Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. India rallied 2.3% while Indonesia, Malaysia and South Korea dropped 1% or more. Europe is currently mostly up. Austria, France, Germany, Amsterdam, Switzerland, London, Italy and Spain are doing very well. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

Yesterday, the reaction to the FOMC minutes was more extreme than the reaction to any of the FOMC meetings going back several years. First there was a quick move down that took out the lows of the day, then a surge which took out the highs of the day and then a plunge which gave everything back and took out the lows again. We haven’t seen such movement in a long time, and I’m not going to guess which move was the right move.

A knee-jerk reaction to any news release is common. A counter move that completely reverses the initial knee-jerk reaction is very common too. But fading the fade of the initial move? Huh? Yeah right. That was predictable in the charts. Not!

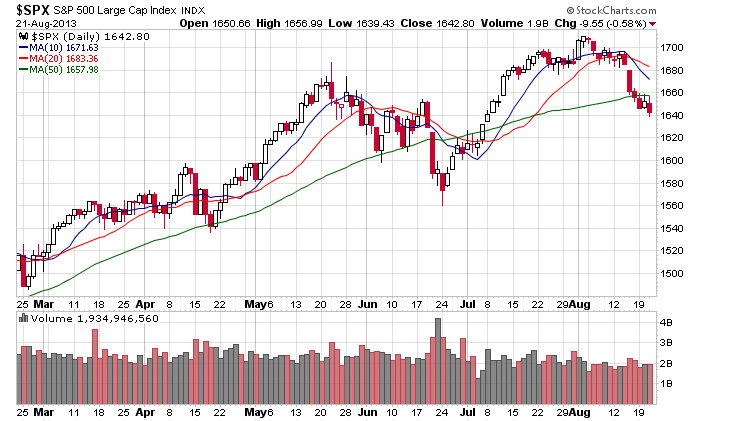

Here’s the S&P daily. The index has fallen 5 of 6 days and 10 of the last 13. It has closed below its 50-day MA four straight days. Overall the trend is up, but in the near term there may not be much support until 1600-1620.

With several indicators having hit levels that are extreme enough to support a bounce, in my opinion, the market needs to bounce (or at least rest) or else the odds of hitting downside air pocket that causes a quick plunge are pretty high.

Be careful out there. The market may be close to an inflection point.

Stock headlines from barchart.com…

Microsoft (MSFT -0.03%) was upgraded to “Buy” from “Neutral” at Nomura.

Dollar Tree (DLTR -0.31%) reported Q2 EPS of 56 cents, lower than consensus of 57 cents.

Target (TGT -3.61%) was downgraded to “Underperform” from “Market Perform” at William Blair.

Marathon Oil (MRO -1.35%) was upgraded to “Outperform” from “Market Perform” at Raymond James.

Sears Holdings (SHLD +4.04%) reported a Q2 adjusted EPS loss of -$1.46, a wider loss than consensus of -$1.10

Abercrombie & Fitch (ANF -3.51%) reported Q2 EPS of 16 cents, well below consensus of 29 cents.

Patterson (PDCO -0.53%) reported Q1 EPS of 45 cents, weaker than consensus of 48 cents.

Hormel Foods (HRL -1.57%) reported Q3 EPS of 42 cents, lower than consensus of 45 cents.

Yahoo! (YHOO -0.22%) is up over 1% in pre-market trading after data from ComScore showed that Yahoo attracted 196 million Web visitors in July, 4.3 million more than Google (GOOG +0.45%) and the first time in 2-years that Yahoo’s Web traffic has surpassed Google.

Kratos Defense (KTOS +3.39%) announced that it was awarded a Blanket Purchase Agreement with an estimated value of $6 billion to provide Continuous Monitoring as a Service to the Department of Homeland Security as part of the Continuous Diagnostics and Mitigation Program.

Hewlett-Packard (HPQ -1.78%) fell over 7% in after-hours trading after it reported Q3 EPS of 86 cents, right on consensus, but gave guidance on fiscal 2013 EPS of $3.53-$3.57, below consensus of $3.57 and said demand in China is soft ‘across the board.’

Synopsys (SNPS -1.22%) reported Q3 EPS of 55 cents, better than consensus of 54 cents, and gave guidance on fiscal 2013 EPS of $2.42 – $2.44, better than consensus of $2.42.

Bloomberg reported that Wells Fargo (WFC -0.54%) will cut 2,300 mortgage lending jobs.

Hain Celestial (HAIN -1.30%) reported Q4 adjusted EPS of 65 cents, stronger than consensus of 62 cents.

LTD Brands (LTD -1.34%) reported Q2 EPS of 61 cents, better than consensus of 60 cents.

Earnings and Economic Numbers from seekingalpha.com…

Notable earnings before today’s open: AERL, ANF, BKE, BONT, CYBX, DLTR, GME, HRL, NM, PDCO

Notable earnings after today’s close: ADSK, ARO, ARUN, GPS, MCRS, MENT, MRVL, P

Today’s economic calendar:

8:30 Initial Jobless Claims

9:00 PMI Manufacturing Index Flash

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 22)”

Leave a Reply

You must be logged in to post a comment.

Hope out of EU – Germany economic expansion looks good. Attempt to rally today will fail I think. Living short for the next month. But not expecting Taper in Sept. Look forward a major scene in Congress on Budget and debt ceiling that will slow the market. In the meanwhile gold should finish corrective leg down @1300 and be abuy for next leg up.

Feeling good today for some reason, hope you are too.

Hey Aussie JS-There is no doubting your Intelligence and I remember the Phillip St Law Pool table very well and I and some mates used to frequent Crystal Palace in George st and play ‘Alley’ (remember that one ? )…aahh the good ole days and there was another exc one at Balmain….both now gone of course.

yeh ,the good ole days of a misspent youth was a long time ago for me

but have been lucky enough to enjoyed all my life

yeh, the good ole days

“Yesterday, the reaction to the FOMC minutes was more extreme than the reaction to any of the FOMC meetings going back several years”

Good point. VXN up bulls getting edgy.