Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

SPY (closed 170.31)

Puts out-number calls 1.9-to-1.0 – slightly less bearish than last month.

Call OI is highest between 165 and 175 and then at 180. The biggest spike is at 170.

Put OI is highest at 150, between 155-160 and between 162 and 169.

As always, puts are stacked up at lower strikes, and calls are stacked up at higher strikes. There’s overlap between 165 and 169, and the biggest open-interest spikes fall at or beyond this range. Hence a close in the middle would cause lots of pain. A close near the top side would cause a little more pain because puts out-number calls. Today’s close as at 170.31 – just above the range. That’s fine – especially because that’s where the big call spike falls – but a small move down would be better.

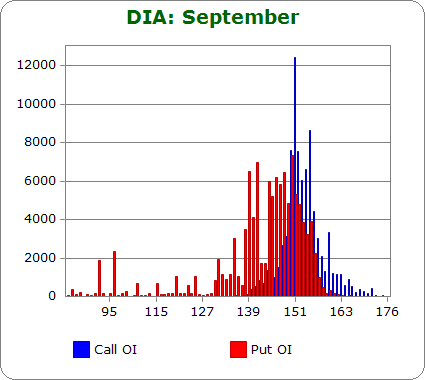

DIA (closed 154.94)

Puts out-number calls 1.3-to-1.0 – same as last month.

Call OI is highest between 150 and 155…the big spike is at 151.

Put OI is highest between 139 and 141 and between 144 and 152.

There’s overlap between 150 and 152, so a close there would cause most calls and puts to expire worthless. Today’s close was at 154.94 – three points above the ideal range. If the market closes here on Friday, some call buyers will make money, including those 151 calls. To achieve max pain, a move down is needed.

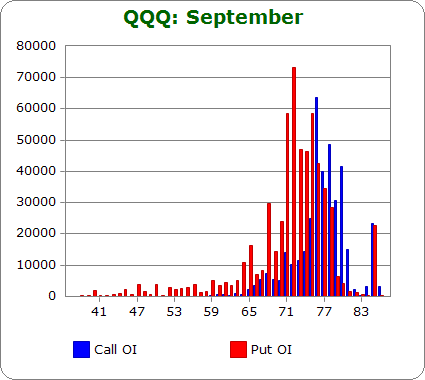

QQQ (closed 77.85)

Calls out-number puts 1.6-to-1.0 – slightly more bearish than last month.

Call OI is highest between 76 and 80.

Put OI is highest between 71 and 76.

There’s overlap at 76, and if you include some lower open-interest strikes, also at 77. Today’s close is at 77.85 – pretty much where the stock needs to be close cause max pain. No movement from the current level is needed the rest of the week.

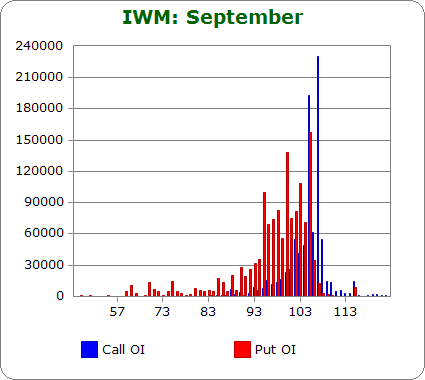

IWM (closed 105.04)

Puts out-number calls 1.8-to-1.0 – slightly less bearish than last month.

Call OI is highest between 105 and 108 with the two big spikes taking place at 105 and 107.

Put OI is highest between 95 and 105.

There’s obvious overlap at 105 – a strike with both high put and call open-interest. That’s where IWM needs to close to cause the most pain. Today’s close was at 105.04 – exactly where it needs to be, so no movement is needed the rest of the week.

Overall Conclusion: Based on the above numbers, if the market is to close Friday at a level where the most number of call and put buyers lose the most amount of money, no movement is needed. The market is already positioned to accomplish the mission. No further analysis is needed.