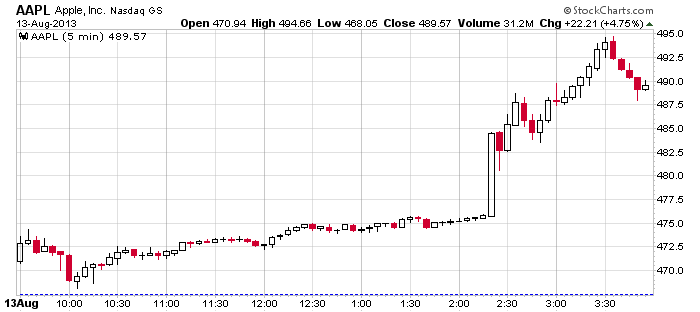

Carl Icahn announced today on Twitter than he had taken a large position in AAPL and that he had just gotten off the phone with AAPL CEO Tim Cook. On the news, AAPL shot up (see intraday chart below).

Icahn is a billionaire. I’m going to assume he’s got lots of smart lawyers around him telling him what he can and can’t say, so what he did today probably isn’t illegal. But it’s still very shady. I don’t see it as being any different than a penny stock pump-n-dump operation. Give me one reason why he feels compelled to announce his position to the world. One reason. One set of conditions that would necessitate this. There isn’t one. If he’s so good at what he does, why doesn’t he quietly go about his business?

Bill Ackman shorted Herbalife and not only announced it, he’s been on a nonstop campaign to convince everyone he’s right. This included a three hour presentation at a conference where he painstakingly went through dozens of slides in an attempt to prove his point.

Dan Loeb went public with his position in YHOO. After the stock went up a bunch (albeit several months later), he dumped the position. He wasn’t a sharehold activist. He wasn’t looking out for shareholder rights or anything like that. He cared about one thing and one thing only – making a quick buck, which he did.

I don’t see how what these fund managers do is any different than a penny stock pump-n-dump operation. Wall St. has become a joke. Many traders went to jail for running pump-n-dump operations back in the day, but the practice continues. Except in steady of buying 20K shares of a penny stock and then announcing it in a chat room, billionaire fund managers do the same thing with more money using the financial media.

It reminds me of when Maria would report from the floor of the NYSE (yes I’m dating myself, but that’s the last time I turned on CNBC). Cramer, would ran a hedge fund at the time, would slip her some BS info about a stock. The stock would pop (or drop), and Cramer’s fund would take a quick profit. Rinse, repeat, rinse, repeat.

And by the way, Warren Buffett does this too. He’s not shy about telling the world about a stock he just bought.

Does this affect me? Not one iota. But it still bothers me that this kind of stuff goes on.

Oh well. I’m just gonna put my head down and keep trading.

0 thoughts on “Is Carl Icahn A Modern Day Pump and Dump Artist”

Leave a Reply

You must be logged in to post a comment.

I don’t see this as a pump and dump operation by any stretch of the imagination. A P&D is for the purpose of creating buyers at inflated prices to sell to on a thinly traded stock penny stock of dubious value.

Icahn is going to have to reveal his positions in his SEC filings anyway. It can’t be hidden. As long as he is not selling into this spike, he is not taking advantage of the news he created (which would probably be illegal). His game is long term price appreciation from company performance, which is not effected by a little blip. How long term? I doubt he knows that. Perhaps when he feels the stock is overvalued rather than undervalued. What difference if he reveals his position today or next month?

Obviously this isn’t a classic pump-n-dump. Icahn is not going to immediately sell his shares just because the stock moved up tonight.

But certainly you see a difference in motivation here. Tim Cook cares about where Apple is headed the next 5-10 years. Icahn only care about where the stock is going the next 6 months. There’s a big difference. Icahn wants Apple to do everything within its power to some how some way get the stock up, so he can sell and move on. Apple on the other hand doesn’t care about the next 6 months; they care about position the company for years to come, and there certainly not going to sacrifice the future so Icahn can make a quick buck.

Bingo Jason!

Reaks royally!

Jack

what is the difference when the FOMC pulls their bullshit and then has their media whores do their bidding with planted bs stories? this entire thing is one giant Ponzi scheme. stay and play if you wish but buyer/seller beware. if you don’t know who the sucker in the room is….

Creates volatility.. this is good. The ‘Icahn Play’ needs to be traded with as much market awareness as any other set up. Without shenanigans/lies/bs from business or government we wouldn’t have nearly as many trading opportunities. Figure out how to get on the right side of it…

I totally agree. That’s why I’m just gonna put my head down and trade.

Jason, on the daily chart AAPL had formed a 6 month rounded bottom pattern and was pushing upward toward a test of resistance with above average volume yesterday. Horizontal resistance was at the $472 area. For those who trade that type of pattern, a break above $472 could be used as an entry on a swing trade. The followup volume expansion was added confirmation that the pattern was probably correct. Granted, his anouncement may have added to the volume, but the pattern was fairly clear so charters were probably watching it anyway for the crossup with volume expansion for what should be a decent swing trade.

Art

I completely agree Art. It was a very good breakout play, but that doesn’t take away from the fact that a hedge fund manager took a position, and then used his celebrity status to assist his position.

Jason,

If you were in his position, do you think you might have done the same? I would imagine he is in the business to make money and if that is the case, I’m sure he saw it as just doing business in a way that might work to his advantage that just happens to be legal. Ethically, possibly questionable, but from a point of view of just trying to make more money legally, probably appropriate.

Art

Art…I’m pretty sure I’d just keep my mouth shut. If I was confident in my position, I’d take it and sit tight and let the market play out.