Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly down. India dropped 4%, Indonesia 2.5% and Australia, China, Japan and Singapore also fell noticeably. Europe is currently mixed. Austria, Italy, Spain and the Czech Republic are doing well; Greece and Switzerland are lagging. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

After almost five weeks of range bound movement where dips got bought and rallies got sold, the market finally made a move. Thanks to news from WMT and CSCO it was to the downside. The indexes gapped down, sold off for another 45 minutes and then settled into a range near its lows for the rest of the day. It was the biggest down day since mid June.

Given the range, there certainly was a lot of pent up buying and selling interest, this release firmly puts the bears in control in the near term. This should not have come as a surprise to anyone. There have been multiple warnings the last couple weeks that told us to be cautious. We also have not had many good set ups to play.

The writing was on the wall…to play it safe and wait for the environment to improve.

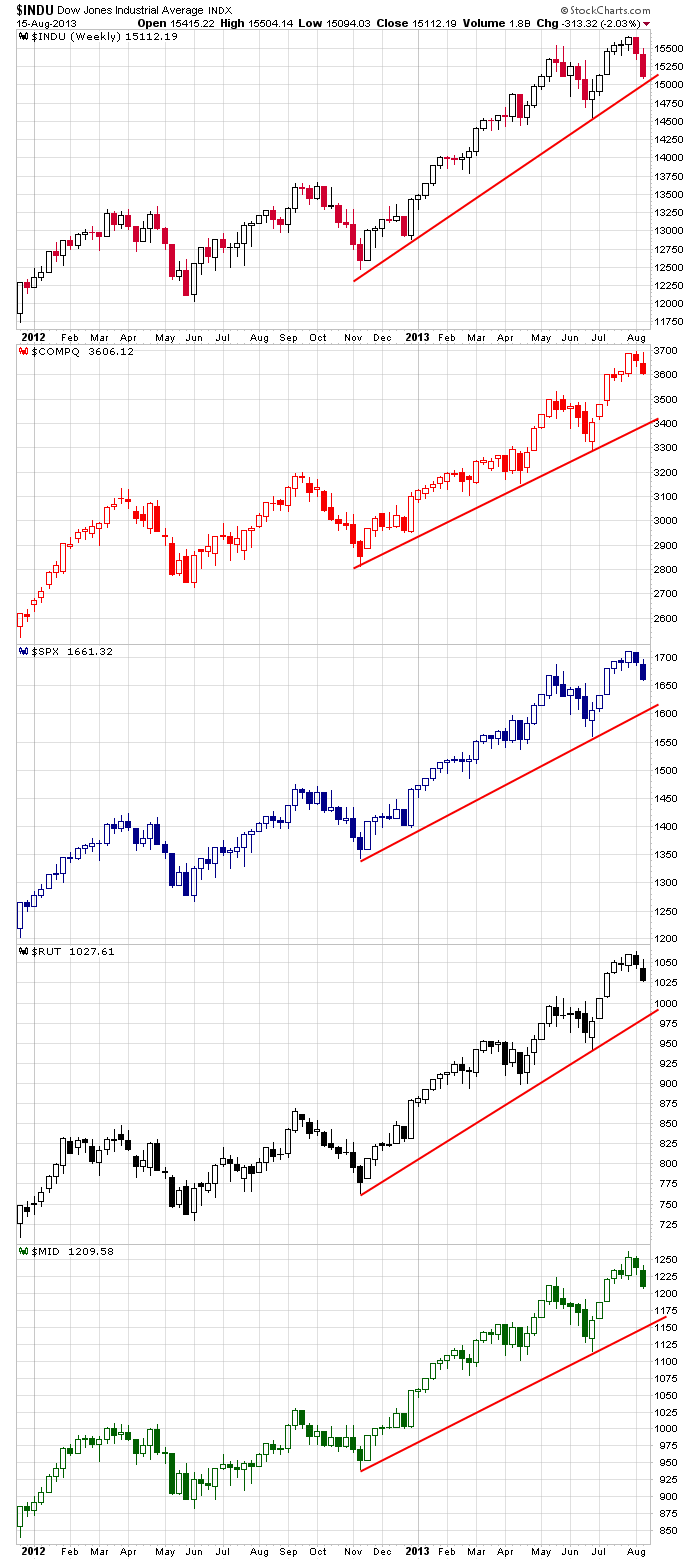

Here are the weekly index charts. Even if we have a simple reversion to the longer term trendlines, the S&P could drop to the low 1600’s – 50 points below yesterday’s close.

I’d welcome such a move. Let’s have a good shakeout to set up a fall rally. I don’t have reason to believe THE top is in place, just a local top.

Stock headlines from barchart.com…

Linear Technology (LLTC -1.31%) was upgraded to “Overweight” from “Equal Weight” at Morgan Stanley who also raised its price target on the stock to $48 from $40.

Xilinx (XLNX -2.33%) was upgraded to “Overweight” from “Equal Weight” at Morgan Stanley who also raised its price target on the stock to $40 from $38.

Pandora (P -3.50%) was upgraded to “Buy” from “Neutral” with a price target of $27 at Goldman.

Anadarko (APC +0.25%) was upgraded to “Strong Buy” from “Buy” at ISI Group.

Alcoa (AA unch) was downgraded to “Underperform” from “Neutral” at BofA/Merrill.

General Mills (GIS -2.88%) was downgraded to “Underperform” from “Hold” at Jefferies.

STMicroelectronics (STM -1.52%) was downgraded to “Underweight” from “Neutral” at HSBC.

JoS. A. Bank (JOSB -1.76%) fell 5% in after-hours trading after it lowered its Q2 EPS estimate to 49 cents-53 cents, well below consensus of 68 cents.

Gabelli reports 5.09% stake in Lennar (LEN +5.12%) .

Nordstrom (JWN -0.35%) fell over 3% in after-hours trading after it reported Q2 EPS of 93 cents, stronger than consensus of 88 cents, but then lowered guidance on fiscal 2013 EPS view to $3.60-$3.70 from $3.65-$3.80, lower than consensus of $3.78.

Applied Materials (AMAT -2.61%) reported Q3 adjusted EPS of 18 cents, weaker than consensus of 19 cents.

Dell (DELL -0.15%) reported Q2 adjusted EPS of 25 cents, better than consensus of 24 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: EJ

Notable earnings after today’s close: none

today’s upgrades/downgrades from briefing.com