Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Japan and China did well; Hong Kong, Singapore, South Korea and Taiwan did not. Europe is currently trading mixed. Switzerland and Greece are up; Amsterdam and Norway are down. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

The market took the day off yesterday. All it’s movement was contained within the high and low of Friday…the range was very tight…volume was very light.

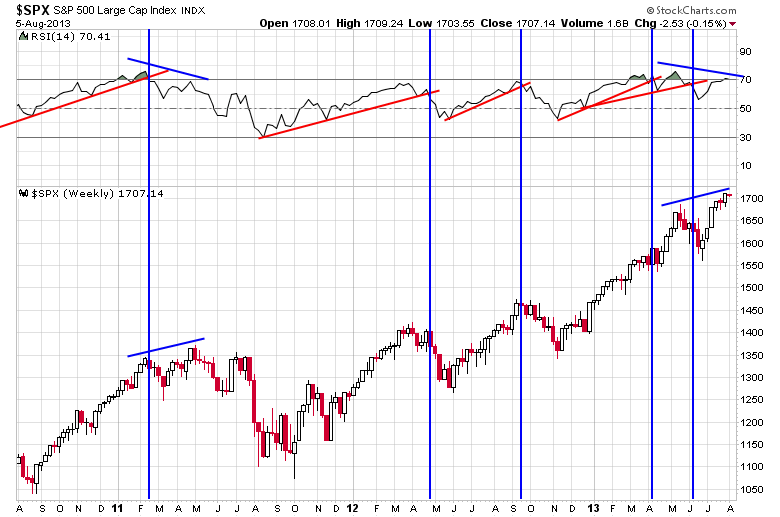

Purely from a technical standpoint, the upside should be limited. There are many indicators diverging from the price action and some divergences appearing on the index charts themselves. But given the price action since the November bottom, you never know. The market could enter idiot mode again and melt up.

Here’s the SPX weekly. A divergence is forming between the index and RSI.

Stock headlines from barchart.com…

Regeneron Pharmaceuticals (REGN -0.51%) reported Q2 EPS of $1.73, weaker than consensus of $1.75.

CVS Caremark (CVS -0.36%) reported Q2 EPS of 97 cents, better than consensus of 96 cents.

Archer-Daniels-Midland (ADM +0.77%) reported Q2 EPS of 46 cents, stronger than consensus of 44 cents.

Emerson Electric (EMR -0.34%) reported Q3 EPS of 97 cents, lower than consensus of 98 cents.

IntercontinentalExchange (ICE -1.49%) reported Q2 EPS of $2.19, better than consensus of $2.14.

Chevron (CVX -0.77%) has agreed to pay $1.28 million in fines after pleading no contest to criminal charges stemming from a 2012 fire at the company’s Richmond, California refinery last year.

Kindred Healthcare (KND +5.47%) reported Q2 core EPS of 32 cents, weaker than consensus of 33 cents.

Deere (DE -0.72%) was downgraded to “Underperform” from “Market Perform” at William Blair.

Washington Post (WPO +1.56%) rallied over 5% in after-hours trading after Jeff Bezos agreed to purchase the Washington Post newspaper publishing business for $250 million.

SAC Capital reported a 5.1% passive stake in Children’s Place (PLCE +0.79%) .

Alleghany (Y +0.12%) reported Q2 EPS of $6.78, well ahead of consensus of $5.36.

Fidelity National (FNF -0.40%) reported Q2 EPS of 68 cents, stronger than consensus of 62 cents.

Hologic (HOLX -0.66%) reported Q3 EPS of 38 cents, higher than consensus of 37 cents, but lowered its guidance on fiscal 2013 EPS to $1.46-$1.47 from $1.54-$1.56 and below consensus of $1.54.

American Eagle Outfitters (AEO -0.40%) slumped over 17% in after-hours trading after it lowered guidance on Q2 EPS to 10 cents, lower than concsensus of 21 cents due to weaker than expected sales and margin results.

Unum Group (UNM -0.58%) reported Q2 adjusted EPS of 82 cents, better than consensus of 80 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: ACM, ADM, AFSI, AKRX, ALLT, ARCC, ARCO, AYR, BPI, CCC, CHTR, CMLP, CNK, CTSH, CVS, D, DBD, DISH, DNR, DWRE, EMR, END, ENDP, EXPD, FBN, FE, FOSL, GGS, HAR, HCN, HPT, HSIC, ICE, IFF, ISIS, KORS, KWK, LIOX, LPX, MGM, NRGY, OAK, OMX, OXF, PH, POZN, PQ, RDC, REGN, RIGL, SATS, SE, SEP, SMG, SPR, SRE, STWD, TA, TAP, TDG, TDW, TECD, TGH, THC, TICC, TRGT, VSI, WMC, ZTS

Notable earnings after today’s close: ALJ, AMTG, ANDE, ATO, AVNR, BID, BIO, BMR, CAR, CF, CHRW, CHUY, CSC, CSOD, DGI, DGIT, DIS, DPM, DVA, ENOC, ENPH, EOG, EXEL, FSLR, FST, FURX, G, GA,GDP, GEOS, GEVO, GIVN, GLUU, GPOR, JAZZ, LQDT, LYV, MCEP, MED, MRO, NUAN, OAS, ONTY, ORA, PRI, PZZA, QUAD, REXX, SD, SLTM, SNTS, SPRD, SYNC, TESO, TWO, URS, VSAT, XNPT, Z

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 6)”

Leave a Reply

You must be logged in to post a comment.

Trade numbers good, fewer bbls of oil. 77% of the new jobs since this Administration took office are part time. And the thirty year bond yield is 3.72% this AM. At 4% the Treasury can not afford its debt level, so do they print more openly, skip the Fed? Be nervous there is no one driving the bus. Congress is on four weeks leave from the asylum then they come back and—do nothing.

we could be on the tip of a iceberg going down

but it is a strange market and can imo be daytraded atm

watch the dji to led,but dax and ndx 100 have to take over

well i think we know something is going on now,but what

i dont care ,im a daytrader and made my money for today ,–so going to sleep

if we dont get a little bounce here for europe close at 11.30 am then def down

“volume was very light”

Well worth noting.