Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Japan got crushed (down 4%). Australia, Hong Kong, South Korea and Taiwan dropped more than 1%. Europe currently leans to the downside. Austria, London and Greece are down. Italy is doing well to the upside. Futures here in the States point towards a gap down open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

The market dropped yesterday for 90 minutes. Then it traded in a tight range just like it had the day before. All the indexes dropped…the small and mid caps suffered the biggest drops, but overall I’d consider the day a normal down day within an uptrend.

The market has now drop two straight days…for only the second time in a month. The S&P has not dropped three straight days in almost two months.

Coming into this week we had a lack of good set ups to play and several breadth indicators that were pointing in the bear’s direction. The coast was certainly not clear.

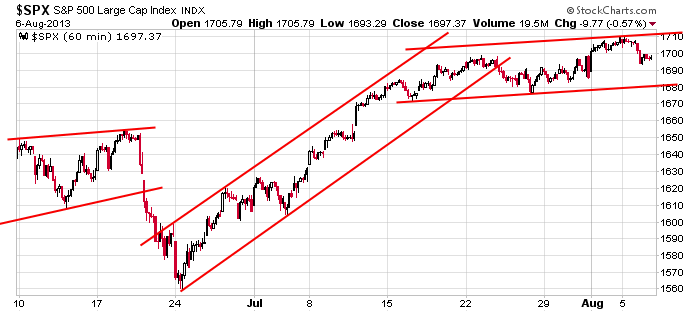

Here’s the 60-min S&P chart. A steep uptrend has flattened out, but the trend is still up. If you’re a longer term swing trader, manage positions wisely. Keep the good ones, dump the under-performers. If you’re shorter term, take profits and let the charts re-set.

Stock stories from barchart.com…

Fossil (FOSL +17.81%) was downgraded to “Neutral” from “Buy” at Citigroup, although Citigroup raised its price target on the stock to $135 from $125.

Marsh & McLennan (MMC -0.47%) reported Q2 EPS of 72 cents, better than consensus of 67 cents.

Devon Energy (DVN -0.36%) reported Q2 EPS of $1.21, well ahead of consensus of 95 cents.

Time Warner (TWX -0.60%) reported Q2 EPS of 83 cents, stronger than consensus of 76 cents.

Marathon Oil (MRO -2.51%) reported Q2 adjusted EPS of 67 cents, lower than consensus of 71 cents.

Live Nation (LYV -1.86%) reported Q2 EPS of 30 cents, well ahead of consensus of 10 cents.

C.H. Robinson (CHRW -0.13%) reported Q2 EPS of 70 cents, weaker than consensus of 74 cents.

URS Corporation (URS -3.95%) reported Q2 non-GAAP EPS of $1.16, better than consensus of 96 cents.

First Solar (FSLR -2.32%) fell over 9% in after-hours trading after it reported Q2 EPS of 39 cents, weaker than consensus of 52 cents, and lowered guidance on its fiscal 2013 EPS outlook to $3.75-$4.25 from $4.00-$4.50.

Disney (DIS +1.56%) reported Q3 EPS ex-items of $1.03, better than consensus of $1.01.

21st Century Fox (FOXA -0.41%) reported Q4 adjusted EPS of 31 cents, lower than consensus of 34 cents.

CF Industries (CF -1.84%) reported Q2 EPS of $8.38, better than consensus of $7.64.

Genpact (G -0.14%) reported Q2 adjusted EPS of 32 cents, well ahead of consensus of 25 cents, but then said it sees fiscal 2013 revenue at the lower half of $2.15 billion-$2.2 billion, below consensus of $2.19 billion.

Sotheby’s (BID -0.51%) reported Q2 EPS of $1.33, weaker than consensus of $1.37.

According to Bloomberg, Amgen (AMGN -2.06%) is set to boost its bid for Onyx (ONXX -1.03%) to $130 per share.

Earnings from seekingalpha.com…

Notable earnings before today’s open: AME, AMSC, AOL, ARIA, AVA, AVT, CLH, CRZO, CWH, DUK, DVN, EZCH, FXCM, GEO, GOLD, HFC, HII, KCG, LXP, MITT, MMC, MOLX, MPEL, NAVB, NCT, NICE, NWN, POM, RL, SBGI, SCLN, SMP, SUNE, TTI, TWX, VOYA, VRX, WCG, WRES, XEC, YRCW

Notable earnings after today’s close: AGU, ARRS, ARRY, ASIA, AWK, BIOL, BIOS, BKD, BPZ, BWC, CECO, CLR, CODI, CTL, CXO, CXW, DEPO, DK, DMD, DRYS, DVR, DXCM, EDMC, EGLE, ENS, ETE, ETP, EXP, FIO, FTEK, FTK, FTR, GMCR, GNMK, GRPN, GTY, HALO, HNSN, IO, JACK, JCOM, LLNW, MBI, MDLZ, MKL, MNTX, MRIN, MWE, NGVC, NRP, NVTL, OILT, OSUR, PKT, PODD, POWR, PPO, PRU, PRXL, PVA, RBCN, RGP, RIG, RLD, RST, RWT, SCTY, SGI, SN, SSRI, STEC, SXL, SZYM, TCAP, TNGO, TSLA, TTEK, TWTC, UHAL, WGL, WR, WTI

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 7)”

Leave a Reply

You must be logged in to post a comment.

The Fed Preidents are all out talking Taper, sooner than later. The markets don’t like it, Japan is falling, China is confused and UK thinks it is on the mend. Love it: Italy and Spain are near defaults, Greece is hopeless and Mario smiles knowingly. Meanwhile the traders are not comfortable: what the hell does taper really??? Maybe a double top in A/D line in the NYSE? Yes. My shorts are in the money. Adding TZA. The Congress will come back and thumb their noses at the Public, the debt ceiling and the budget, whatever that is. Cheers, you are in trouble.

streight down or dip and recover

next hour will tell

europe may not bounce for close

usa starts trading at midday on hand over from london

long grain rice or short grain

bears only like short grain