Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China, South Korea and Taiwan moved down. Japan, India and Indonesia moved up. Europe is currently mixed. Germany, Stockholm, London and the Czech Republic are down. Belgium and Italy are up. Futures here in the States point towards a slight up open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are up.

The market didn’t react at all to Bernanke speaking before Congress yesterday. Perhaps Wall St. has Fed fatigue; perhaps Wall St. is just tired of the Fed and is tired of clinging to their every word right now. I’m thinking we can put the Fed and all the Fed speakers on the back burner until the next FOMC meeting, which is the last day of the month.

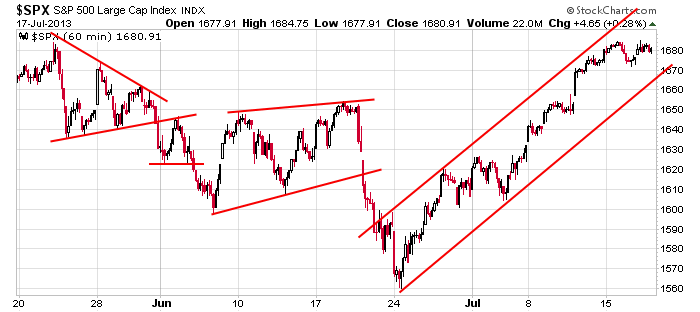

To put in perspective what the market has done the last month, here’s the S&P 60-min chart. The channel is unsustainable.

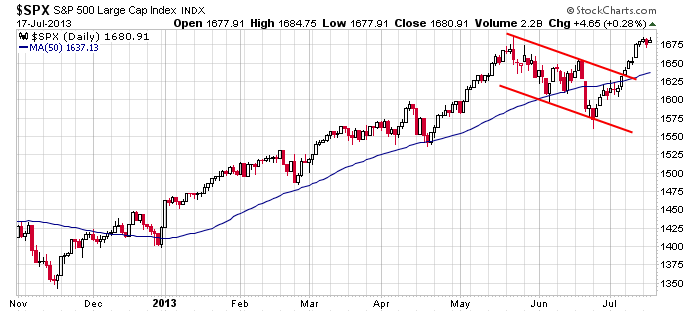

Zooming out with the daily. We got a breakout from a ralling rectangle pattern within a solid up trend. This is a textbook chart pattern. Since the 50-day brought buyers to the market so many times since the November bottom, that’s my target should the market correct off its current level.

The market is in good shape. All signs point towards more gains, but the risk/rewards right now are not as good as they were just a few weeks ago.

Here are your overnight stock movers from barchart.com…

Fith Third Bancorp (FITB +0.69%) reported Q2 EPS of 66 cents, better than consensus of 42 cents.

BlackRock (BLK +1.47%) reported Q2 EPS of $4.15, much better than consensus of $3.81.

UnitedHealth Group (UNH -1.02%) reported Q2 EPS of $1.40, well ahead of consensus of $1.25.

Philip Morris International (PM -0.27%) reported Q2 EPS of $1.30, weaker than consensus of $1.41.

Crown Holdings (CCK +0.50%) reported Q2 EPS ex-items of 96 cents, better than consensus of 93 cents.

Noble Corp. (NE +1.16%) reported Q2 EPS ex-charges of 63 cents, better than consensus of 57 cents.

Carl Icahn reported a 15.54% stake in Navistar (NAV +4.44%) .

Xilinx (XLNX +0.58%) reported Q1 EPS of 56 cents, higher than consensus of 47 cents.

Universal Forest (UFPI -0.23%) reported Q2 EPS of 79 cents, better than consensus of 67 cents.

eBay (EBAY +1.00%) fell 6% in after-hours trading after it reported Q2 EPS of 63 cents, weaker than consensus of 64 cents, and lowered guidance on fiscal 2013 EPS to $2.70-$2.75, weaker than consensus of $2.75.

IBM (IBM +0.36%) climbed nearly 4% in after-hours trading after it reported Q2 EPS of $3.91, higher than consensus of $3.77, and boosted its fiscal 2013 EPS view to ‘at least’ $16.90, higher than a previous estimate of $16.70.

American Express (AXP -1.88%) reported Q2 EPS of $1.27, better than consensus of $1.22.

SanDisk (SNDK -0.10%) climbed over 6% in after-hours trading after it reported Q2 EPS of $1.21, well ahead of consensus of 93 cents and said it sees fiscal 2013 revenue of $5.75 billion-$6.05 billion, higher than consensus of $5.82 billion.

Plexus (PLXS -0.39%) rose 5% in after-hours trading after it reported Q3 EPS of 68 cents, better than consensus of 58 cents.

Covanta (CVA -0.64%) reported Q2 adjusted EPS of 10 cents, stronger than consensus of 6 cents.

Intel (INTC -0.41%) fell over 3% in pre-market trading after it reported Q2 EPS of 39 cents, weaker than consensus of 40 cents and said it sees fiscal 2013 revenue approximately flat year-over-year, weaker than consensus of $53.51 billion.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 18)”

Leave a Reply

You must be logged in to post a comment.

“The best traders focus on doing one thing well. The best traders identify a trade, or possibly two trades, that work, that jives with their personality, and they execute over and over and over. They specialize in doing one thing very well, and they completely ignore everything else and they resist the temptation change.” Wall Street World.

Day two Fed speak. The volume is low so HFT are having their way. Still long index and sectors that seem to be working. VLO is not working and it get closed today it if sinks any further.

The earnings are so so but no one is seriously trying to do much.

My tools are not designed for a market like this. I am back to riding the pine. I don’t see a lot of upside even if there is I don’t like the risk. Picking tops is risky business.

neal

let me help you

the market is moving higher on LEVERAGE

it is you that is making peanuts

but you have the right to be old fashion and buy hold PREY

on no leverage

my intra day long is closed and short the weakest nas 100