Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Indonesia rallied 3.4%, Hong Kong, Singapore and Taiwan more than 1% and New Zealand and South Korea around 1%. Europe is currently doing great. France, Germany, Amsterdam and the Czech Republic are up more than 1%; Austria, Stockholm and London are also doing well. Futures here in the States point towards a big gap up open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are down.

The big news is Larry Summers has withdrawn his name from consideration for Fed Chief. In my opinion, it’s a cowardly thing to do. He probably got word he wasn’t going to get picked, and instead of dealing with the pain/embarrassment of the rejection, he quit. Until the President made his official choice, Summers had a voice. Why didn’t he use it to verbalize what he believed in? This once again makes Janet Yellen to top contender. She’s very much like Bernanke, so if chosen, you can expect more of the same policy regarding QE and rates.

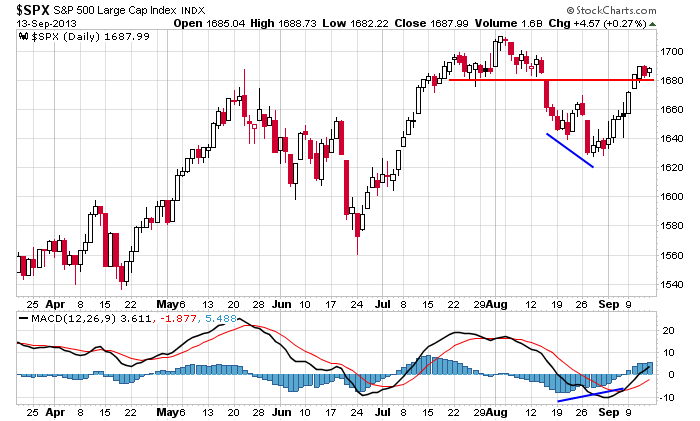

Here’s the SPX daily. If the futures hold their current level, the index will open around 1705 – only a couple points from the high.

The Nas is already at a new high.

Many indicators also greatly improved last week.

The big news out this week of course is Wednesday’s FOMC meeting. Will the Fed taper? How much? A lot? A little? Besides bond purchases possibly decreasing, will there be any hint of overnight rates or the discount rate being moved up?

With the rally off the August low and today’s gap up, needless to say, the market is priced for perfection. It’s not worried about the Fed, so the Fed better not disappoint.

Bernanke doesn’t like to disappoint. It’s a combination of him be transparent and therefore dictating expectations and his desire to do what Wall St. wants anyways. Love him or hate him, although the economy has muddled around for years, the market has done great. He doesn’t want that to change on his way out the door.

Stock headlines from barchart.com…

Packaging Corp. (PKG +0.65%) will acquire Boise (BZ +3.86%) for $12.55 per share in cash or $1.995 billion.

ChinaEdu (CEDU +0.14%) was downgraded to “Neutral” from “Overweight” at Piper Jaffray due to valuation.

According to DigiTimes, Samsung (SSNLF +2.71%) has cut its notebook component orders in September to about half of its original forecast and may also reduce its shipment forecast in 2013 to 13 million units from 13.8 million in 2012.

Under Armour (UA -2.59%) was downgraded to “Neutral” from “Positive” at Susquehanna.

Bristol-Myers (BMY -0.27%) was upgraded to “Overweight” from “Neutral” at JPMorgan.

Oaktree Capital (OAK +1.52%) was downgraded to “Neutral” from “Buy” at BofA/Merrill.

Barclays (BCS -0.31%) was upgraded to “Buy” from “Reduce” at Nomura.

Citigroup kept its “Buy” rating on United Natural Foods (UNFI +12.94%) and raised its price target on the stock to $80 from $64.

AstraZeneca (AZN +0.16%) was upgraded to “Buy” from “Sell” at Nordea.

ALPS Advisors reported a 5.0% passive stake in MarkWest Energy (MWE -1.21%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Empire State Mfg Survey

9:15 Industrial Production

Notable earnings before today’s open: none

Notable earnings after today’s close: OCLR

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 16)”

Leave a Reply

You must be logged in to post a comment.

SPX is near a triple top, but an engulfing candle says UP today. We celebrate today the demise of the candidate Summers and the rise of radical QE queen Yellen. In the meanwhile, Congress and the President say “no negotions on debt ceiling”, and the CR will be a gimick that blows up at year end. The Japanese are emptying storage pool 4 at Topco plant, a slip and we should all move south of Jason even, Chile? Bonds down in yield and up in price. God is not in his heaven. Have a nice day.