S&P daily chart. As of yesterday’s close, the indexes was above two key trendlines and the 50-day MA, but today’s open will be below the up-slanting trendline and the 50-day.

I’ve been advising for several weeks to play it safe and play good defense, that this wasn’t a time to take big chances. So far, so good. This attitude has kept us from churning out accounts. The market still has to make a decision as to what it wants to do next.

Here are stock-specific stories from barchart.com…

Sprint (S -4.37%) was downgraded to “Hold” from “Buy” at Argus.

Reuters reported that Microsoft (MSFT -1.11%) wants to recruit computer geeks in its ongoing efforts to protect Windows PCs from attacks, offering rewards of as much as $150,000 to anybody who helps identify and fix major security holes in its software.

FedEx (FDX +1.07%) was downgraded to “Equal Weight” from “Overweight” at Morgan Stanley.

Rite Aid (RAD -0.64%) reported Q1 EPS of 9 cents, right on consensus, although Q1 revenue of $6.29 billion was better than consensus of $6.27 billion.

GameStop (GME +0.18%) rose 6% in after-hours trading after Microsoft reversed its rental policy for Xbox One games and will now allow users to trade-in and rent disc-based games the same way they do on the current Xbox 360 console.

Ann Inc. (ANN -0.87%) was upgraded to “Outperform” from “Perform” at Oppenheimer.

American Eagle (AEO -2.30%) was downgraded to “Perform” from “Outperform” at Oppenheimer.

Red Hat (RHT -0.88%) reported Q1 adjusted EPS of 32 cents, better than consensus of 31 cents.

Jabil Circuit (JBL -0.50%) reported Q3 EPS of 56 cents, better than consensus of 54 cents.

Micron (MU +1.60%) reported Q3 EPS of 4 cents, double consensus of 2 cents.

Nokia (NOK -0.26%) is up 3% in after-hours trading after Dow Jones reported that Microsoft (MSFT -1.11%) and Nokia were in advanced talks on devices business.

Finisar (FNSR +0.55%) is up 10% in after-hours trading after it reported Q4 EPS of 20 cents, better than consensus of 17 cents.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

Dead cat coming?

the market makers may have to buy here if they dont want to loose money