Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. New Zealand, South Korea and Taiwan dropped more than 1%. Europe is currently up across-the-board. Austria, France, Germany, Norway, Stockholm, Switzerland, London, Spain and Greece are up at least 1%. Futures here in the States point towards a large gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

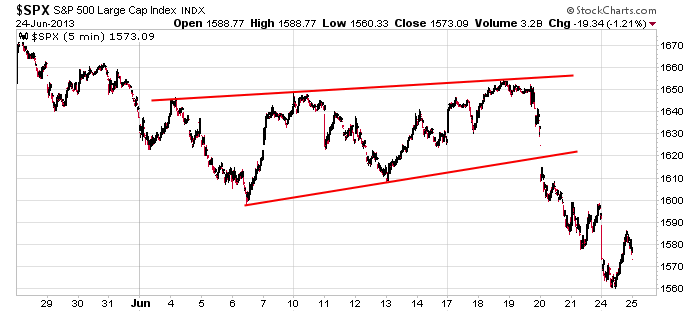

This market is a day trader’s dream. When it moves, the S&P doesn’t just move 5 points, it moves 10-15 at a time. Here’s the 60-min chart. Just this month we’ve gotten several 25+ point swings. Heaven.

Swing trading has been more difficult. Constant up and down moves and news that has the ability to jerk prices around are not ideal. But it is what it is.

Despite the bulls making rally attempts the last two days and today’s expected gap up open, in my view, the path of least resistance is still down. A lot of technical damage has been done, and news – whether it be interest rate related or China related – has not been good. Right now the bears are in control in the intermediate term, and this will remain the case until prices can at least be pushed back into the recent patterns and held there.

Until things change, rallies will be shortable for an eventual move down to the low 1500’s – at least that’s what I’m shooting for.

Needless to say I’m in a wait-and-see mode for swing trades.

Here are some stock-specific headlines from barchart.com…

Oppenheimer reduced its estimates for Apple’s (AAPL -2.65%) June quarter based on “mixed demand” for Apple’s iPhone 5.

Netflix (NFLX -0.60%) was downgraded to “Underperform” from “Market Perform” at Bernstein.

Walgreen (WAG -1.35%) reported Q3 adjusted EPS of 85 cents, well below consensus of 91 cents.

Lennar (LEN -0.74%) reported Q2 EPS of 43 cents, better than consensus of 31 cents.

Marvell (MRVL -1.61%) was upgraded to “Buy” from Hold at Brean Capital.

Agilent (A -1.56%) was downgraded to “Neutral” from “Buy” at Goldman.

Hewlett Packard (HPQ -2.98%) was awarded a $679.79 million modification to a previously awarded continuity of services contract for the Navy Marine Corps Intranet.

Demand Media (DMD -1.68%) acquired Society6 for $94 million in cash and common stock.

Sonic (SONC -0.77%) fell 4% in after-hours trading after it reported Q3 EPS of 26 cents, right on consensus, although Q3 revenue of $146.6 million was slightly below consensus of $147.54 million.

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 25)”

Leave a Reply

You must be logged in to post a comment.

I was looking for a gap down and a retest of yesterdays bounce to go long. Not in the cards. I won’t trade today’s gap up. I do like to trade into gaps when the conditions are right. They are not good today. I do look for more downside.

Paul

the figure is ZERO,then i will have all those ”’INVESTORS”’ money

so buy /hold and PREY

perhaps you think this fantasy ponsi market can only go i one direction –up

so keep on thinking that and ”invest ” ur money

Neal I am very clear with everything I say in the member’s section of the site.