Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Indonesia rallied 3.8%, Hong Kong 2.4%, Australia, New Zealand and Taiwan more than 1%. Europe is currently up across the board. Austria, Belgium, France, Germany, Amsterdam, Norway, Stockholm, Switzerland, London, Spain and Italy are up more than 1%. Futures here in the States suggest a moderate gap up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are getting crushed.

If you like gaps, you love this market. As of now the S&P will gap up 10 points. This is the fifth straight day (every day since the last FOMC) the market has gapped a bunch at its open.

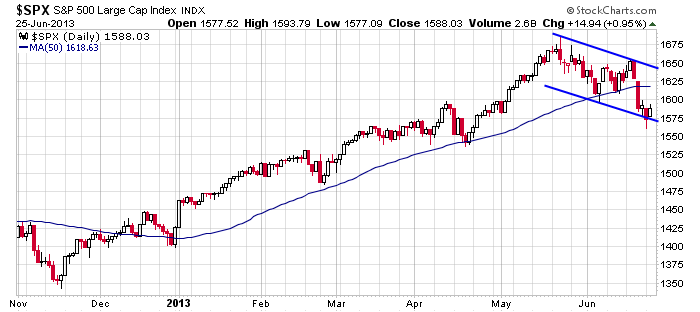

As of today’s open the S&P will be 35-40 points off its recent low. My target on this bounce has been the low 1600’s (1610ish), so so far, so good. The 1600 level may be a tough nut to crack because 1) the market will have already rallied 40 points by the time it gets there, 2) it has served as support and resistance in the past, so it’s proven to be a significant level and 3) it’s a big, fat, whole number. But I like a little higher than 1600. More often than not, the market doesn’t get rejected by exact key levels. Instead the market will overshoot to lure in traders…then the floor gets pulled out.

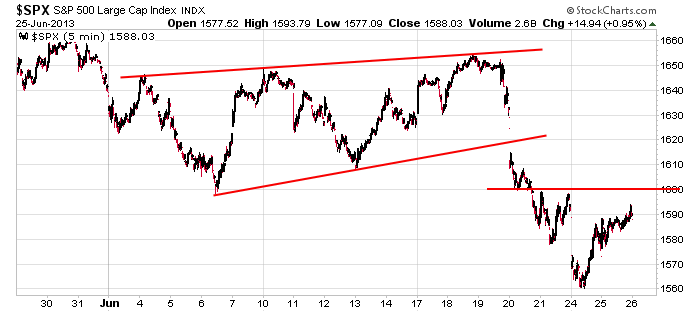

Here’s a 5-min chart going back a month. Let’s not forget the gap that may pull prices up.

Another level to key on is 50-day MA on the daily.

Play it safe.

Here are stock-specific stories from barchart.com…

Reuters reported that China’s securities regulator granted licences to HSBC Holdings (HBC +2.68%) and Citigroup (C +3.43%) , which will allow the banks to distribute mutual funds and expand their services in China.

Southwest (LUV +0.30%) was downgraded at Morgan Stanley to “Underweight” from “Equal Weight.”

Barrick Gold (ABX -2.78%) was downgraded to “Neutral” from “Outperform” at Credit Suisse who also cut their price target for the stock to $20 from $36.

Health Net (HNT -0.23%) was upgraded to “Outperform” from “Neutral” at Credit Suisse who also raised their price target for the stock to $38 from $32.

General Mills (GIS +0.02%) reported Q4 EPS of 53 cents, a bit below consensus of 54 cents, although it reported Q4 revenue of $4.41 billion, higher than consensus of $4.32 billion.

Enbridge Gas Distribution (ENB +2.88%) announced that it has received approval from the Ontario Energy Board for new rates effective July 1.

Standard & Poor’s Rating Services raised its corporate rating on U.S. Silica (SLCA +1.07%) to BB- from B+ with a stable outlook.

Smith & Wesson (SWHC +3.74%) reported Q4 EPS of 44 cents, right on consensus, but reported Q4 revenue of $179 million, better than consensus of $170.72 million.

Apollo Group (APOL +1.36%) reported Q3 EPS of $1.05, stronger than consensus of 85 cents.

Williams’ (WMB +0.79%) board has voted to approve the company’s Bluegrass Pipeline project that will connect supply from the Marcellus and Utica shale-gas areas in the U.S. Northeast to growing petrochemical and export markets in the U.S. Gulf Coast.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jun 26)”

Leave a Reply

You must be logged in to post a comment.

The revision to Q1 GDP is very interesting (2.4 to 1.8?). The sell off will resume here shortly, so be careful and use stops as mother always says. And the Obama fuels policy re coal will drive energy prices up seriously as they recontract to find low cost power. Then we have the health program which is a wreck on its way to the scene.

As for you Neal, the trouble with substituting you for Jason is that there is much more to shoot at. Give us a list of things you think you did correctly so we can pick targets. I can not recall one thing, but I may have overlooked something, if that is possible in your case.

The weather off the coast of Hawaii is wonderful and we are running low on Merlot, things could get serious if we are not careful. Do I have to pay taxes if I become a citizen of WaterWorld??

any sane investor has just given up on this market.

Jason

I do love gaps but only when there is predictability in them. Today’s gap up was not worth trading. Give me a gap up Thursday and I am going back short.