Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. India rallied 2.3%, and Indonesia, Malaysia, Singapore, South Korea and Taiwan moved up 1% or more. Europe is currently mostly up. Only Greece (up 1.7%) is up more than 1%, but Austria, Amsterdam, Stockholm, Italy and London are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. oil and copper are down. Gold and silver are down.

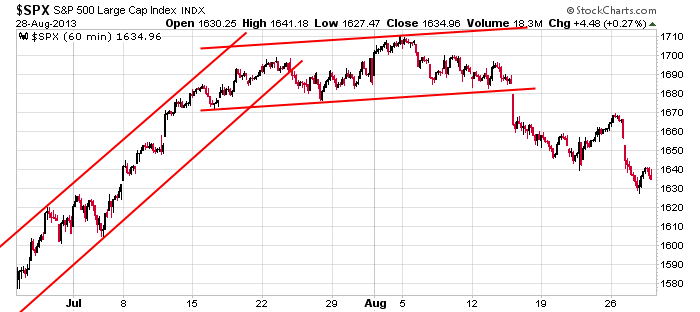

Let’s go right to the charts. Here’s the S&P 60. It broke down from a topping pattern, bounced at the end of last week, and in the last couple days, legged down again and took out the lows. Since early August, the trend has been down, and this would explain why there has been a lack of good set ups to play, why I’ve been in conservative mode.

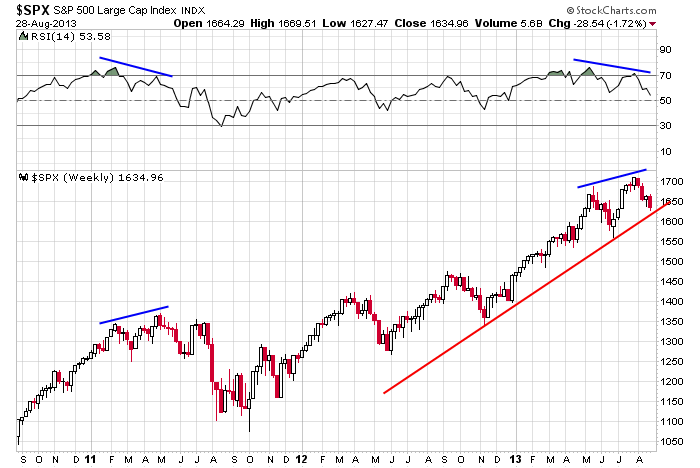

Backing up to the weekly, the long term trend is still up, but the index is still working off an RSI divergence.

I mostly trade in the direction of the long term trend, but within the trend I’ll alternate between being passive and aggressive. When the short term trend is also up, I’m actively playing breakouts and giving stocks time and space to move around. When we get a short term pullback within the overall uptrend, I scale back. Such has been the case the last month. Hence why I’ve been laying low lately.

Don’t force trades. Don’t be a hero.

Stock headlines from barchart.com…

Citigroup group keeps its “Buy” rating on Harley-Davidson (HOG +0.59%) and said the company’s new motorcycles for 2014 should accelerate sales growth.

Signet Jewelers (SIG +2.98%) reported Q2 EPS ex-items of 90 cents, better than consensus of 83 cents.

Mohawk (MHK -1.51%) was upgraded to “Strong Buy” from “Outperform” at Raymond James.

AMC Networks (AMCX -0.57%) was upgraded to “Buy” from “Neutral” at B. Riley.

Pall Corp. (PLL +0.55%) reported Q4 EPS of 90 cents, better than consensus of 89 cents.

Campbell Soup (CPB -0.80%) reported Q4 EPS of 45 cents, stronger than consensus of 42 cents.

Shanda Games (GAME +3.88%) reported Q2 adjusted EPS of 24 cents, better than consensus of 20 cents.

The Fresh Market (TFM -0.09%) reported Q2 EPS of 32 cents, right on consensus, but lowered guidance on fiscal 2013 EPS to $1.50-$1.55, below consensus of $1.59.

Guess (GES +0.29%) surged 17% in after-hours trading after it reported Q2 adjusted EPS of 52 cents, well ahead of consensus of 36 cents.

S.A.C. Capital reported a 5.1% passive stake in Diamond Foods (DMND +0.92%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q2

8:30 Corporate Profits

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

7:45 PM James Bullard: Economic and Monetary Policy

Notable earnings before today’s open: BRLI, COCO, CPB, FLWS, JASO, LRN, PLL, RY, TD

Notable earnings after today’s close: BEBE, CRM, KKD, OVTI, PSUN, SPLK, WMS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 29)”

Leave a Reply

You must be logged in to post a comment.

wonderful, GDP is up, but not so good it is mostly due to inventory adjustments, government spending, and some up scale building. But it shows a host of weak spots. Over on Wall Stree end of month window dressing pushes up on low volume, a trap for the buyer unless you are saving your customer base. Now Syria: there is nothing good going on, now the UN will get to make the call and Obama goes to Petersburg to be an also-ran partipant probably ignored by Putin. I am long energy, and harvested by puts to see what happens next. Technition types will miss all of this and see a slight consolidation with a prayer of moving up, not.

Nothing changed from y’day, and overnight the futures lost of all what was gained (and not very impressively) y’day. We’ll open below Wed’s cash close. If we don’t hold 1630 (futures saying we aren’t going to), and for sure spx 1610-13, then the bulls are outta there for a while.

Target downside 1617. For today.

thank god its free, cause that is what it is worth.

Ok, so the bulls came to play today. Defended spx 1630 with a vengeance. Strongest resistance is 1650. Might be too much to ask to get today, but if they can power thru it and break 1655, they take the 1614 off the table.

Always an “either or” game.

Today the market is floating up on light volume. It makes buying naked puts very attractive… I won’t because if it looks too good it turns out sour.

neal there are no daytraders here ,only me

i closed all world shorts at asia tradeing as markets reversed

just closed my longs and will see what happens at y/days high for a pos short

butlooking at Jasons chart we have had a impulsive 5 swing down now a pos abc up to correct

but im just a daytrader/scalper