Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. Australia, China, Singapore, South Korea and Taiwan led the way; Indonesia dropped 1%. Europe is currently mixed. Only Stockholm (down 0.7%) and Greece (up 0.6%) have moved much. Futures here in the States point toward a slight up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The market just concluded its fourth straight up week. The indexes are at or very near either all-time highs or multi-year highs. It’s hard to argue with the overall movement, but the market has often reversed within a couple days of options expiration. Let’s be on the look out for such a development the next couple days.

Nothing major came out of the 2-day G-20 meeting of finance ministers and central bank chiefs that concluded Saturday.

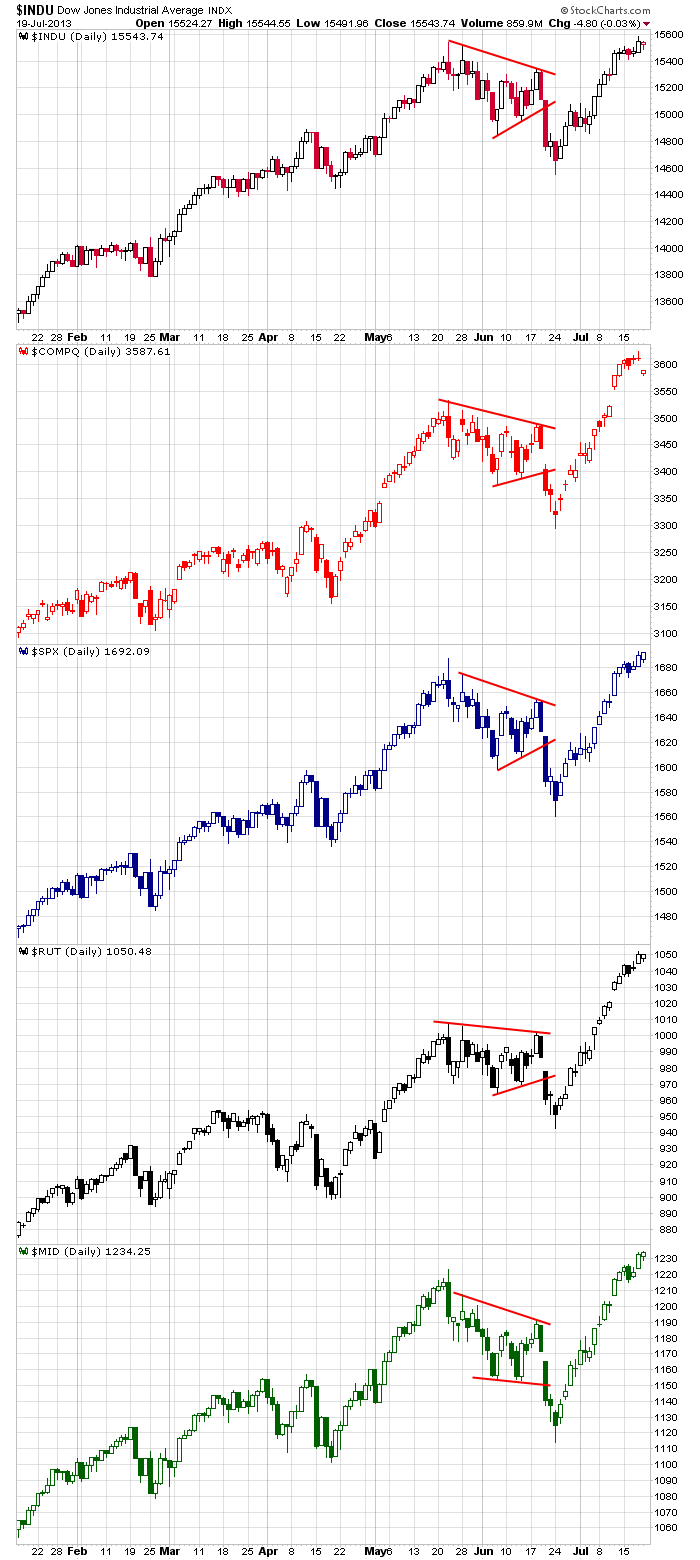

Here are the daily charts. Ridiculous. Throw TA out the window. The market is on crack right now. There are no trendlines that can describe the movement, and for the time being, indicators are useless. Overbought can stay overbought for a long enough time to frustrate anyone trying to pick a top.

Don’t over-analyze. The market is doing its own thing right now.

Here are stock-specific headlines from barchart.com…

Kimberly Clark (KMB +0.59%) reported Q2 adjusted EPS this morning of $1.41, slightly above the consensus of $1.39. The company also said it will realign cost structure and streamline European manufacturing.

Halliburton (HAL +2.44%) reported Q2 EPS of 73 cents, 1 cent above the consensus of 72 cents.

Facebook (FB -1.15%) will create a streamlined social network for simple phones, according to the NY Times.

Apple (AAPL -1.58%) said its developers website was taken down because of a hacking attack.

Hasbro (HAS -2.37%) reported Q2 adjusted EPS of 29 cents, below the consensus of 34 cents.

Dick’s Sporting (DKS -0.55%) was upgraded to Overweight from Equal Weight at Morgan Stanley.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 22)”

Leave a Reply

You must be logged in to post a comment.

There is no reason to be in this market either. Pure speculation that Abe, China and the Fed will keep the put in place. But only the multiple is expanding, not earnings. This is a place to keep a few ETF hedges in waiting for developments. The gold miners are up today 1300. GDX may be interesting for a while. In the meanwhile Detroit and Oakland, Chicago continue to bleed. Is the country coming unglued??

You can be short this week. You can be long this week. Frankly this market makes no sense so I am walking away.

Statistically this market has to retreat but that does not mean it is going to.

Jason you have nailed it TA is out the window.

Weinstein returns with a vengeance lol

The Weinie Bros are Back !!