Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mixed and with a bearish slant. China, Japan and Taiwan each dropped more than 1.5%; there were no big winners. Europe is currently trading mostly down. Italy and Norway are doing well to the upside; The Czech Republic and Greece are leading to the downside. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil and copper are up. Gold is up, silver down.

Today is options expiration day. It’s been a meaningless day for a long time, and it’ll be meaningless today. Option traders who need to square off positions have already done so; they’re already looking to the next expiration cycle, whether it’s next week or next month.

As of now the indexes are up moderately on the week, so barring a move down, the market will close with its 4th straight up week, but for what it’s worth, it’ll be the smallest weekly gain among the last four unless we get a sizable rally.

Yesterday after the close, MSFT and GOOG disappointed with earnings. Both sold off about 5% in after-hour trading, but GOOG has cut it’s loss in half (down 2.7% now) this morning while MSFT has added to its (down 7.5%).

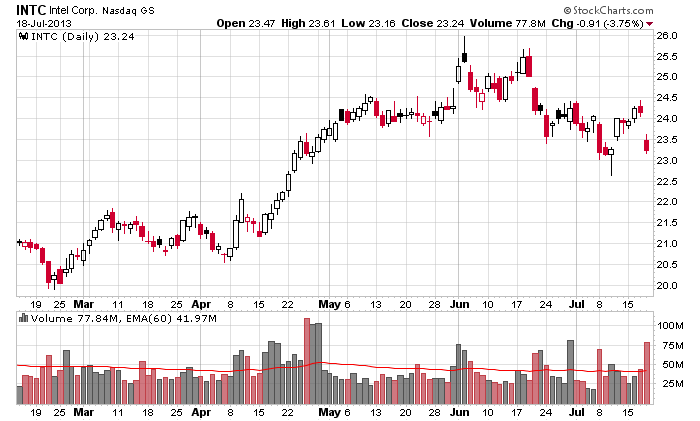

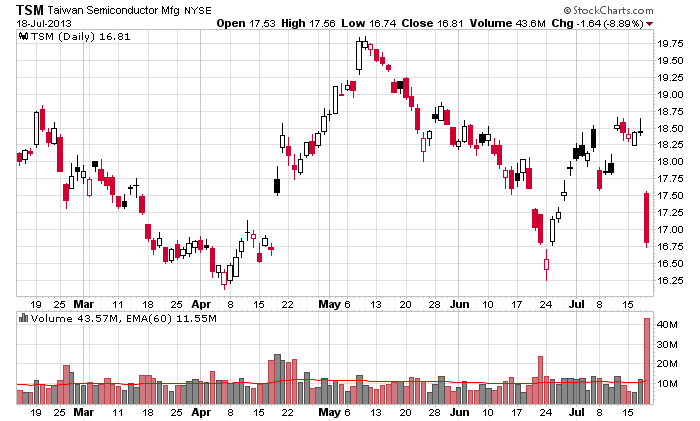

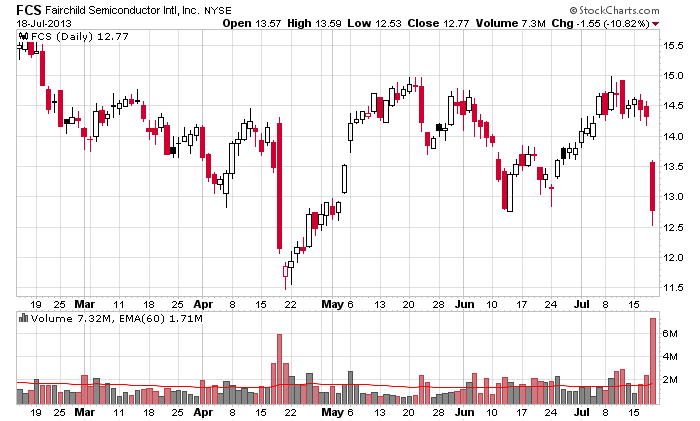

Add this to some semiconductor stocks that took big hits yesterday, and you gotta start to wonder if there’s trouble in tech land. It’s something to keep an eye on, but I don’t think tech is the leadership group it used to be because we no longer need to update our gadgets every 12 months. We can easily use a computer for several years, and considering how prices come down over time, it’s a double whammy for tech stocks. Here are some semis which took hits yesterday.

Chipotle (CMG) on the other hand is up 4.7%.

In other news, the city of Detroit filed for bankruptcy. This has very little to do with the market but will be very interesting to follow. Do long-time city employees lose their pensions? Tough times in the motor city, and it could serve as a precedent for other cities.

