Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across-the-board. Australia, Hong Kong, India, Indonesia, Japan, South Korea and Taiwan all did well. Europe is currently mostly up. Germany, Austria, Amsterdam, Stockholm and the Czech Republic are leading the way. Greece is down 1%. Futures here in the States point towards a gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is up.

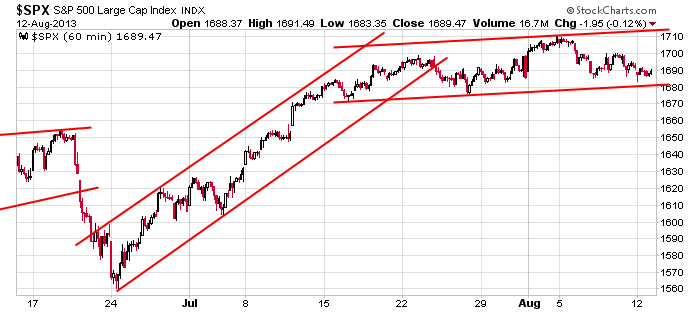

The market remains in consolidation mode. Here’s an update of the 60-min SPX chart. Rallies get sold, dips get bought, and in the end the S&P has moved in a 30-point range for 4+ weeks.

The market moves in cycles. At times it’s relatively easy to trade because the trend is strong, individual charts set up and breakouts get follow through so there’s little stress involved. Other times the market chops and churns. The near term trend is nonexistent, there are very few good set ups to be had, and the ones that do form don’t tend to follow through much when they take out key levels. This is the current situation, so don’t force trades.

Stock headlines from barchart.com…

Flowers Foods (FLO +0.04%) reported Q2 adjusted EPS of 24 cents, better than consensus of 23 cents.

J.C. Penney (JCP +2.33%) says Bill Ackman has resigned from board.

Valspar (VAL +1.22%) reported Q3 adjusted EPS of $1.07, weaker than consensus of $1.09, and then lowered guidance on fiscal 2013 EPS view to $3.45-$3.55, below consensus of $3.70.

Marvell (MRVL +0.08%) was upgraded to “Top Pick” from “Outperform” at RBC Capital.

Microsoft (MSFT +0.52%) was downgraded to “Hold” from “Buy” at Stifel.

Xerox (XRX +1.20%) was upgraded to “Buy” from “Neutral” at Citigroup.

Global Brass & Copper (BRSS +0.10%) reported Q2 adjusted EPS of 75 cents, better than consensus of 59 cents.

Lockheed Martin (LMT -0.82%) was awarded a $852.3 million government contract modification for the procurement of special tooling and special test equipment for the U.S. Navy, U.S. Air Force and international partners.

Northern Tier (NTI -1.66%) reported Q2 EPS of 70 cents, stronger than consensus of 47 cents.

The U.S. Food and Drug Administration approved Tivicay, a new drug from GlaxoSmithKline (GSK -0.41%) to treat HIV-1 infection.

Third Avenue reported a 22.78% passive stake in Cavco Industries (CVCO +1.27%) .

Yum! Brands (YUM +0.09%) fell over 3% in after-hours tradng after it reported July same-store sales declined an estimated 13% for its China Division.

Spirit AeroSystems (SPR -1.24%) reported Q2 adjusted EPS of 72 cents, well ahead of consensus of 50 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: AG, FLO, VAL

Notable earnings after today’s close: BRCD, CREE, JDSU, JKHY, MM, MYGN, PRMW, XONE

this week’s Earnings

this week’s today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 13)”

Leave a Reply

You must be logged in to post a comment.

Consumers did not spend at the forecasted rate, a little disappointment. But Ben speaks tomorrow and he will support the idea of tapering down bond buying, but holding rates low. The outcome of all this must concern everyone. Japan has been playing this game for years and falling further behind each year.

The Japanese debt dilemma is one we all need to know. How has one of the most industrious countries on the planet managed to go from a viable debt-to-GDP level of 50% in 1980 to 240% in 2013? That’s akin to a country generating $100,000 in revenue while attempting to deal with a $240,000 credit card debt. As Japan goes the USA will follow. The Fed plans are fatal, and the total absence of Congress controlling social spending means Japan is our model. Meanwhile on Martha’s Vinyard the golf ball fly and Cory Booker, super politican, saddles up to take the Senate. More problems than the stock market, its call survival.

the big PONSI implosion will hit japan,europe,usa sometime in the future

meanwhile in the next few days,we need to fatten up the bulls some more,before they are sold

,but we are close

the extingsion of the bulls will be a joyouse event,with exhilerating long range days,

well exceeding the 500 point dow mini correction of 2008/9

bull fighting ,a lost art will become a dayly household event throughout the world

Neal will make a fortune selling RED dow tea shirts to wave at the doomed bulls

now this is all a load of b.ll