Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Australia, India, Japan, South Korea and Taiwan did well. China did not. Europe is currently mostly up. Austria, Belgium, Amsterdam, London and Greece are leading. Futures here in the States point towards a flat open for the cash market.

The dollar is up slightly. Oil and copper are up a small amount. Gold and silver are down.

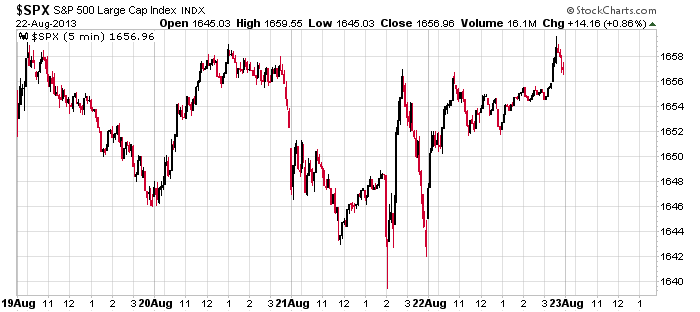

Here’s the 5-min S&P chart that covers this week. The market was weak on Monday and strong on Tuesday. Wednesday saw some crazy post-FOMC Minutes volatility, and then yesterday was a solid up day. As of now the market is up a small amount for the week, so flat trading or a move up would end the 2-week losing streak.

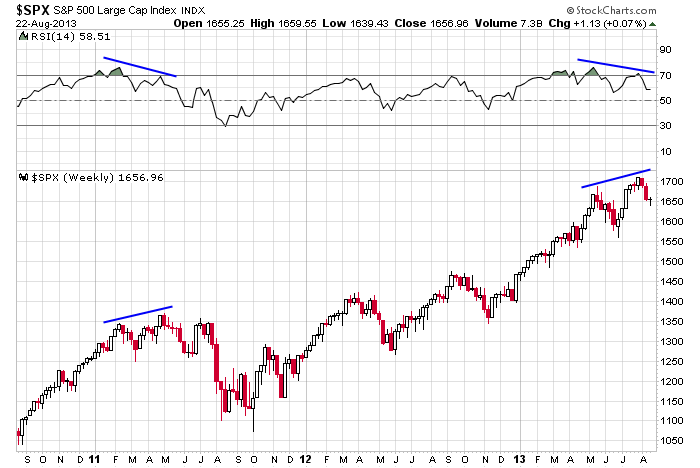

Here’s the SPX weekly. In the grand scheme of things, I see nothing out of the ordinary about the market’s movement. The S&P rallied hard off its June low and has pulled back the last couple weeks. No big deal. The overall trend remains solidly up, so with regards to longer term trades, I’m treating this like a pullback within an uptrend, not the beginning of a downtrend. If I’m wrong, fine. I’d rather be wrong once at the top than incorrectly guess tops numerous times over the course of several years. The bulls get the benefit of the doubt. The deserve it because the trend has been up for so long and because every dip since the 2009 has been bought.

The best set ups I see right now are from the gold and silver groups. There are many flag patterns forming, so if the group can get a little nudge, we could see quick 10-20% across-the-board gains.

Stock headlines from barchart.com…

Foot Locker (FL -0.15%) reported Q2 EPS of 46 cents, weaker than consensus of 48 cents.

Staples (SPLS -1.40%) was downgraded to “Neutral” from “Outperform” at Credit Suisse.

Both Trina Solar (TSL +0.78%) and First Solar (FSLR +1.22%) were upgraded to “Market Perform” from “Underperform” at Raymond James.

Williams Partners (WPZ +1.00%) was upgraded to “Buy” from “Neutral” at BofA/Merrill.

Flotek (FTK +2.07%) rose over 3% in after-hours trading after the company announced it will be added to the S&P 600 as of the August 26 close.

Nordson (NDSN +2.43%) reported Q3 adjusted EPS of 99 cents, below consensus of $1.05.

Charles F. Dolan reported a 14.3% stake in Cablevision (CVC +0.96%) and a 12.1% stake in Madison Square Garden (MSG +0.78%) .

