Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. India and Indonesia dropped more than 3%; Malaysia, Singapore and Taiwan also suffered decent losses. Europe is currently down across the board. Austria, France, Germany, Amsterdam, Stockholm, Switzerland, Greece, Italy, Spain and the Czech Republic are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

This was supposed to be a semi slow week. The indicators were mixed, the indexes had room to move in both directions before triggering any alerts, and there was a lack of good set ups to play anyways. Then John Kerry made Syria-related comments yesterday afternoon, and between ensuing sell-off and today’s gap down, the S&P will be down about 20 points in about an hour of trading.

News trumps the charts, and right now it’s all about Syria.

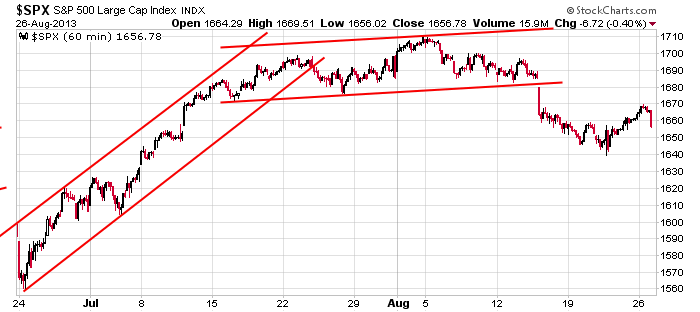

Here’s the 60-min SPX chart (as if it matters right now). Yesterday the index went right up to the bottom of a thin trading area before falling. Today’s open will be near 1646, still about 6 points off last week’s low.

Wall St. won’t like the prospect of war or even the US’s involvement, so until there’s more clarity in Syria, the market may be held hostage.

We were already in a conservative mode, so our MO right now stays the same. Be careful out there.

Stock headlines from barchart.com…

Donaldson (DCI +1.04%) reported Q4 EPS ex-items of 49 cents, stronger than consensus of 45 cents.

Brown Shoe (BWS +0.81%) reported Q2 adjusted EPS of 33 cents, better than consensus of 22 cents.

Apache (APA -0.09%) was downgraded to “Neutral” from “Buy” at Guggenheim.

Monsanto (MON +1.49%) was upgraded to “Buy” from “Neutral” at UBS.

Tiffany (TIF -0.40%) reported Q2 EPS of 83 cents, beter than consensus of 74 cents.

9to5Mac reported that Apple (AAPL +0.39%) is planning to launch iPhone trade in program as soon as next month that will allow customers that own earlier iPhone models to bring the phones into an Apple store and exchange for a newer iPhone model at a discounted price.

Lone Pine Capital reported 5.4% passive stake in Dollar General (DG +0.98%) .

Wolverine Asset Management reported a 9.99% passive stake in Good Times Restaurants (GTIM +1.89%) .

SAIC (SAI +0.39%) announced it was awarded a $224 million contract by the Federal Retirement Thrift Investment Board, or FRTIB for information security and enterprise-wide information technology support services.

Reuters reported that Ackman’s Pershing square will sell its entire stake in J. C. Penney (JCP -1.11%) , approximately 39 million shares.

Reuters reported that JPMorgan Chase (JPM -0.99%) has been found liable for breach of contract and ordered to pay $42.5 million in damages after being accused of mismanaging an investment account by betting on mortgage-backed securities.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

1:00 PM Results of $34B, 2-Year Note Auction

Notable earnings before today’s open: BMO, BNS, BWS, DCI, DSW, LDK, TIF

Notable earnings after today’s close: ARAY, AVAV, AVGO, HEI, TIVO, WDAY, WMS, WTSL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 27)”

Leave a Reply

You must be logged in to post a comment.

I would often buy into this gap down looking for a bounce but given the divergence between the Nasdaq S&P 500 and the small caps… No way.

Just the start of a move. The real news is the debt ceiling and budget. The President and his sec Trea want hard ball, so we pay for it. Case Shiller up 12.07% which is more bubble than value. Easy money for mortgages and foreign buys of cheap US reality are driving this move, but it is not the entire market, just 20 sample markets representing less than40 of home value in USA. A lousy statistic which should be used knowingly. The current concern is M2 money supply, the QE has the market short of Treasuries and the Repro market is thin. Banks are unable to raise short term money to help clients do deals. This could be the spoke in the wheel that slows the economy into a recession. Bonds, not bond funds are interesting to look at here.

There is a saying “when the missiles fly, so does the market.” The threat of involvement causes the market to take a dump, CHECK, but watch out for the reaction. Oil +$3 right now. Just don’t get too bearish OR too bullish.

PS Forgot to add, we didn’t crack SPX 1670 yes’day. Only 1669.51. Like I said, it’s an index, can’t put too fine of a point on it.