Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan dropped 2.1% followed by China, Singapore and Taiwan. Europe is currently down across-the-board. London, Switzerland, Stockholm, Amsterdam and Germany are suffering the biggest losses. Futures here in the States point towards a large gap down open for the cash market.

The dollar is down. Oil is up, copper down. Gold is down, silver up.

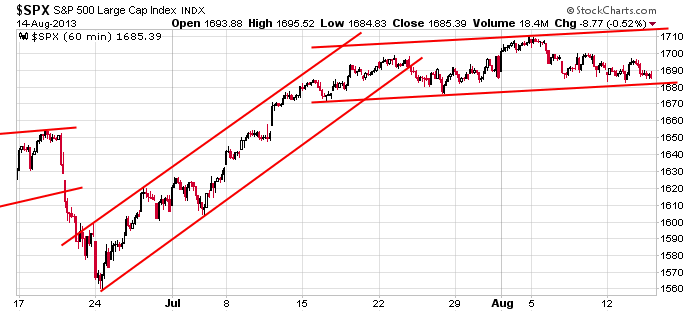

The market remains in a consolidation pattern. Rallies get sold, dips get bought. No move lasts very long. But there are some developments that bother me and need to be resolved before the market can rally. These developments can be resolved with a healthy correction or the passage of time. Right now the market is choosing the latter, but it wouldn’t take much to push the indexes below their ranges and induce a round of selling.

Here’s the 60-min S&P chart. As of now the index will open near 1675 – still above horizontal support from the beginning of the pattern but dangerously close to breaking down.

I maintain my stance traders need to be selective and cautious right now. Without a decent intermediate term trend and without helpful follow through, it’s best to scale things back and not force trades. The market moves in waves or cycles…it trends and then it chops in a range. You can’t apply trending strategies to a range bound market.

Stock headlines from barchart.com…

Wal-Mart (WMT -0.60%) fell over 2% in pre-market trading after it reported Q2 EPS of $1.25, right on expectations, but then lowered guidance on fiscal 2013 EPS to $5.10 to $5.30 from $5.20 to $5.40, below consensus of $5.30.

Estee Lauder (EL -1.99%) reported Q4 EPS of 24 cents, better than consensus of 21 cents.

Kohl’s (KSS +0.02%) reported Q2 EPS of $1.04, right on expectations.

Carnival (CCL +0.87%) was upgraded to “Buy” from “Neutral” at Goldman.

Briggs & Stratton (BGG +0.05%) reported Q4 adjusted EPS of 22 cents, better than consensus of 19 cents.

Intel (INTC +0.22%) was downgraded to “Neutral” from “Outperform” at RW Baird.

CACI International (CACI +0.54%) reported Q4 adjusted EPS of $1.59, slightly below consensus of $1.60.

Dean Foods (DF -2.75%) announced a 1-for-2 reverse stock split of issued Dean Foods common stock that will be effective after the close of trading on Monday, August 26.

Dillard’s (DDS -1.10%) reported Q2 EPS of 79 cents, stronger than consensus of 74 cents.

Agilent (A -0.87%) reported Q3 adjusted EPS of 68 cents, better than consensus of 62 cents, and raised guidance on fiscal adjusted 2013 EPS to $2.83-$2.85, higher than consensus of $2.78.

Cisco (CSCO +0.23%) slumped over 8% in after-hours trading even after it reported Q4 EPS of 52 cents, better than consensus of 51 cents, after it said revenue for the current quarter throuh October will be $12.2 billion to $12.5 billion, below consensus of $12.5 billion. The company also said that it will reduce its workforce by approximately 4,000 employees starting in Q1 of 2014.

NetApp (NTAP +0.09%) reported Q1 EPS of 53 cents, stronger than consensus of 49 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: BGG, DANG, EL, KSS, PAAS, PRGO, RRGB, SOL, WMT

Notable earnings after today’s close: AMAT, BYI, JWN

this week’s Earnings

this week’s today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 15)”

Leave a Reply

You must be logged in to post a comment.

The correction is barking at the door today. My puts are going to be helpful, closing all index positions for the duration until Congress does something. Long precious metals right now. What gives with bonds? Higher rates are not helpful to anyone. And oil is that Equpt? Can not see much techically, the NDX broke support at its long consolidation. So the leader falls today.

Overnight the ES (SPX futures) broke major support, and after the 830 it decisively demolished it. There will be a regression to the mean, which means there will be a bounce, someday, but the trend is down. Yesterday was a big clue in that regard. All targets above 1700 are now erased. A level to watch today is 1675 SPX. If we get over that, next likely upside tgt is 1683 SPX.

I love trading gaps but this one is not one I am going into. The markets could spring back up or go into a free fall. Collaring options is about all i will consider.