Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Australia and New Zealand did well; Indonesia and Japan fared the worst. Europe is currently mixed. Amsterdam and Stockholm are leading to the downside; Greece is doing ok to the upside. Futures here in the States point towards a small gap down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

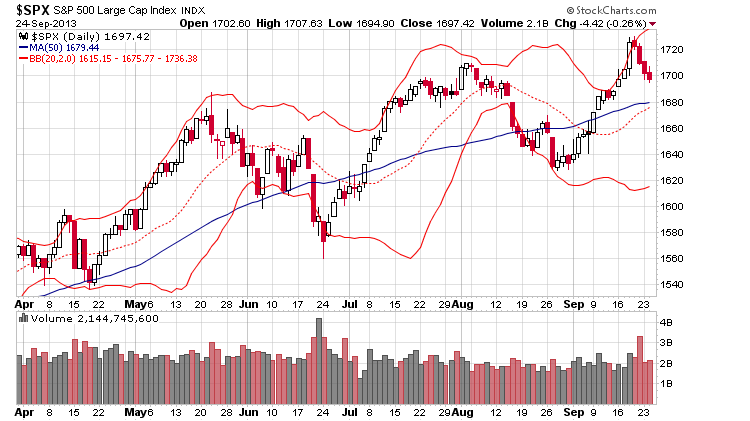

The S&P has dropped 4 straight days for the first time since mid August and for only the second time this year. The points given up are reasonable and healthy for an index coming off a 100-point, 4-week rally. But you still have to manage positions wisely. Don’t let a big gain turn into a small gain and a small gain into a loss. When the big picture trend is up, there will always be mini swings in both directions. When the swings are up, you can give positions a little more time and space to play out. When the swings are down, you need to be content with smaller gains. Swing for singles and the occasional double, not homeruns.

Here’s the SPX daily. My first downside target is 1675-1680 – that’s where the 50-day and middle band of the Bollinger Bands are.

Keep it simple. We entered this week with the near term being unclear, and although the market closed down Mon and Tues, it hasn’t been a 1-way market. There have been some playable swings in the up direction.

Stock headlines from barchart.com…

Reliance Steel (RS -0.23%) was downgraded to “Neutral” from “Buy” at BofA/Merrill.

Nordstrom (JWN -0.39%) upgraded to “Outperform” from “Neutral” at Macquarie.

Oppenheimer keeps an “Outperform” rating on Facebook (FB +2.67%) and raises its price target on the stock to $54 from $36.

Ross Stores (ROST -0.08%) was upgraded to “Conviction Buy” from “Buy” at Goldman Sachs.

Carnival (CCL -7.65%) was downgraded to “Neutral” from “Buy” at BofA/Merrill.

AutoZone (AZO -0.84%) reported Q4 EPS of $10.42, stronger than consensus of $10.34.

Copart (CPRT -0.73%) reported Q4 EPS of 32 cents, below consensus of 40 cents.

Northrop Grumman (NOC +0.09%) was awarded a $101.59 million government contract modification for the sustainment of the propulsion/ground/guidance/reentry system reentry vehicle systems of the ICBM weapon system.

Boeing (BA +1.27%) was awarded a $225 million government contract modification for the procurement of six operational flight trainers, six weapons tactics trainers, two part task trainers, one training systems support center, three 10-seat electronic classrooms, and one 20-seat electronic classroom in support of the U.S. Navy P-8A Poseidon low rate initial Production IV and full rate Production I aircraft.

Harris (HRS +0.09%) was awarded a $140.7 million government contract for the production of the Mid-Tier Networking Vehicular radio.

Crown Holdings (CCK +0.16%) slid 6% in after-hours trading after it lowered its Q3 EPS view to $1.05-$1.10 from prior $1.15-$1.25, below consensus of $1.21.

Fluor (FLR +0.58%) announced that it was awarded a new $95 million contract by Pemex to develop the first phase of the overall project to reconfigure the Miguel Hidalgo Refinery, located in Tula, Hidalgo, Mexico.

Ascena Retail (ASNA -1.65%) reported Q4 adjusted EPS of 34 cents, well ahead of consensus of 21 cents.

SAC Capital reported a 5.1% passive stake in SunEdison (SUNE +0.51%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Durable Goods

10:00 New Home Sales

10:30 EIA Petroleum Inventories

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: AZO

Notable earnings after today’s close: BBBY, JBL, WOR

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 25)”

Leave a Reply

You must be logged in to post a comment.

Mortgage apps up 5.% but banks are releasing mortgage staff. Housing in trouble? LEI show +.1 after -8 in July. Who is cheering? Congress says maybe a CR for two months, and need debt ceiling by OCT 15? No better circus ever if only it were pretend. Bonds are looking interesting, stocks not so interesting. Have a good day.