Here are stock-specific headline stories from barchart.com…

Ingersoll-Rand PLC (IR +1.97%) reported Q2 EPS of $1.14, better than consensus of $1.08.

Honeywell International (HON +0.64%) reported Q2 EPS of $1.28, higher than consensus of $1.21.

General Electric (GE +0.38%) reorted Q2 EPS of 36 cents, better than consensus of 35 cents.

Whirlpool (WHR -1.02%) reported Q2 EPS of $2.37, weaker than consensus of $2.42.

Schlumberger (SLB +1.12%) reported Q2 EPS of $1.15, higher than consensus of $1.10.

Celanese (CE +1.42%) reported Q2 adjusted EPS of $1.12, below consensus of $1.16.

Moody’s Investors Service moved the outlook on the Aaa government bond rating of the United States back to stable, replacing the negative outlook that has been in place since August 2011.

Apache (APA +1.32%) announced it has agreed to sell its Gulf of Mexico Shelf operations and properties to Fieldwood Energy, an affiliate of Riverstone Holdings, for cash proceeds of $3.75 billion.

AMD (AMD +5.94%) reported a Q2 EPS loss of -9 cents, a smaller loss than consensus of -13 cents.

Intuitive Surgical (ISRG +1.43%) fell over 5% in after-hours trading after it reported Q2 EPS of $3.90, below consensus of $4.04.

Stryker (SYK +0.91%) reporeds Q2 adjusted EPS of $1.00, right on consensus, although it reported Q2 revenue of $2.20 billion, better than consensus of $2.19 billion.

Microsoft (MSFT -0.84%) slumped over 6% in after-hours trading after reported Q4 EPS with items of 59 cents, weaker than consensus of 75 cents.

Chipotle (CMG +0.26%) climbed 7% in after-hours trading after it reported Q2 EPS of $2.82, slightly better than consensus of $2.81.

Google (GOOG -0.86%) slid over 4% in after-hours trading after it reported Q2 EPS of $9.56, well below consensus of $10.78.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 19)”

Leave a Reply

You must be logged in to post a comment.

Today OPEX objective is to do nothing. They will succeed. Then the rest of life. Ben has not got much space left. He mentioned deflation last time out. I think he knows he has a knife at a gun fight. The performance of MSFT, GOOG and XLK in general are all suggesting weakness in consumer giants. Fascinated by interest rates, They run up/dw like an elevator every day, but inexorably UP. This move kills housing eventually, the GSEs are busted, but right they are buying a lot of junk housing buys, God help us; not another housing bust. The market does not buy that taper is put off. Detroit gives one an idea where muni bonds are in bankruptcy: gut the bond holders and Detroit’s policies will and kill the muni markets. Then look at the EU and China slipping. Japan has its diet upper house election this weekend and ABE has his QE policy in the balance. We are in the “dead season”, so I have only rally index hedges in place, and bought a few puts. British Open this weekend. Docking SDO this AM, nice get-away. Cheers.

the charts above look sick

it facinates me why americans think only usa markets count,they dont

the world trend changer will come from europe and london is the biggest financial center in the world–wall street and uncle ben are just pussy cats

that said all markets died 4 years ago and we now only have fantasy markets

the big boy instos play with themself to give the illusion of motion in order to make a dollar

so which way for next week/month or quad witch options

after pushing some indexes to new highs and expiring most options worthless today the instos will need a 20% drop after being set short to give the illusion of life and make a quick buck

and thus the fantasy continues

Hey, I live on quick bucks, no investing anymore, I do better with short swings than anywhere else. Also be patient with commodities; Australia was formerly a great China play, but not anymore but maybe it blooms again when the democratize the economy in China. Love the Aussie wine and we are now told overproduction has the Aussie breaking bottles. London used to be the center of the world, but now there is no center, maybe that is the problem. Cheers JS

Hey Whidbey,

what a boring nite,only thing worth playing is the nas 100,which will led the market lower

my best trades are under 2 hours on high margin,–the 7 swing intradayers stretch my concentration the 5 swing ew intradayers are ok ,but i usually stay out of waves 2 and 4 congestions but amazing how mathimaticaly calculated piviots dictate the intraday stop points

the lord mayor of london used to be a yank i think and his aim was to turn london into the world no one financial center–but what gave us leahmans a london lehmans trader

all usa instos do most their trading out of london,which is also the major arab commodities center

OZ is bankrupt with our labour govt–sorry about the wine

enjoy ur sailing trip

the usa fed and usa govt,usa law is run and owned by wall street

my favourite usa and fed president is jamie diemound

now thats a fantasy –isnt it