Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up; Australia and South Korea led the way. Europe currently is trading mixed and with a positive lean. Germany, Norway, Italy and Spain are doing the best; Greece is lagging. Futures here in the States point towards a down open for the cash market.

Check out some of our current and recent set ups here.

The dollar is down slightly. Oil is down, oil up. Gold is down, silver up.

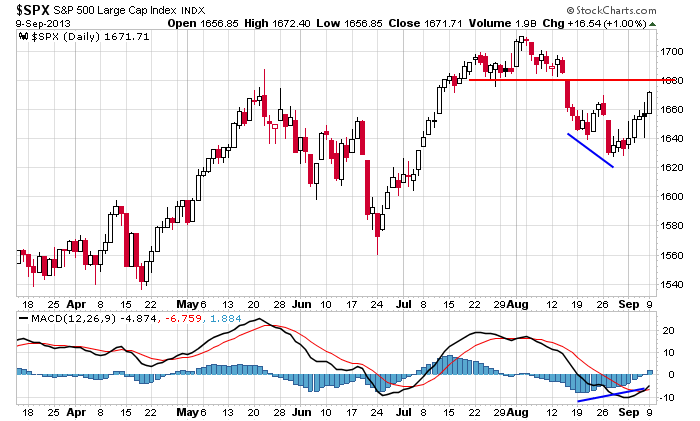

The market is on a heck of a run. The S&P has rallied 6 straight days and 8 of the last 9 and is about 55 points off its recent bottom. For the bears who were looking for an innocent bounce within a downtrend, frustration is all they’re getting. Enough of the pullback has been recovered to shift sentiment to favor the bulls. Odds favor a continuation of the move up (perhaps after a pause), not a re-establishment of the move down.

Last night Obama spoke to the nation to lay out his case for strikes against Syria. With futures being down a couple points, I’d say Wall St. is taking the news in stride. Considering Syria related news in the last couple weeks has quickly moved the market intraday, for premarket futures to be barely changed tells me Syria is known and factored in.

Here’s the daily S&P 500. A higher high has been made and a previous support level has been re-captured. Note the last two rallies (April/May and June/July). Each kept going and going and didn’t give the bulls a chance to get long. Such is life on Wall St. when the Fed plays an active roll.

Stock headlines from barchart.com…

Morgan Stanley (MS +2.19%) was upgraded to “Buy” from “Neutral” at UBS.

Procter & Gamble (PG -0.27%) was downgraded to “Neutral” from “Buy” at SunTrust.

Nokia (NOK +2.54%) was upgraded to “Buy” from “Neutral” at BofA/Merrill.

Apple (AAPL -2.28%) was downgraded to “Neutral” from “Buy” at BofA/Merrill and was downgraded to “Neutral” from “Outperform” at Credit Suisse.

Brocade (BRCD -0.13%) said it will cut 300 jobs, consolidate facilities, and take $30 million-$40 million in charges in Q4.

Raytheon (RTN +1.37%) was awarded a $136.25 million government contract for MK15 Phalanx Close-In Weapon System upgrades and conversions, system overhauls and associated hardware.

Bloomberg reported that Verizon (VZ +1.22%) plans to sell between $45 billion-$49 billion of debt to finance its acquisition of Vodafone’s (VOD -0.99%) stake in Verizon Wireless.

S&P cuts Argentina’s debt rating to CCC+ from B- with a Negative Outlook.

Southeastern Asset reported a 11.9% passive stake in News Corp (NWSA +1.41%) .

International Paper (IP +0.24%) announced a $1.5 billion share repurchase plan and raised its quarterly dividend to 35 cents from 30 cents.

Waddell & Reed reported a 10.1% passive stake in Harman (HAR +0.98%) .

Cohen & Steers reported a 10.47% passive stake in Healthcare Trust (HTA -0.09%) .

Restoration Hardware (RH -0.96%) reported Q2 adjusted EPS of 49 cents, stronger than consensus of 43 cents, and raised guidance on fiscal 2013 EPS view to $1.65-$1.70, better than consensus of $1.48.

Select Equity Group reported a 11.7% passive stake in PBF Energy (PBF +0.09%) .

Oxford Industries (OXM +1.35%) reported Q2 adjusted EPS of $1.01, better than consensus of 98 cents, but then lowered guidance on fiscal 2013 EPS view to $2.90-$3.05 from $3.00-$3.15, lower than consensus of $3.12.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Wholesale Trade

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

Notable earnings before today’s open: none

Notable earnings after today’s close: MW, VRA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 11)”

Leave a Reply

You must be logged in to post a comment.

Odds? What is the hurry? We have an equation with three unknowns: budget, debt limit, and the FED. I will sit this one out. Multiple expansions are not impressive growth except at the end of a rally. Good Luck.

Jason

MACD? Not my favorite. Hint they work better by over weighting certain values over others.