Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 2.3%; China and Hong Kong also dropped noticeably. Europe is currently mostly up. Greece is up 2.2%; Austria, France and Italy are also doing well. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

The market dropped yesterday for the third straight day – it’s first 3-day losing streak since since mid August. Given the market’s rally (it moved up 15 of 18 days), a 3-day losing streak is perfectly normal and healthy and nothing for the long term bulls to worry about. But if you’re a short term trader, you can’t sit tight and watch gains disappear. You never know when a minor correction will turn into a full-blown downtrend, so you have to be a little more active managing positions. This does not mean you blindly sell everything. It just means you set your sights lower and be content with smaller gains.

Overall the market remains in good shape…the debt ceiling talks are the biggest issue going forward.

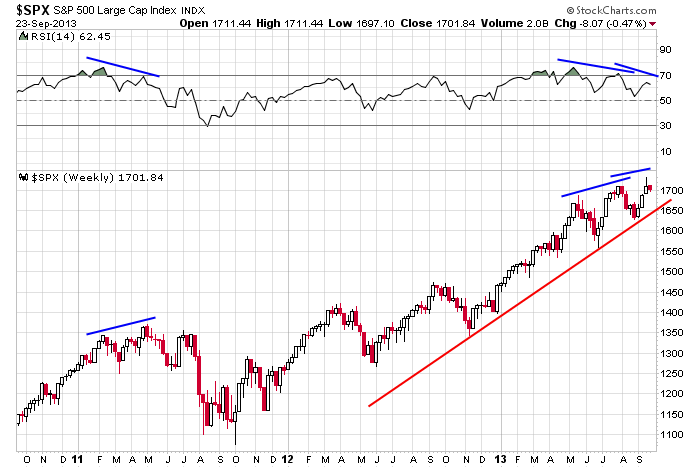

On the weekly, an RSI divergence is forming…

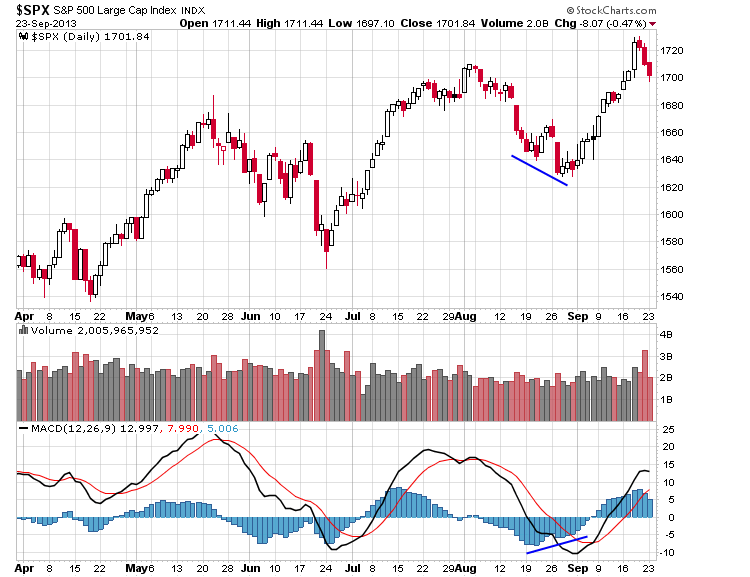

On the daily, the MACD Histogram is contracting…

This are just little hints that tell us to play it safe in the near term.

Stock headlines from barchart.com…

CarMax KMAX reported Q2 EPS of 62 cents, better than consensus of 57 cents.

DirecTV DTV and DISH DISH were both downgraded to “Neutral” from “Buy” at Moffett Research.

The NY Times reports that JPMorgan Chase JPM is preparing to be sued by U.S. prosecutors who suspect that the bank sold “shoddy” mortgage securities to investors prior to the financial crisis.

Hologic HOLX was upgraded to “Strong Buy” from “Buy” at ISI Group.

Hanesbrands HBI was downgraded to “Neutral” from “Buy” at DA Davidson.

Apple AAPL was upgraded to “Positive” from “Neutral” at Susquehanna with a price target of $625.

Lennar LEN reported Qe EPS of 54 cents, better than consensus of 45 cents.

CIT Group CIT was upgraded to “Buy” from “Hold” at Jefferies who also raised their price target on the stock to $65 from $52.

Westar Energy (WR +1.77%) filed to sell 8 million shares of common stock.

KKR Fund Holdings reported a 28.4% stake in RigNet (RNET +0.61%) .

Red Hat (RHT -0.54%) tumbled 8% in pre-market trading after it reported Q2 adjusted EPS of 35 cents, above consensus of 33 cents, but also reported Q2 billings, a predictor of future revenue, rose only +8% y/y, weaker than consensus of a +17% y/y increase.

Deutsche Bank kept its “Buy” rating on Apple (AAPL +4.97%) and raised its price target on the stock to $575 from $480.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

1:00 PM Results of $33B, 2-Year Note Auction

Notable earnings before today’s open: CCL, KBH, KMX, LEN, NEOG

Notable earnings after today’s close: AIR, ASNA, CPRT, LNDC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 24)”

Leave a Reply

You must be logged in to post a comment.

Jason says it could go either way, but the SP came off its top with some volume,so traders are ready to sell on weakness. Weakness comes from many places: seasonal, Fed rants (amounting to insanity), Congress and the President (budgets are for dopes), and performance of firms which are not gaining earnings at rates consistent with fall, holiday orders etc (Christmas = 20-50% of the retail take each year) Be suspicious.

But maybe it is time to think about alternatives. HAO, XQQQ, GXC MCHI,FXI are all China stocks, some sector plays too. China fudges its GDP data and it has no Fed, just a party committee, but a rally is due and they want it so….look it over. Not dull, but dangerous.

Not XQQQ buy CQQQ. FXI is proforming best in recent days.