Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China and Singapore did relatively well with moderate gains; India dropped. Europe is currently mixed. Austria is down; Amsterdam and Spain are up. Futures here in the States are flat.

The dollar is up slightly. Oil is up, copper down. Gold and silver are getting hit hard.

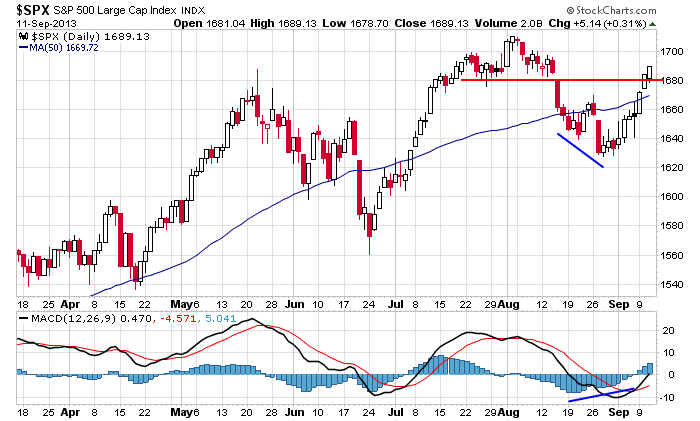

The S&P has now moved up about 7 straight days and it about 60 points off its end-of-August low. The move is more than one would expect for a dead-cat bounce within a downtrend. At the very least sentiment has been neutralized.

Here’s the daily S&P again. First the 50 was taken out. Then a higher high was made. And finally a previous support level. And of course this bounce has recaptured much more than 50% of 62% of the move down. From a technical standpoint, these are all good measurements. There are of course no guarantees, but for now, the odds favor a continuation of the move up – even if the market has to rest first.

Things that could change the market include…

The Fed next week…will they taper, how much?

Syria…our involvement could grow.

The debt ceiling…it hasn’t been talked about much but it will be front and center once next week’s FOMC meeting passes.

Sentiment will also play a role. Traders got too bearish in August, so this bounce was not hard to accomplish. If sentiment continues to be bearish, new highs will be made, but if the bears throw in the towel and get bullish, the wall of worry won’t be there to climb. More after the open.

Stock headlines from barchart.com…

Halliburton (HAL -0.26%) was downgraded to “Neutral” from “Outperform” at Macquarie.

lululemon (LULU -1.50%) slipped over 9% in pre-market trading after it reported Q2 EPS of 39 cents, better than consensus of 35 cents, but then lowered guidance on fiscal 2013 EPS view to $1.94-$1.97, below consensus $1.99.

Wendy’s (WEN +0.73%) was upgraded to “Buy” from “Hold” at Argus.

Symantec (SYMC +0.12%) was downgraded to “Equal Weight” from “Overweight” at Morgan Stanley.

Men’s Wearhouse (MW -0.62%) slumped over 10% in after-hours trading after it reported Q2 EPS of $1.01, well below consensus of $1.14, and then lowered guidance on fiscal 2013 EPS view to $2.40-$2.50 from $2.70-$2.80, below consensus of $2.77.

As of the September 20 close, Ametek (AME +0.41%) and Vertex (VRTX -1.86%) will be added to the S&P 500, while AMD (AMD -1.29%) and SAIC (SAI +2.07%) will be deleted and added to the S&P 400.

Billionare investor Carl Icahn said he bought more Apple (AAPL -5.44%) stock Wednesday as the price fell and that he likes the Netflix (NFLX -1.52%) model and has not sold his shares.

Qualcomm (QCOM -2.85%) announced a new $5 billion share repurchase program.

Royal Caribbean (RCL +1.28%) raised its quarterly dividend to 25 cents per share from 12 cents per share.

Vera Bradley (VRA +2.53%) tumbled 11% in after-hours trading after reported Q2 EPS of 37 cents, better than consensus of 32 cents, but then lowered guidance on fiscal 2014 EPS view to $1.47-$1.52 from $1.74-$1.78, below consensus of $1.71.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: KR, LULU, NTWK

Notable earnings after today’s close: ULTA, UNFI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 12)”

Leave a Reply

You must be logged in to post a comment.

Initial claims down, but due to computer change, whatever that means. As for Jasons forecast UP more, It is discouraging. P/E expansion is questionable unless one is just

wants motion, no substance. The banks and funds are doing the buying to invest the cash sloshing around in the economy. Houses and stocks. But not everyone.

Over 47 million Americans receive benefits from the Supplemental Nutrition Assistance Program (formerly food stamps), Other elements of the federal safety net include mortgage relief, and Temporary Assistance to Needy Families. The provision of subsidized health care for those earning below 400 percent of the poverty line under the Affordable Care Act, beginning in 2014, will exacerbate this. ZeroHedge extract>

The claims will continue to fall, who needs work?

This market has been strange. The NASDAQ is hitting new highs while the others lag… Most often a sign a fall is coming but it has not all year. Low volume on up days higher on down yet the market keeps climbing.

We know the Fed can’t print money forever and a nasty day will happen… Question is when????

I told a friend of mine that if I had next months WSJ I would be a billionaire. He one upped me saying I would have to trade options and work at it… He would just go out and buy a lotto ticket since he would have the winning numbers. There is more than one way to skin a cat.