Moody’s Investors Service has placed the senior and subordinated debt ratings of the holding companies for Goldman Sachs (GS +1.46%) , JPMorgan Chase (JPM +1.12%) , Morgan Stanley (MS +0.81%) , and Wells Fargo (WFC +0.28%) on review for possible downgrade to reflect the impact of US bank resolution policies.

Scansource (SCSC -0.62%) reported Q4 adjusted EPS of 71 cents, well ahead of consensus of 61 cents.

Marvell (MRVL -0.69%) reported Q2 EPS of 23 cents, better than consensus of 19 cents.

Aeropostale (ARO -3.85%) slumped over 10% in after-hpurs trading after it reported a Q2 adjusted EPS loss of -34 cents, a bigger loss than consensus of -24 cents, and said Q2 same-store-sales tumbled -15%. The company said it will close 30-40 stores in fiscal 2013, more than the 15-20 stores it had previously announced will close.

Ross Stores (ROST +1.42%) reported Q2 EPS of 98 cents, stronger than consensus of 93 cents.

Autodesk (ADSK +1.43%) reported Q2 EPS of 45 cents, stronger than consensus of 42 cents, but said Q3 EPS will only be 36 cents to 40 cents, below consensus of 50 cents.

Gap (GPS -1.57%) reported Q2 EPS of 64 cents, right on consensus, although Q2 revenue was $3.87 billion, higher than consensus of $3.83 billion and Q2 same-store-sales were up 5%.

Pandora (P +1.02%) fell over 7% in after-hours trading after reported Q2 EPS of 4 cents, double expectations of 2 cents, but gave guidance on Q3 EPS of 3 cents to 6 cents, below consensus of 8 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 New Home Sales

Notable earnings before today’s open: ANN, FL, HIBB

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 23)”

Leave a Reply

You must be logged in to post a comment.

how to explain this—the above cash charts you are looking at are dellusions/illusions

pawns to their derivitive masters–the futures/options

there is a little known rule that the instos use

the cash market can only get out of alignment with the futures a certain percentage—fair valve — then the exchange has to bring them back into alighment—see index arb .com

the instos/central banks rule the markets with futures/day -weekly options

this is what happened to the nasdax y/day–it was flooded with futures/opts buying

and what happened to australia today

History is on the side of a rising market? Is that technical analysis or what Jason? It is Friday and the SP is moving toward 1672 before the correction starts again. Still holding my puts and will add shortly. Why? The prospects for nothing from Congress and the Fed has apparently died, or should. In any case, the markets are adrift in a sea of unknowns, ambiguity is the enemy of strength. Then look at the sectors, not much strength and lots of weakness. Be careful. And do get Neal’s book, Amazon? Give us a citation.

The book exists and a recent addition they say. I read the reviews they sum up to “weak tea and lots of junk but no evidence that it works”. Neal T Weintrub? What exactly is your speciality in trading aside from writing interviews with others? Are we missing something, just lucky?

One observation supporting your chart annotations is a weekly cross-plot of TLT:$SPX on stockcharts.com.

The oversold condition of the RSI(14) of spring 2011 is here again.

Can you post a link to your weekly cross-plot of TLT:$SPX chart?

Sorry, I use the free portion of the site and apparently the link copy option is not active. I just learned to do cross-plots so here it is. Go to stockcharts.com and type in TLT:$SPX in the symbol box (SharpChart Option), and change the period to weekly. RSI(14) is a default at the top of the chart.

A swing trader who buys and holds for several weeks doesn’t care about the Nas shutting down and opening flat a few hours later.

And besides, I talked about the Nas yesterday in my after-market report. This morning write-up is just a bunch of quick comments. The Nas shutting down is old news and doesn’t matter right now.

Craig, is this your chart that Jason wants?

http://stockcharts.com/h-sc/ui?s=TLT:$SPX&p=W&yr=3&mn=0&dy=0&id=p33233147075

Yes, that’s the one. I’ll subscribe to stockcharts at some point. Thanks

Thanks Anne.

face reality ,the market IS a casino run by the instos

learn to play at the high rollers table

flood the market with futures options and rig the game

close down the casino with a big bet that cant be layed off

Universities are filled with very smart people who are very broke. It’s all about herding sheep.