Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 2.5%; South Korea and Taiwan lost more than 1%. Japan rallied 1.7%. Europe currently leans to the upside. London, Switzerland, Amsterdam and France are leading. Greece and the Czech Republic are pulling up the rear. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are up.

The market got clobbered yesterday. There’s no way to spin it. It was a good old fashioned blood bath…the single worst day in several months. The bulls never had a chance. Two waves of selling – one in the morning and one in the afternoon – sandwiched range bound movement during the mid day session.

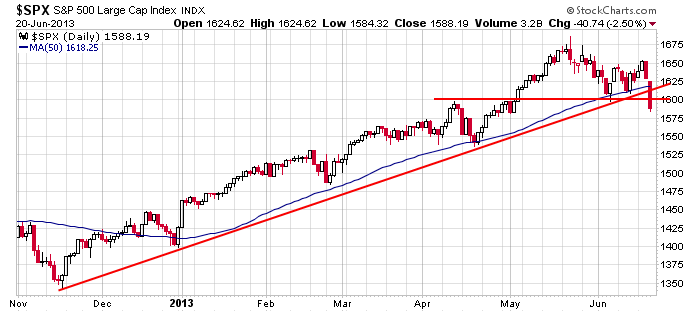

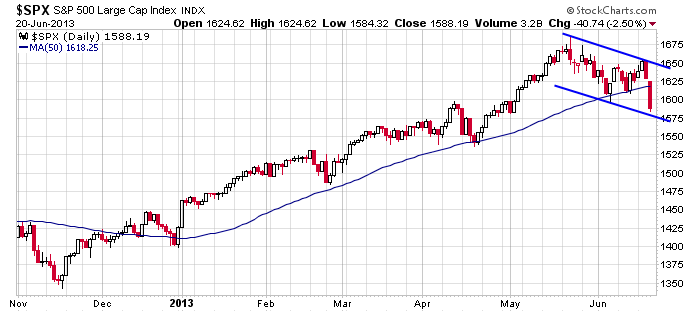

Here’s the S&P daily. The two trendlines and the 50-day MA were all penetrated.

In my eyes the last line of defense is around 1575. That’s where a trendline drawn parallel to resistance and through the bottom of the pattern comes in. I see potential tops do this enough times for me to always be on the lookout for it…what looks like a top morphs into a falling wedge or rectangle, and then the underlying takes off again. I’m not predicting this; I’m just pointing it out.

Otherwise the path of least resistance is down. The charts tell me to favor shorts, and while there’ll always be pops along the way (the market’s biggest rallies take place in downtrends), I think the S&P drops to the low 1500’s. After that I re-assess things. I’m not making long term predictions…just a summer expectation that could take a week or a month to play out.

Here are stock-specific stories from barchart.com…

CarMax (KMX -6.11%) reported Q1 EPS of 64 cents, better than consensus of 58 cents.

Cardinal Health (CAH -2.69%) was upgraded to “Outperform” from “Market Perform” at William Blair.

Newmont Mining (NEM -6.74%) was downgraded to “Neutral” from “Buy” at UBS following a lowered gold price target at the firm.

Facebook (FB -1.69%) was upgraded to “Buy” from “Neutral” at UBS who also raised their price target on the stock to $30 from $28.

Darden Restaurants (DRI -2.64%) reported Q4 EPS of $1.02, weaker than consensus of $1.04.

Forest Oil (FST -4.44%) will replace Enzo Biochem (ENZ -1.73%) in the S&P SmallCap 600 as of the June 28 close.

News Corp. (NWSA -2.95%) will replace Apollo Group (APOL -0.75%) in the S&P 500 and Apollo Group will replace Forest Oil (FST -4.44%) in the S&P MidCap 400 as of the June 28 close.

iCAD (ICAD -1.37%) announced approval by the U.S. Food and Drug Administration for use of the company’s SecondLook mammography computer-aided detection system.

TIBCO (TIBX -1.73%) reported Q2 adjusted EPS of 18 cents, right on consensus, and reported Q2 revenue of $245.8 million, slightly below consensus of $246.55 million.

Oracle (ORCL -2.58%) slumped nearly 8% in after-hours trading after it reported Q4 adjusted EPS of 87 cents, right on consensus, and said Q4 adjusted revenue was $11.0 billion, slightly below consensus of $11.12 billion. Oracle also raised its quarterly dividend to 12 cents from 6 cents, announced a $12 billion share buyback program, and said it will list its stock on the NYSE.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 21)”

Leave a Reply

You must be logged in to post a comment.

“In my eyes the last line of defense is around 1575.”

Concur with that, Jason. If we hold that line, the target projects to 1730 ish. We break it, all bets are off.

i saw a flock of hindenbergs

they were all on fire and the hot air was escaping

they were all crashing

never the less the big boy market makers banks managed to close the spx futures –es on the highly populated strike of 1600 for the quadwitch opts ex

just closed my shorts–may take a long or reenter short if i see any fat bulls