Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Australia, Hong Kong, Japan and Singapore dropped more than 1%; Indonesia rallied 1.5%. Europe is currently mostly down. Germany, Switzerland and Italy are down more than 1%; Austria, Belgium, Stockholm, London and the Czech Republic are also down noticeably. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are up.

The market took a beating yesterday. It gapped down and steadily sold off all day and barely managed an intraday bounce attempt. It was the market’s biggest down day since just before the June low.

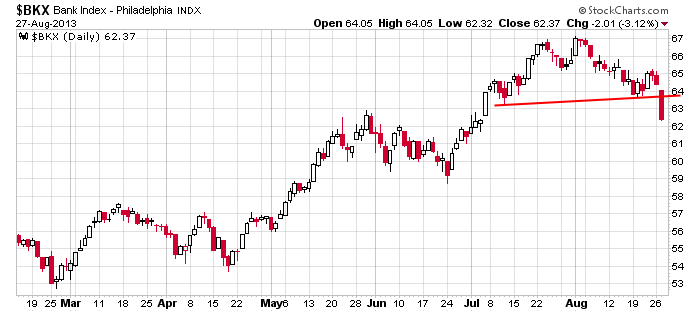

Not only did the indexes suffer big losses and take out their previous lows, several key groups did too. Here’s $BKX.

Don’t be a hero out there. I’ve been in a conservative mode for a couple weeks because the near term has been unclear and research has not revealed many good set ups. Now we have the potential for US military strikes against Syria, so the potential for market-moving news suddenly crossing the wires is much higher than normal. Again, don’t be a hero. There’s nothing wrong with laying low and waiting for the charts to set up and for anxiety levels to drop.

Stock headlines from barchart.com…

Chico’s FAS (CHS -1.60%) reported Q2 EPS of 27 cents, weaker than consensus of 32 cents.

DSW (DSW +7.91%) was downgraded to “Sell” from “Hold” at Brean Capital, citing rich valuation.

Joy Global (JOY -2.95%) reported Q3 EPS of $1.70, well ahead of consensus of $1.36.

Dow Jones reported that Las Vegas Sands (LVS -3.18%) will pay $47 million to settle Department of Justice money-laundering probe.

CNBC reported that the website of the New York Times (NYT -2.93%) has been shut down because of hackers.

Dycom (DY -1.94%) reported Q4 EPS of 44 cents, weaker than consensus of 45 cents.

Tiffany (TIF -1.04%) was downgraded to “Neutral” from “Buy” at Citigroup based on valuation.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Pending Home Sales

10:30 EIA Petroleum Inventories

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: AMAP, BF.B, CHS, EXPR, FRO, JOY, ZLC

Notable earnings after today’s close: GAME, GES, TFM, WSM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 28)”

Leave a Reply

You must be logged in to post a comment.

Important day. Fell to my support level and closed on it: spx 1630. We have room to maneuver to the downside, but if we break 1613-1610, the bears have it. If that happens and we bounce, which would be normal, don’t interpret it as bullish.

If we can move up from 1630 and validate it as support, good for bulls.

As Jason says, don’t be a hero. Market needs to tell us what it is gonna do. Can go either way, and news can change direction in a heartbeat as we saw Mon where Kerry spoke.

I don’t see a bottom … yet.

I will go out on a limb and say October 22 be long or be wrong.

Bonds interesting today, lots of upside potential shows 138, then 149. Mind blowing. The lows in equities seem to be well below the current level, but its the holiday season so its thin and we can get some breathing – short moves up. Shorting rally? The global move in oil is the major threat 130/bbl is where it binds and hurts economies. Acquired new puts, and sold my winners. I think this feel like it could get down to the lows in June this year and maybe in the fall 12? Still riding gold and silver, but it is disappointing nothing happening.