Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly down. Indonesia dropped 3.7%, China 2.4%, Hong Kong, New Zealand and Taiwan more than 1%. Europe is currently up across-the-board. Germany is up 2.3%, France 1.9%, Amsterdam, Spain, Italy and Stockholm also up more than 1%.

The dollar is down slightly. Oil is down, copper up. Gold and silver are up.

I don’t have anything new to add to the comments I made over the weekend in the weekly report. The market paused for couple days last week and then put in a solid up day on Friday. The price action looked great, but volume was light.

On a closing basis, the Russell 2000 small caps are sitting at an all-time high. The Nas and S&P 400 mid caps have almost completely recaptured their post-FOMC losses. The S&P 500 and Dow are pulling up the rear. This is exactly what you want to see when the market attempts to move…you want to see money moving into small caps, mid caps and tech stocks before it moves into the bigger safe-haven companies.

Last week’s action officially finished neutralizing the bearish sentiment that quickly came into the market after the Fed. It also significantly increased the odds we get a summer range…something I’ve been talking about for a couple weeks. This means for the time being I will continue to keep trades on a short leash. I’m not going to assume we get trending moves that last several weeks.

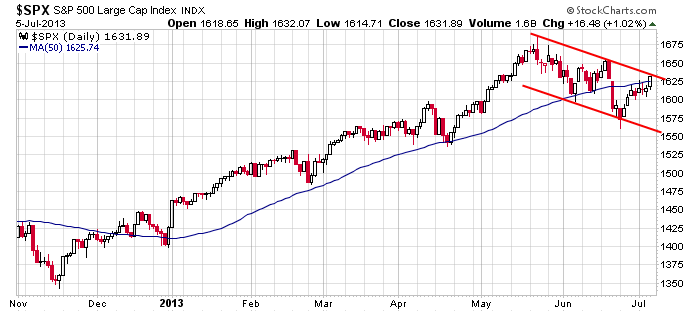

Here a quick snap shot of the S&P daily. The index has recaptured more than 50% of its move off the highs, which many would consider normal. It climbed above 1600 and successfully tested the level last week and then rallied and closed above its 50-day MA. But a potential resistance level looms above.

Here are stock-specific headlines from barchart.com…

PetroChina (PTR +0.29%) was upgraded to “Outperform” from “Market Perform” at Bernstein.

Phillips 66 (PSX -0.76%) was upgraded to “Outperform” from “Market Perform” at Wells Fargo.

Lazard Capital predicts that a slowdown in hysterectomies will drive Intuitive Surgical’s (ISRG +0.86%) procedure growth in Q2 to miss the consensus estimate of 18.4%.

BP (BP -0.02%) was downgraded to “Neutral” from “Buy” at ISI Group which said the final Macondo settlement remains “elusive” and the investment case continues to be pushed out.

TD Ameritrade (AMTD +2.54%) was upgraded to “Buy” from “Neutral” at Citigroup who raised their price target on the stock to $29 from $25.

VeriFone (PAY +0.96%) was downgraded to “Equal Weight” from “Overweight” at Barclays who lowered their price target on the stock to $18 from $22.

Intel (INTC +1.26%) was downgraded to “Underweight” from “Equal Weight” at Evercore.

UnitedHealth (UNH +0.96%) received a favorable mention in Barron’s, which said that UnitedHealth could jump 40% over two years since the insurer with its size can focus on boosting its profit margin rather than gaining market share.

AT&T (T +0.59%) and Chernin Group submitted a joint bid for Hulu, according to Bloomberg.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 8)”

Leave a Reply

You must be logged in to post a comment.

The move on the Job report was up without volume. The question now is wether its possible to continue up on the jobs report. Just volume says no. But the VIX is staying down – no fear. Overall, some index long positions will not hurt, but with stops only. Appears the market can do an C-D down move anytime to complete the B-C move up which may complete at about 1638SnP and be realized on open. Bonds are a worry, they are rising too fast for a recovery rally this summer. Historical data says an up week. Also concerned over the strength of the dollar. Hurts Exports. Then there is the EU (source of the bond bid) which is just too messy to believe. But it is up today – Who ME Worry?

range trading is diferent than swing trading and has a different trading plan

but this is to small a range to surf the usa summer

the bottom is not in yet

eat a fat bull intra dayly